Question: Efficient market hypothesis The efficient market hypothesis states that it is impossible for any one investor to earn a return above the average market return

Efficient market hypothesis

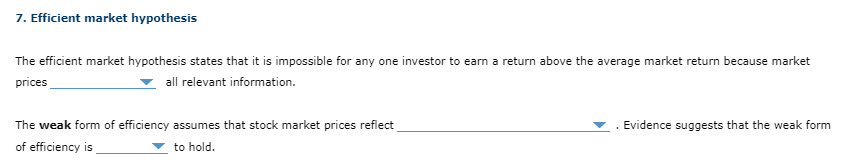

The efficient market hypothesis states that it is impossible for any one investor to earn a return above the average market return because market

prices

all relevant information.

The weak form of efficiency assumes that stock market prices reflect

Evidence suggests that the weak form

of efficiency is

to hold.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock