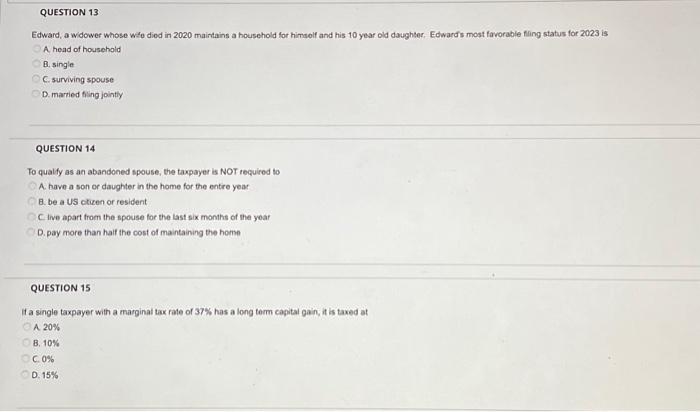

Question: Edward, a widower whose wefo died in 2020 maintains a houschold for himsolf and his 10 year old daughter. Edward's most favorable fling status for

Edward, a widower whose wefo died in 2020 maintains a houschold for himsolf and his 10 year old daughter. Edward's most favorable fling status for 2023 is A. head of household B. single C. surviving spouse D. martied fing jointly QUESTION 14 To qualfy as an abandoned spouse, the taxpayer is NOT required to A. have a son or daughter in the home for the entire year B. be a US ctizen or resident C Iive apart from the spouse for the last six months of the yoar D. pay more than haif the cost of maintaining the home QUESTION 15 If a single taxpayer with a marginal tax rade of 37% has a long term cagital gain, it is taxed at A. 20% B, 10\% C. 016 D. 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts