Question: Edit dit File Format View Window Help Megabox 3 course case study 52019.rtf B 1 Times New Romo Regular Megabox, Inc. (version 3.26 August 2015)

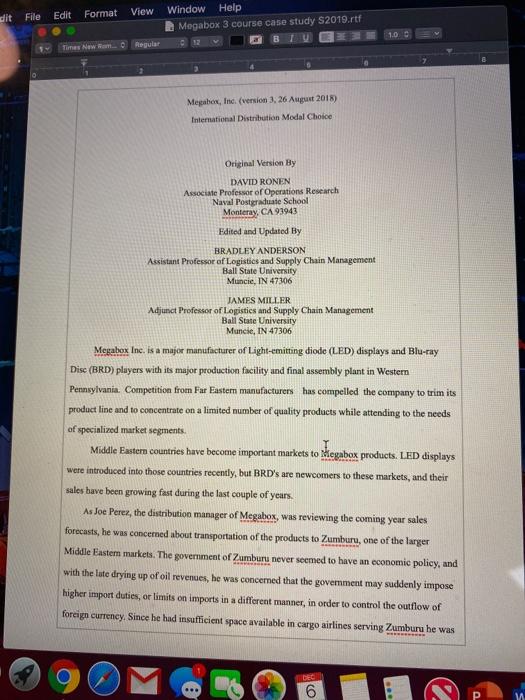

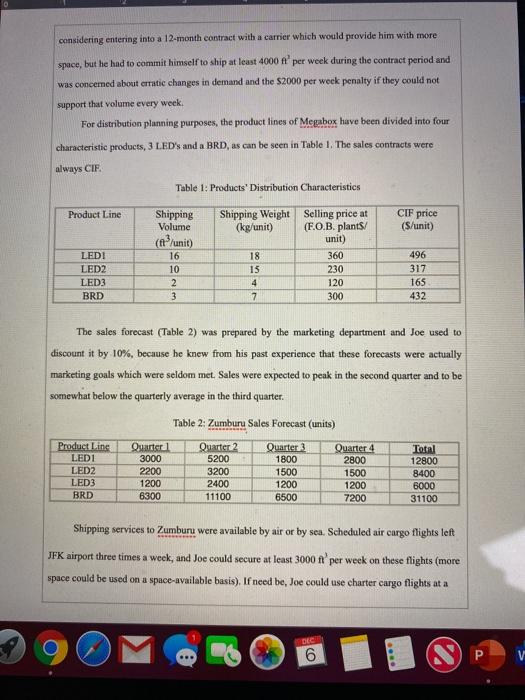

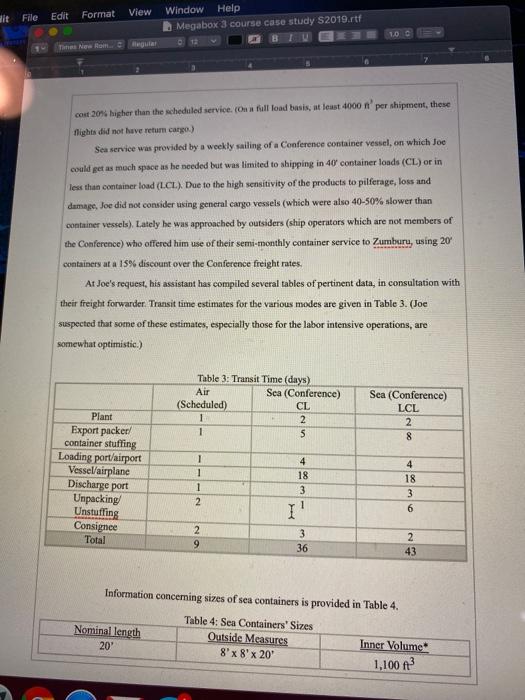

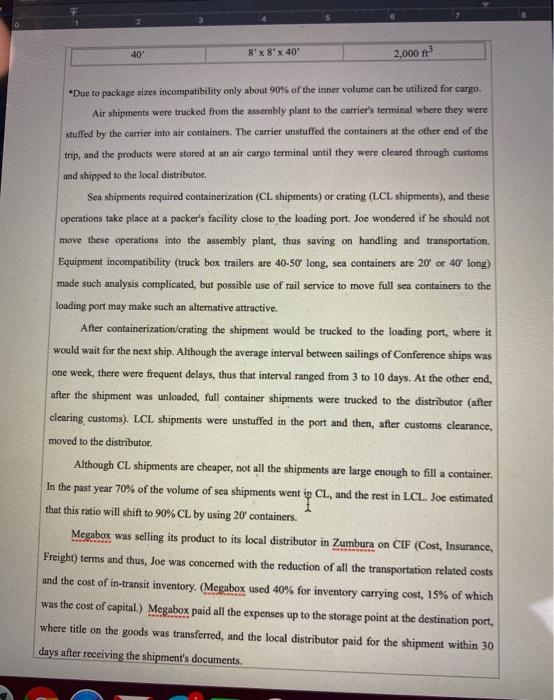

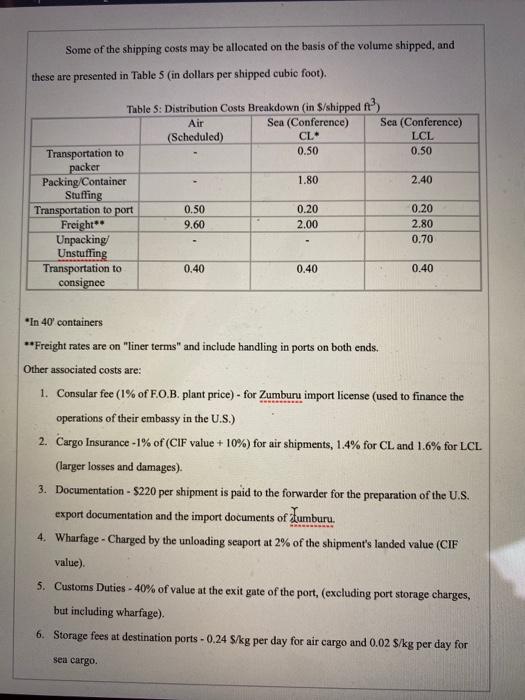

Edit dit File Format View Window Help Megabox 3 course case study 52019.rtf B 1 Times New Romo Regular Megabox, Inc. (version 3.26 August 2015) International Distribution Modal Choice Original Version By DAVID RONEN Associate Professor of Operations Research Naval Postgraduate School Monteray, CA 93943 dited and Updated By BRADLEY ANDERSON Assistant Professor of Logistics and Supply Chain Management Ball State University Muncie, IN 47306 JAMES MILLER Adjunct Professor of Logistics and Supply Chain Management Ball State University Muncie, IN 47306 Megabox Inc. is a major manufacturer of Light-emitting diode (LED) displays and Blu-ray Dise (BRD) players with its major production facility and final assembly plant in Western Pennsylvania. Competition from Far Easter manufacturers has compelled the company to trim its product line and to concentrate on a limited number of quality products while attending to the needs of specialized market segments. Middle Eastern countries have become important markets to Megabox products. LED displays were introduced into those countries recently, but BRD's are newcomers to these markets, and their sales have been growing fast during the last couple of years. As Joe Perez, the distribution manager of Megabox, was reviewing the coming year sales forecasts, he was concerned about transportation of the products to Zumbury, one of the larger Middle Eastem markets. The government of Zumburu never seemed to have an economic policy, and with the late drying up of oil revenues, he was concerned that the goverment may suddenly impose higher import duties, or limits on imports in a different manner, in order to control the outflow of foreign currency. Since he had insufficient space available in cargo airlines serving Zumburu he was DEC 6 W considering entering into a 12-month contract with a carrier which would provide him with more space, but he had to commit himself to ship at least 4000 ft' per week during the contract period and was convered about erratic changes in demand and the S2000 per week penalty if they could not support that volume every week For distribution planning purposes, the product lines of Megabox have been divided into four characteristic products, 3 LED's and a BRD, as can be seen in Table 1. The sales contracts were always CIF Table 1: Products' Distribution Characteristics Product Line CIF price (S/unit) LEDI LED2 LED3 BRD Shipping Volume (unit) 16 10 2 3 Shipping Weight Selling price at (kg/unit) (F.O.B. plants/ unit) 18 360 15 230 4 120 7 300 496 317 165 432 The sales forecast (Table 2) was prepared by the marketing department and Joe used to discount it by 10%, because he knew from his past experience that these forecasts were actually marketing goals which were seldom met. Sales were expected to peak in the second quarter and to be somewhat below the quarterly average in the third quarter. Table 2: Zumburu Sales Forecast (units) Total Product Line LED1 LED2 LED3 BRD Quarter 3000 2200 1200 6300 Quarter 2 5200 3200 2400 11100 Quarter 3 1800 1500 1200 6500 Quarter 4 2800 1500 1200 7200 12800 8400 6000 31100 Shipping services to Zumburu were available by air or by sea. Scheduled air cargo flights left JFK airport three times a week, and Joe could secure at least 3000 f'per week on these flights (more space could be used on a space available basis). If need be, Joe could use charter cargo flights at a DEC 6 P Bit File Edit Format View Window Help Megabox 3 course case study S2019.rtf 100 The New Regular cout 20% higher than the scheduled service. Oua full load basis, at least 4000 n per shipment, these flights did not have return cargo) Sea service was provided by a weekly sailing of a Conference container vessel, on which Joe could get as much space as he needed but was limited to shipping in 40' container loads (CL) or in less than container load (LCL). Due to the high sensitivity of the products to pilferage, loss and damage, Joe did not consider using general cargo vessels (which were also 40-50% slower than container vessels). Lately he was approached by outsiders (ship operators which are not members of the Conference) who offered him use of their semi-monthly container service to Zumburu, using 20 containers at a 15% discount over the Conference freight rates. At Joe's request, his assistant has compiled several tables of pertinent data, in consultation with their freight forwarder. Transit time estimates for the various modes are given in Table 3. (Joe suspected that some of these estimates, especially those for the labor intensive operations, are somewhat optimistir.) Table 3: Transit Time (days) Air Sea (Conference) (Scheduled) CL 1 2 1 5 Sea (Conference) LCL 2 8 1 1 Plant Export packer/ container stuffing Loading port/airport Vessel/airplane Discharge port Unpacking Unstuffing Consignee Total 4 18 3 1 2 4 18 3 6 I' 2 9 3 36 2 43 Information concerning sizes of sea containers is provided in Table 4. Table 4: Sea Containers' Sizes Nominal length Outside Measures Inner Volume 8' x 8' x 20 20 1,100 f? 12 40 8'*8'x 400 2,000 ft *Due to package Sizes incompatibility only about 90% of the inner volume can be utilized for cargo Air shipments were trucked from the assembly plant to the carrier's terminal where they were stuffed by the carrier into air containers. The carrier unstuffed the containers at the other end of the trip, and the products were stored at an air cargo terminal until they were cleared through customs and shipped to the local distributor. Sea shipments required containerization (CL shipments) or crating (LCL shipments), and these operations take place at a packer's facility close to the loading port. Joe wondered if he should not move these operations into the assembly plant, thus saving on handling and transportation. Equipment incompatibility (truck box trailers are 40-50" long, sea containers are 20 or 40' long) made such analysis complicated, but possible use of rail service to move full sea containers to the loading port may make such an alternative attractive. After containerization/crating the shipment would be trucked to the loading port, where it would wait for the next ship. Although the average interval between sailings of Conference ships was one week, there were frequent delays, thus that interval ranged from 3 to 10 days. At the other end, after the shipment was unloaded, full container shipments were trucked to the distributor (after clearing customs). LCL shipments were unstuffed in the port and then, after customs clearance, moved to the distributor Although CL shipments are cheaper, not all the shipments are large enough to fill a container. In the past year 70% of the volume of sea shipments went ip CL, and the rest in LCL. Joe estimated that this ratio will shift to 90% CL by using 20' containers. Megabox was selling its product to its local distributor in Zumbura on CIF (Cost, Insurance, Freight) terms and thus, Joe was concerned with the reduction of all the transportation related costs and the cost of in-transit inventory. (Megabox used 40% for inventory carrying cost, 15% of which was the cost of capital.) Megabox paid all the expenses up to the storage point at the destination port, where title on the goods was transferred, and the local distributor paid for the shipment within 30 days after receiving the shipment's documents. Some of the shipping costs may be allocated on the basis of the volume shipped, and these are presented in Table 5 (in dollars per shipped cubic foot). Table 5: Distribution Costs Breakdown (in $/shipped n? Air Sea (Conference) Sea (Conference) (Scheduled) CL LCL Transportation to 0.50 0.50 packer Packing/Container 1.80 2.40 Stuffing Transportation to port 0.50 0.20 0.20 Freight** 9.60 2.00 2.80 Unpacking 0.70 Unstuffing Transportation to 0.40 0.40 0.40 consignee "In 40' containers **Freight rates are on "liner terms" and include handling in ports on both ends. Other associated costs are: 1. Consular fee (1% of F.O.B. plant price) - for Zumburu import license (used to finance the operations of their embassy in the U.S.) 2. Cargo Insurance -1% of (CIF value + 10%) for air shipments, 1.4% for CL and 1.6% for LCL (larger losses and damages). 3. Documentation - $220 per shipment is paid to the forwarder for the preparation of the U.S. export documentation and the import documents of Aumburu. 4. Wharfage - Charged by the unloading scaport at 2% of the shipment's landed value (CIF value) 5. Customs Duties - 40% of value at the exit gate of the port, (excluding port storage charges, but including wharfage). 6. Storage fees at destination ports - 0.24 $/kg per day for air cargo and 0.02 $/kg per day for sea cargo. Fle Megabox 3 course case study S2019.rtf 1.0 B Regular Times New Rom The distributor who receives the goods is interested in receiving frequent small shipments to reduce his average inventory (ie, air shipments). Moreover, on air shipments he pays lower customs duties (no wharfage included in the value for customs duties calculations), thus Megabox grants the distributor a 2% discount on sea shipments (off CIF prices, which are: LEDI-S496, LED2-$317. LED3-S165, BRD-S432). Bearing all these facts in mind, Joe was contemplating if he should enter into the 12 month contract with the air carrier (who required freight rates 10% below scheduled carriers). Company policy was to only contract one method of transport every year. He needed a comparative analysis of the costs of the different shipping alternatives which will take into account the cost of inventory in transit in addition to the direct shipping cost. He wondered whether the CIF price fully covered the logistics costs. There are so many risks that could happen to this particular business for Megabox he thought listing out the top three or four and providing the analysis for them would be helpful to his boss. I Edit dit File Format View Window Help Megabox 3 course case study 52019.rtf B 1 Times New Romo Regular Megabox, Inc. (version 3.26 August 2015) International Distribution Modal Choice Original Version By DAVID RONEN Associate Professor of Operations Research Naval Postgraduate School Monteray, CA 93943 dited and Updated By BRADLEY ANDERSON Assistant Professor of Logistics and Supply Chain Management Ball State University Muncie, IN 47306 JAMES MILLER Adjunct Professor of Logistics and Supply Chain Management Ball State University Muncie, IN 47306 Megabox Inc. is a major manufacturer of Light-emitting diode (LED) displays and Blu-ray Dise (BRD) players with its major production facility and final assembly plant in Western Pennsylvania. Competition from Far Easter manufacturers has compelled the company to trim its product line and to concentrate on a limited number of quality products while attending to the needs of specialized market segments. Middle Eastern countries have become important markets to Megabox products. LED displays were introduced into those countries recently, but BRD's are newcomers to these markets, and their sales have been growing fast during the last couple of years. As Joe Perez, the distribution manager of Megabox, was reviewing the coming year sales forecasts, he was concerned about transportation of the products to Zumbury, one of the larger Middle Eastem markets. The government of Zumburu never seemed to have an economic policy, and with the late drying up of oil revenues, he was concerned that the goverment may suddenly impose higher import duties, or limits on imports in a different manner, in order to control the outflow of foreign currency. Since he had insufficient space available in cargo airlines serving Zumburu he was DEC 6 W considering entering into a 12-month contract with a carrier which would provide him with more space, but he had to commit himself to ship at least 4000 ft' per week during the contract period and was convered about erratic changes in demand and the S2000 per week penalty if they could not support that volume every week For distribution planning purposes, the product lines of Megabox have been divided into four characteristic products, 3 LED's and a BRD, as can be seen in Table 1. The sales contracts were always CIF Table 1: Products' Distribution Characteristics Product Line CIF price (S/unit) LEDI LED2 LED3 BRD Shipping Volume (unit) 16 10 2 3 Shipping Weight Selling price at (kg/unit) (F.O.B. plants/ unit) 18 360 15 230 4 120 7 300 496 317 165 432 The sales forecast (Table 2) was prepared by the marketing department and Joe used to discount it by 10%, because he knew from his past experience that these forecasts were actually marketing goals which were seldom met. Sales were expected to peak in the second quarter and to be somewhat below the quarterly average in the third quarter. Table 2: Zumburu Sales Forecast (units) Total Product Line LED1 LED2 LED3 BRD Quarter 3000 2200 1200 6300 Quarter 2 5200 3200 2400 11100 Quarter 3 1800 1500 1200 6500 Quarter 4 2800 1500 1200 7200 12800 8400 6000 31100 Shipping services to Zumburu were available by air or by sea. Scheduled air cargo flights left JFK airport three times a week, and Joe could secure at least 3000 f'per week on these flights (more space could be used on a space available basis). If need be, Joe could use charter cargo flights at a DEC 6 P Bit File Edit Format View Window Help Megabox 3 course case study S2019.rtf 100 The New Regular cout 20% higher than the scheduled service. Oua full load basis, at least 4000 n per shipment, these flights did not have return cargo) Sea service was provided by a weekly sailing of a Conference container vessel, on which Joe could get as much space as he needed but was limited to shipping in 40' container loads (CL) or in less than container load (LCL). Due to the high sensitivity of the products to pilferage, loss and damage, Joe did not consider using general cargo vessels (which were also 40-50% slower than container vessels). Lately he was approached by outsiders (ship operators which are not members of the Conference) who offered him use of their semi-monthly container service to Zumburu, using 20 containers at a 15% discount over the Conference freight rates. At Joe's request, his assistant has compiled several tables of pertinent data, in consultation with their freight forwarder. Transit time estimates for the various modes are given in Table 3. (Joe suspected that some of these estimates, especially those for the labor intensive operations, are somewhat optimistir.) Table 3: Transit Time (days) Air Sea (Conference) (Scheduled) CL 1 2 1 5 Sea (Conference) LCL 2 8 1 1 Plant Export packer/ container stuffing Loading port/airport Vessel/airplane Discharge port Unpacking Unstuffing Consignee Total 4 18 3 1 2 4 18 3 6 I' 2 9 3 36 2 43 Information concerning sizes of sea containers is provided in Table 4. Table 4: Sea Containers' Sizes Nominal length Outside Measures Inner Volume 8' x 8' x 20 20 1,100 f? 12 40 8'*8'x 400 2,000 ft *Due to package Sizes incompatibility only about 90% of the inner volume can be utilized for cargo Air shipments were trucked from the assembly plant to the carrier's terminal where they were stuffed by the carrier into air containers. The carrier unstuffed the containers at the other end of the trip, and the products were stored at an air cargo terminal until they were cleared through customs and shipped to the local distributor. Sea shipments required containerization (CL shipments) or crating (LCL shipments), and these operations take place at a packer's facility close to the loading port. Joe wondered if he should not move these operations into the assembly plant, thus saving on handling and transportation. Equipment incompatibility (truck box trailers are 40-50" long, sea containers are 20 or 40' long) made such analysis complicated, but possible use of rail service to move full sea containers to the loading port may make such an alternative attractive. After containerization/crating the shipment would be trucked to the loading port, where it would wait for the next ship. Although the average interval between sailings of Conference ships was one week, there were frequent delays, thus that interval ranged from 3 to 10 days. At the other end, after the shipment was unloaded, full container shipments were trucked to the distributor (after clearing customs). LCL shipments were unstuffed in the port and then, after customs clearance, moved to the distributor Although CL shipments are cheaper, not all the shipments are large enough to fill a container. In the past year 70% of the volume of sea shipments went ip CL, and the rest in LCL. Joe estimated that this ratio will shift to 90% CL by using 20' containers. Megabox was selling its product to its local distributor in Zumbura on CIF (Cost, Insurance, Freight) terms and thus, Joe was concerned with the reduction of all the transportation related costs and the cost of in-transit inventory. (Megabox used 40% for inventory carrying cost, 15% of which was the cost of capital.) Megabox paid all the expenses up to the storage point at the destination port, where title on the goods was transferred, and the local distributor paid for the shipment within 30 days after receiving the shipment's documents. Some of the shipping costs may be allocated on the basis of the volume shipped, and these are presented in Table 5 (in dollars per shipped cubic foot). Table 5: Distribution Costs Breakdown (in $/shipped n? Air Sea (Conference) Sea (Conference) (Scheduled) CL LCL Transportation to 0.50 0.50 packer Packing/Container 1.80 2.40 Stuffing Transportation to port 0.50 0.20 0.20 Freight** 9.60 2.00 2.80 Unpacking 0.70 Unstuffing Transportation to 0.40 0.40 0.40 consignee "In 40' containers **Freight rates are on "liner terms" and include handling in ports on both ends. Other associated costs are: 1. Consular fee (1% of F.O.B. plant price) - for Zumburu import license (used to finance the operations of their embassy in the U.S.) 2. Cargo Insurance -1% of (CIF value + 10%) for air shipments, 1.4% for CL and 1.6% for LCL (larger losses and damages). 3. Documentation - $220 per shipment is paid to the forwarder for the preparation of the U.S. export documentation and the import documents of Aumburu. 4. Wharfage - Charged by the unloading scaport at 2% of the shipment's landed value (CIF value) 5. Customs Duties - 40% of value at the exit gate of the port, (excluding port storage charges, but including wharfage). 6. Storage fees at destination ports - 0.24 $/kg per day for air cargo and 0.02 $/kg per day for sea cargo. Fle Megabox 3 course case study S2019.rtf 1.0 B Regular Times New Rom The distributor who receives the goods is interested in receiving frequent small shipments to reduce his average inventory (ie, air shipments). Moreover, on air shipments he pays lower customs duties (no wharfage included in the value for customs duties calculations), thus Megabox grants the distributor a 2% discount on sea shipments (off CIF prices, which are: LEDI-S496, LED2-$317. LED3-S165, BRD-S432). Bearing all these facts in mind, Joe was contemplating if he should enter into the 12 month contract with the air carrier (who required freight rates 10% below scheduled carriers). Company policy was to only contract one method of transport every year. He needed a comparative analysis of the costs of the different shipping alternatives which will take into account the cost of inventory in transit in addition to the direct shipping cost. He wondered whether the CIF price fully covered the logistics costs. There are so many risks that could happen to this particular business for Megabox he thought listing out the top three or four and providing the analysis for them would be helpful to his boss