Question: E-Eyes.com just issued some new preferred stock. The issue will pay an annual dividend of $26.8 in perpetuity. If the market requires a return of

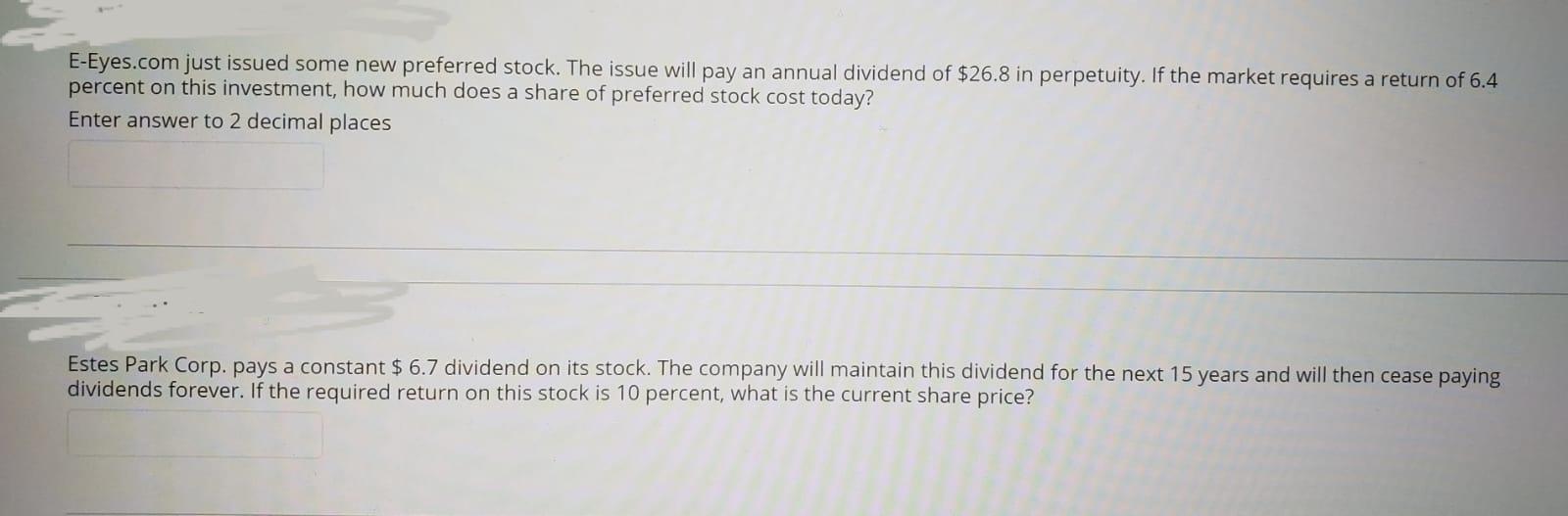

E-Eyes.com just issued some new preferred stock. The issue will pay an annual dividend of $26.8 in perpetuity. If the market requires a return of 6.4 percent on this investment, how much does a share of preferred stock cost today? Enter answer to 2 decimal places Estes Park Corp. pays a constant $ 6.7 dividend on its stock. The company will maintain this dividend for the next 15 years and will then cease paying dividends forever. If the required return on this stock is 10 percent, what is the current share price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock