Question: EE 7-5 333 OBJ. 4 W PE 7-5A Periodic inventory using FIFO, LIFO, and weighted average cost methods The units of an item available for

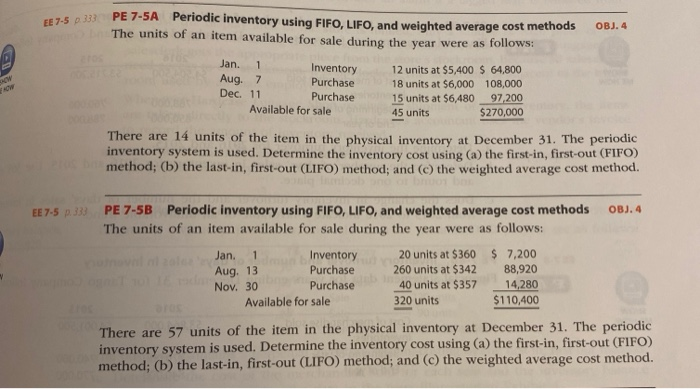

EE 7-5 333 OBJ. 4 W PE 7-5A Periodic inventory using FIFO, LIFO, and weighted average cost methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 12 units at $5,400 $ 64,800 Aug. 7 Purchase 18 units at $6,000 108,000 Dec. 11 Purchase 15 units at $6,480 97,200 Available for sale 45 units $270,000 There are 14 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) the first-in, first-out (FIFO) method; (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method. EE 7-5 p.333 OBJ.4 PE 7-5B Periodic inventory using FIFO, LIFO, and weighted average cost methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 20 units at $360 $ 7,200 Purchase 260 units at $342 88,920 Nov. 30 Purchase 40 units at $357 14,280 Available for sale 320 units $110,400 Aug. 13 There are 57 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) the first-in, first-out (FIFO) method; (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts