Question: Editing 1. ENTRIES FOR BAD DEBT EXPENSE USING ALLOWANCE METHOD (15 Points) Prepare the journal entries for the following transactions assume the company uses the

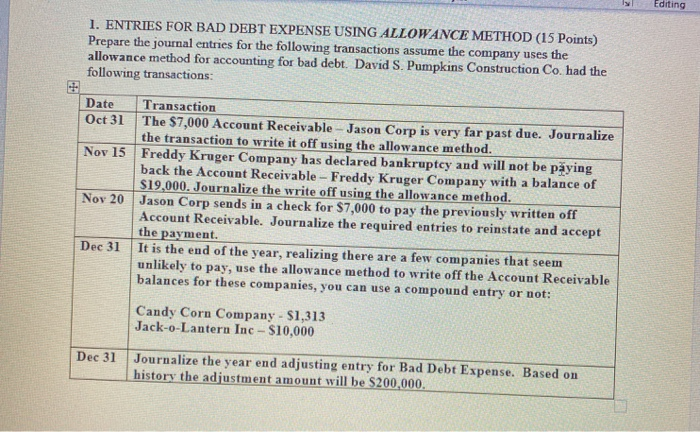

Editing 1. ENTRIES FOR BAD DEBT EXPENSE USING ALLOWANCE METHOD (15 Points) Prepare the journal entries for the following transactions assume the company uses the allowance method for accounting for bad debt. David S. Pumpkins Construction Co. had the following transactions: Date Transaction Oct 31 The $7,000 Account Receivable - Jason Corp is very far past due. Journalize the transaction to write it off using the allowance method. Nov 15 Freddy Kruger Company has declared bankruptcy and will not be pying back the Account Receivable - Freddy Kruger Company with a balance of $19,000. Journalize the write off using the allowance method. Nov 20 Jason Corp sends in a check for $7,000 to pay the previously written off Account Receivable. Journalize the required entries to reinstate and accept the payment. Dec 31 It is the end of the year, realizing there are a few companies that seem unlikely to pay, use the allowance method to write off the Account Receivable balances for these companies, you can use a compound entry or not: Candy Corn Company - $1,313 Jack-o-Lantern Inc - $10,000 Dec 31 Journalize the year end adjusting entry for Bad Debt Expense. Based on history the adjustment amount will be $200,000. Editing Voice Journal to be used for question 1: Date Accounts DR CR earch For

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts