Question: EEEE 1. Using the last 2 digits of your UIN, create your yield by adding 0.041 to the last 2 digits divided by 10000 (example:

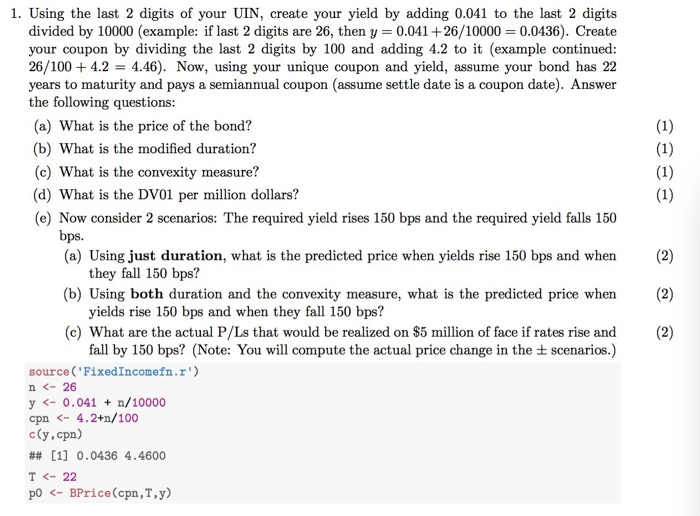

EEEE 1. Using the last 2 digits of your UIN, create your yield by adding 0.041 to the last 2 digits divided by 10000 (example: if last 2 digits are 26, then y= 0.041 +26/10000 = 0.0436). Create your coupon by dividing the last 2 digits by 100 and adding 4.2 to it (example continued: 26/100+ 4.2 = 4.46). Now, using your unique coupon and yield, assume your bond has 22 years to maturity and pays a semiannual coupon (assume settle date is a coupon date). Answer the following questions: (a) What is the price of the bond? (b) What is the modified duration? (c) What is the convexity measure? (d) What is the DV01 per million dollars? (e) Now consider 2 scenarios: The required yield rises 150 bps and the required yield falls 150 bps. (a) Using just duration, what is the predicted price when yields rise 150 bps and when they fall 150 bps? (b) Using both duration and the convexity measure, what is the predicted price when yields rise 150 bps and when they fall 150 bps? (c) What are the actual P/Ls that would be realized on $5 million of face if rates rise and fall by 150 bps? (Note: You will compute the actual price change in the scenarios.) source (Fixed Incomefn.r') n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts