Question: Edit Format Tools Help Download Normal BIU A- A - SEE invested in European stocks. The euro is currently trading at US$1.10. Your expectation is

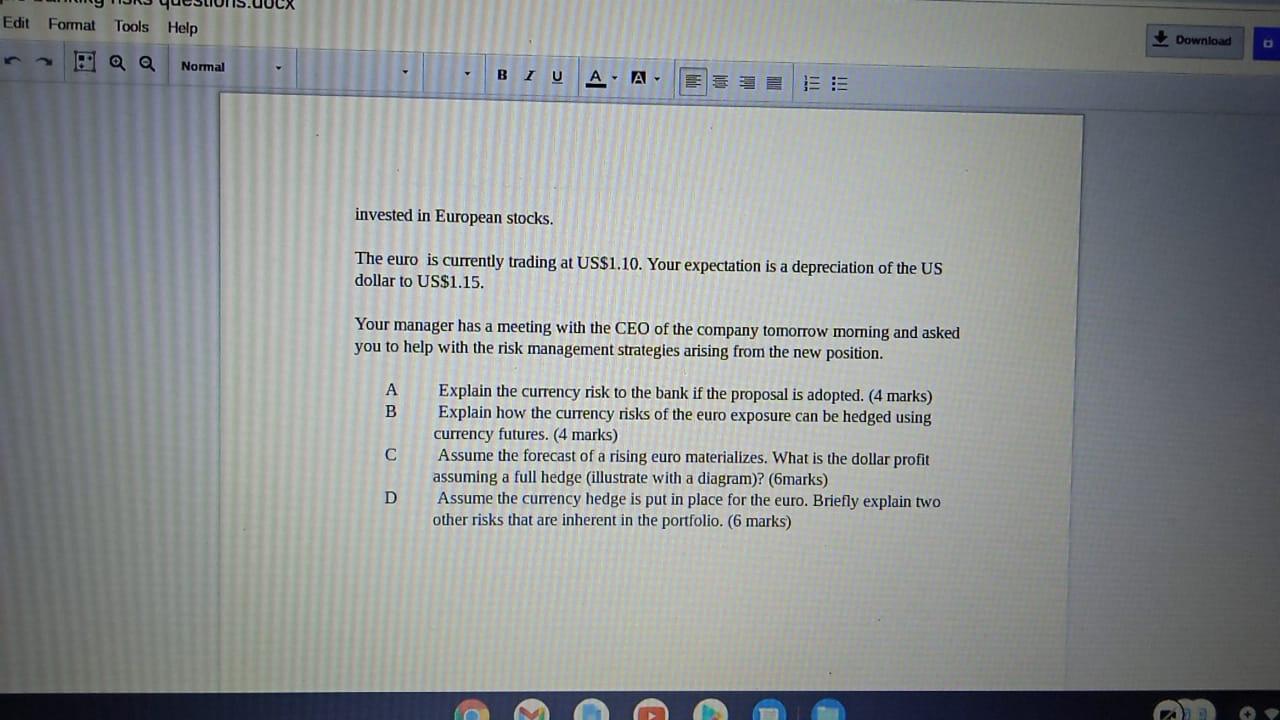

Edit Format Tools Help Download Normal BIU A- A - SEE invested in European stocks. The euro is currently trading at US$1.10. Your expectation is a depreciation of the US dollar to US$1.15. Your manager has a meeting with the CEO of the company tomorrow morning and asked you to help with the risk management strategies arising from the new position. A B Explain the currency risk to the bank if the proposal is adopted. (4 marks) Explain how the currency risks of the euro exposure can be hedged using currency futures. (4 marks) Assume the forecast of a rising euro materializes. What is the dollar profit assuming a full hedge (illustrate with a diagram)? (6marks) Assume the currency hedge is put in place for the euro. Briefly explain two other risks that are inherent in the portfolio. (6 marks) D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts