Question: educationwiley.com / was / ui / v 2 / assessment - player / indexhtm / ilaunchld - 9 d 2 8 6 1 8 1

educationwiley.comwasuivassessmentplayerindexhtmilaunchlddfebbacdaabeaequestion

emal

My SNHU

Case Searh : Akan

Two WileyPLUS Question Set

Question of

View Policies

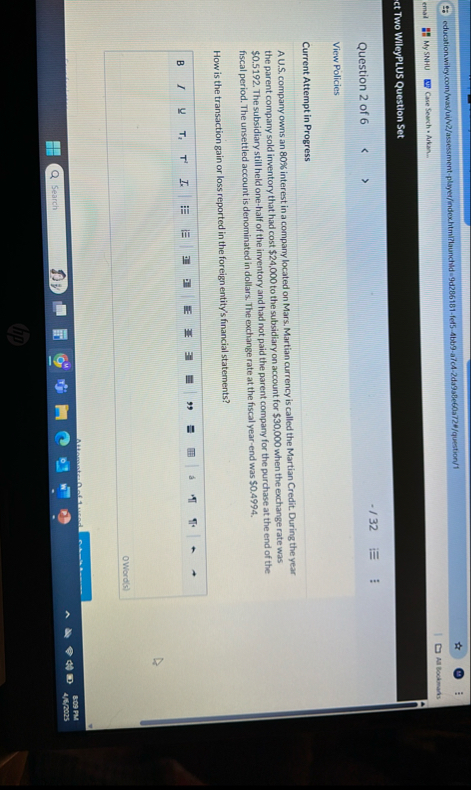

Current Attempt in Progress

A US company owns an interest in a company located on Mars. Martian currency is called the Martian Credit. During the year the parent company sold inventory that had cost $ to the subsidiary on account for $ when the exchange rate was $ The subsidiary still held onehalf of the inventory and had not paid the parent company for the purchase at the end of the fiscal period. The unsettled account is denominated in dollars. The exchange rate at the fiscal yearend was $

How is the transaction gain or loss reported in the foreign entity's financial statements?

B

T

a

II

OWords

Search

OD

E

Fm

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock