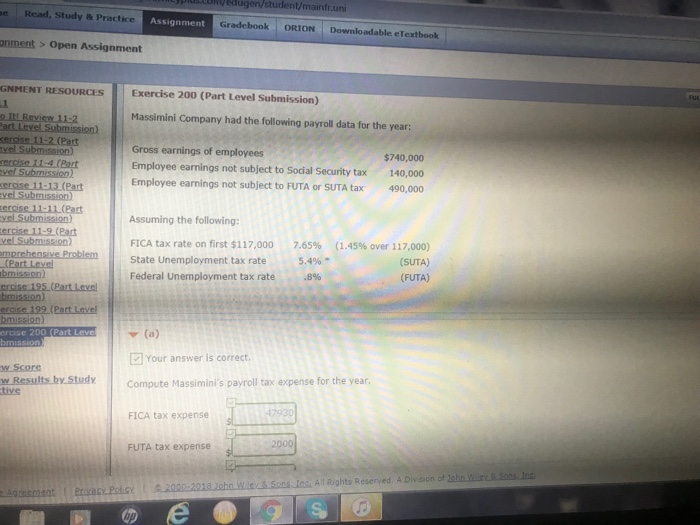

Question: edugen/student/mainfr.un e Read, Study& Practice Assignment Gradebook ORION Downloadable eTextbook nment Open Assignment GNMENT RESOURCES Exercise 200 (Part Level Submission) oIL Review 11-2 Massimini Company

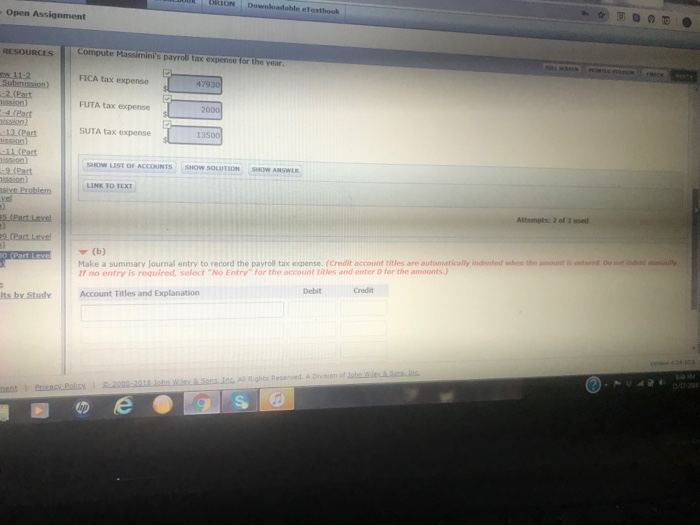

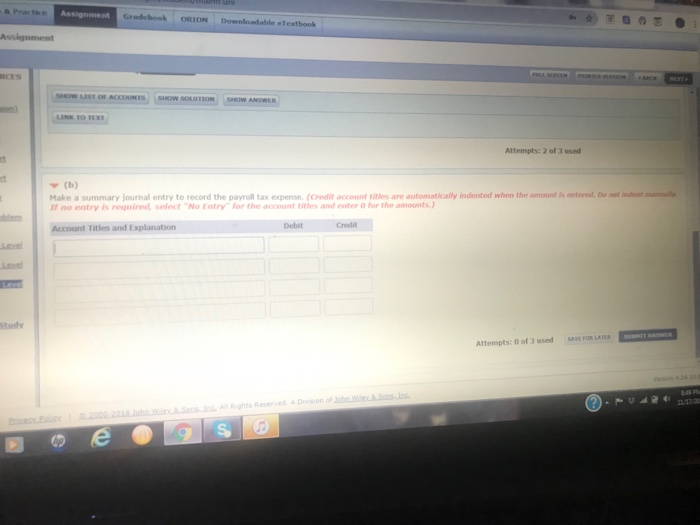

edugen/student/mainfr.un e Read, Study& Practice Assignment Gradebook ORION Downloadable eTextbook nment Open Assignment GNMENT RESOURCES Exercise 200 (Part Level Submission) oIL Review 11-2 Massimini Company had the following payroll data for the year (Part Gross earnings of employees Employee earnings not subject to Social Security tax Employee earnings not subject to FUTA or SUTA tax $740,000 140,000 490,000 ercise 11-4.0 erise 11-13 (Part ercise 11-11 ercise 11-9 (Part Assuming the following: FICA tax rate on first $117,000 State Unemployment tax rate Federal Unemployment tax rate (1.45% over 117,000) SUTA) (FUTA) 7.65% mp 5,496" .8% erciss 195 (Part Level erase 200 [..] Your answer is correct. w Score w Resuilts by study Compute Massimini's payroll tax expense for the year tive FICA tax expense 2000 FUTA tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts