Question: E-Eyes.com just issued some new preferred stock. The issue will pay an annual dividend of $14 in perpetuity, beginning 4 years from now. If the

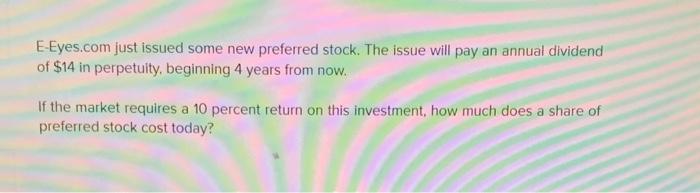

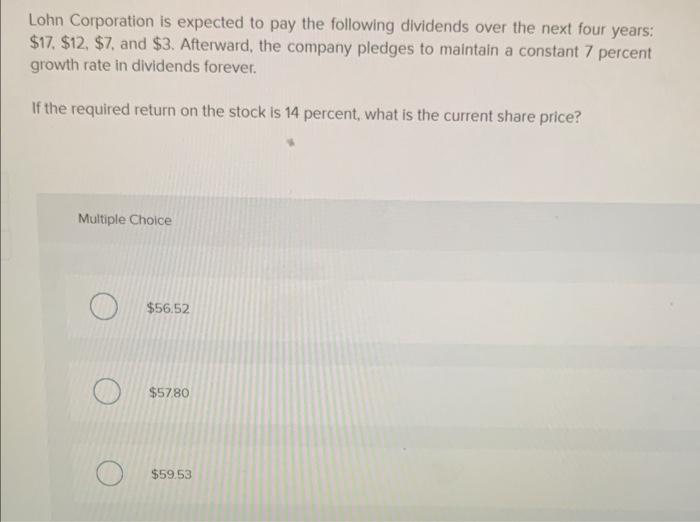

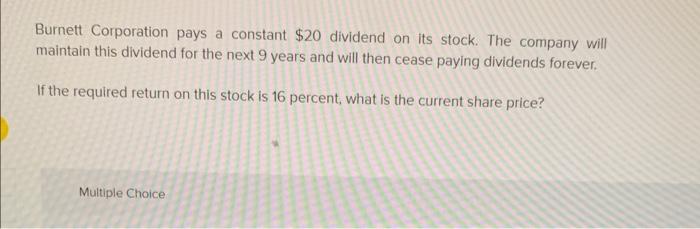

E-Eyes.com just issued some new preferred stock. The issue will pay an annual dividend of $14 in perpetuity, beginning 4 years from now. If the market requires a 10 percent return on this investment, how much does a share of preferred stock cost today? Lohn Corporation is expected to pay the following dividends over the next four years: $17,$12,$7, and $3. Afterward, the company pledges to maintain a constant 7 percent growth rate in dividends forever. If the required return on the stock is 14 percent, what is the current share price? Multiple Choice $56.52 $5780 $5953 Burnett Corporation pays a constant $20 dividend on its stock. The company will maintain this dividend for the next 9 years and will then cease paying dividends forever. If the required return on this stock is 16 percent, what is the current share price? Multiple Choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts