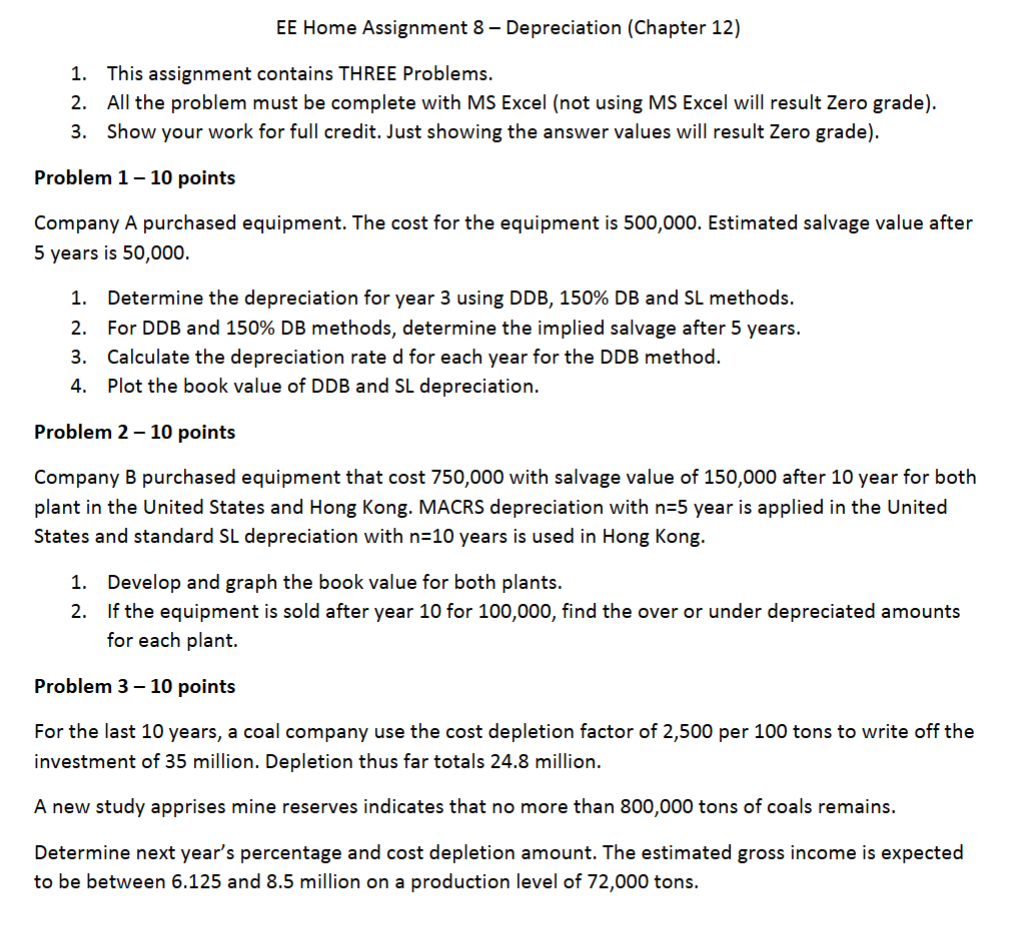

Question: EE Home Assignment 8 - Depreciation ( Chapter 1 2 ) 1 . This assignment contains THREE Problems. 2 . All the problem must be

EE Home Assignment Depreciation Chapter This assignment contains THREE Problems. All the problem must be complete with MS Excel not using MS Excel will result Zero grade Show your work for full credit. Just showing the answer values will result Zero grade

Problem points Company A purchased equipment. The cost for the equipment is Estimated salvage value after years is Determine the depreciation for year using DDB DB and SL methods. For DDB and DB methods, determine the implied salvage after years. Calculate the depreciation rate d for each year for the DDB method. Plot the book value of DDB and SL depreciation. Problem points Company B purchased equipment that cost with salvage value of after year for both plant in the United States and Hong Kong. MACRS depreciation with n year is applied in the United States and standard SL depreciation with mathrmn years is used in Hong Kong. Develop and graph the book value for both plants. If the equipment is sold after year for find the over or under depreciated amounts for each plant. Problem points For the last years, a coal company use the cost depletion factor of per tons to write off the investment of million. Depletion thus far totals million. A new study apprises mine reserves indicates that no more than tons of coals remains. Determine next year's percentage and cost depletion amount. The estimated gross income is expected to be between and million on a production level of tons.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock