Question: Effective Interest Amortization On December 31, 2011, Echo, Inc., issued $850,000 of 11%, 10-year bonds for $782,000, yielding an effective interest rate of 12%. Semiannual

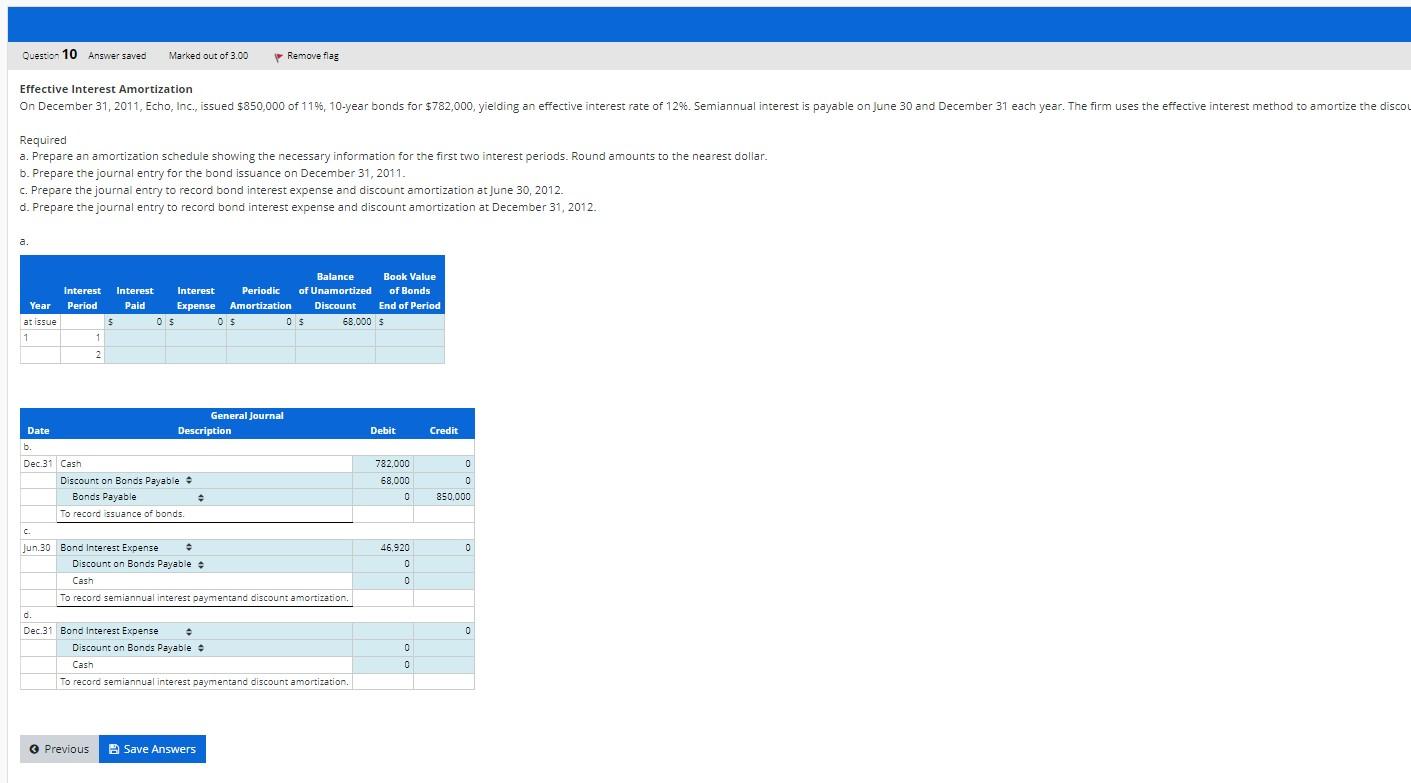

Effective Interest Amortization On December 31, 2011, Echo, Inc., issued $850,000 of 11%, 10-year bonds for $782,000, yielding an effective interest rate of 12%. Semiannual interest is payable on June 30 and December 31 each year. The firm uses the effective interest method to amortize the discount. Required a. Prepare an amortization schedule showing the necessary information for the first two interest periods. Round amounts to the nearest dollar. b. Prepare the journal entry for the bond issuance on December 31, 2011. c. Prepare the journal entry to record bond interest expense and discount amortization at June 30, 2012. d. Prepare the journal entry to record bond interest expense and discount amortization at December 31, 2012.

Guys, I am at a loss here, a loss of too many hours trying to get one number filled in, thanks in advance!

Effective Interest Amortization Required a. Prepare an amortization schedule showing the necessary information for the first two interest periods. Round amounts to the nearest dollar. b. Prepare the journal entry for the bond issuance on December 31,2011. c. Prepare the journal entry to record bond interest expense and discount amortization at june 30, 2012. d. Prepare the journal entry to record bond interest expense and discount amortization at December 31,2012

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts