Question: Eignment 15 - Chapter 17 Help Save & Exit Check my Required information The following information applies to the questions displayed below) art 1 of

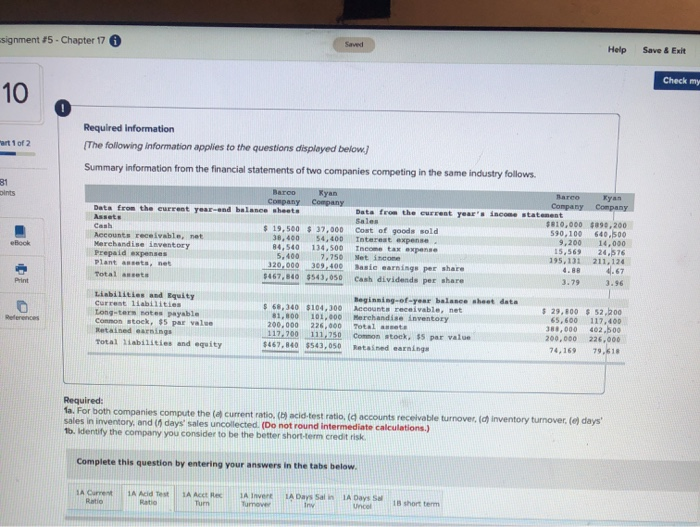

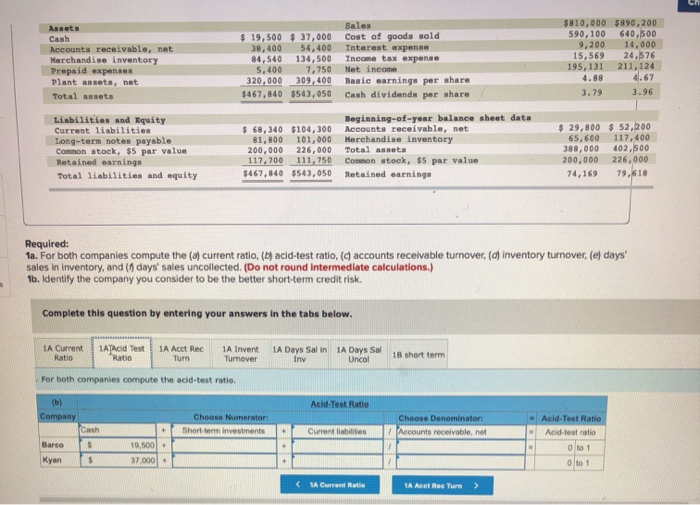

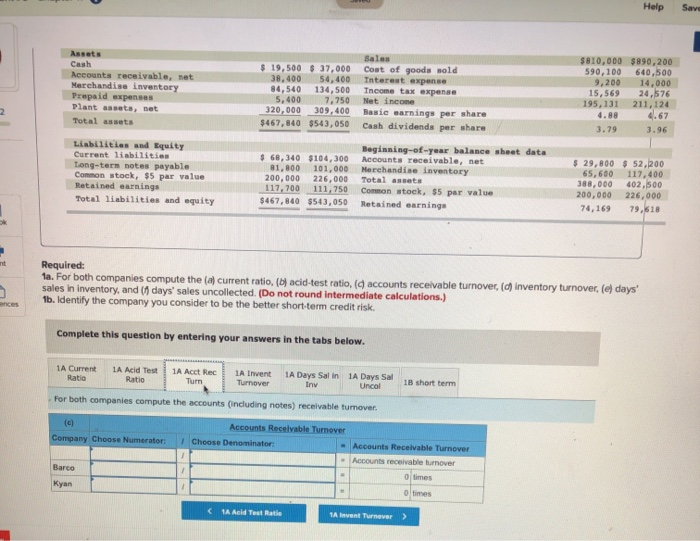

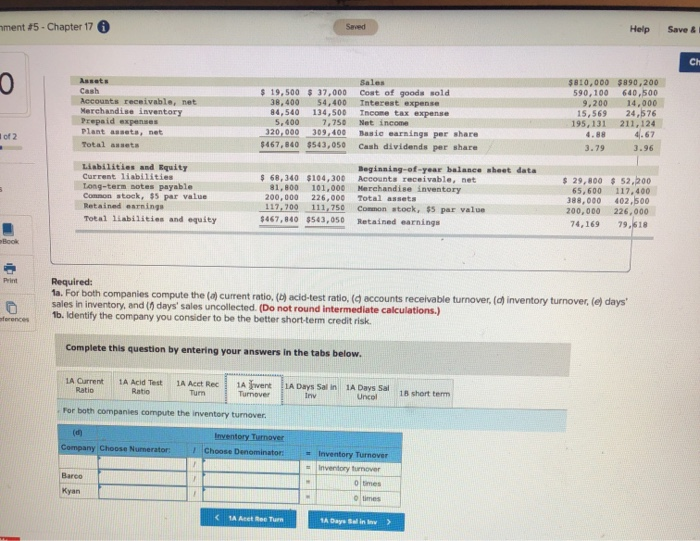

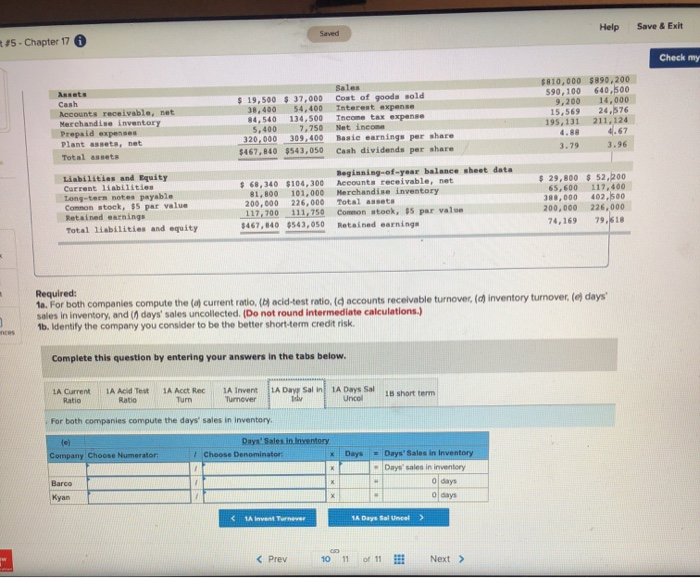

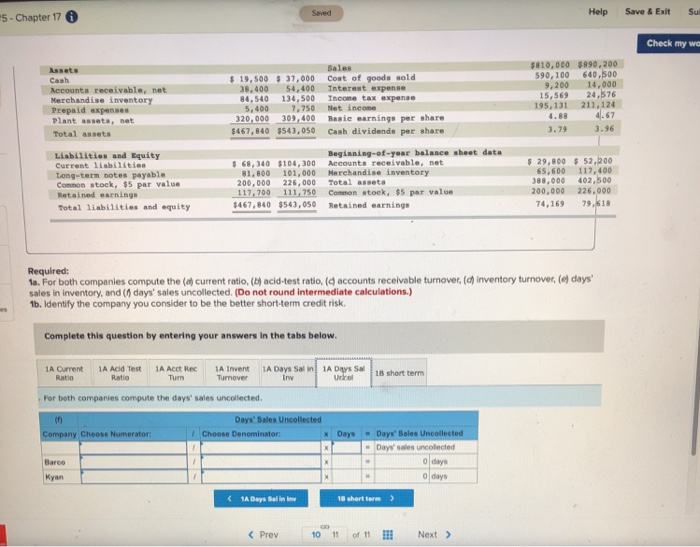

Eignment 15 - Chapter 17 Help Save & Exit Check my Required information The following information applies to the questions displayed below) art 1 of 2 Summary information from the financial statements of two companies competing in the same industry follows. ya Barco Ryan Company Company Data from the current year and balance sheets Assets $19.500 $37.000 Accounts receivable, not 38,400 54,400 Merchandise inventory 84,540 134.500 Prepaid expenses 5.400 7.750 Plant asta, net 320,000 309, 400 Totalt 0467,840 $54,050 Bares Company Company Data from the current year'income statement Sales SO10,000 $90,200 Cost of goods sold 590,100 60.00 Tatareat expense. 9.200 14.000 Income tax expense 15,569 20,576 Net Income 195,131 211,124 Base sanninge per share 4.88 4.67 Cash dividende per share 3.79 3.96 Liabilities and Equity Current liabilities Long-ters notes payable Common stock, $5 par value Retained earnings Total liabilities and equity $ 68,340 $104,300 81,800 101,000 200.000 226,000 117,700 111,250 5467.840 $54), 050 Beginning-of-year balance sheet data hecounts receivable, net Merchandise inventory Total auta Common stock, 55 par value Retained earnings $29.00 $ 52.900 65,600 117,400 388,000 402.500 200.000 226.000 76,169 79,618 Required: 1a. For both companies compute the current ratio (1) acid-test ratio, accounts receivable turnover, sales in inventory, and days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk inventory turnover (c) days! Complete this question by entering your answers in the tabs below. I Current A Acid Test 1A ACH I A IN LA Days Salin Turny A Days SM a Canh Accounts receivable, net Marchandise inventory Prepaid expenses plant assets, bet Total assets $ 19,500 $ 37,000 38,400 54,400 84.540 134,500 5.400 7.750 320,000 309,400 $467,840 $543, 050 Sales cost of goods sold Interest expense Income tax expense Nat income Basic earnings per share Cash dividends per share $810,000 $890,200 590.100 640,500 9,200 14,000 15.569 24.576 195,131 211,124 4.88 4.67 3.79 3.96 Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity Beginning-of-year balance sheet data $68.340 $104.300 Accounts receivable, net 81,800 101.000 Merchandise inventory 200.000 226.000 Total assets 117.700 111,750 Common stock, SS par value 5467.840 $543.050 Retained earnings $ 29,800 $ 52,200 65,600 117,400 388,000 402.500 200,000 226,000 74,16979,618 Required: 1a. For both companies compute the (a) current ratio, () acid-test ratio, accounts receivable turnover.() inventory turnover, (e) days' sales in inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. IA Qurrent Ahed Test Ratio 1A Act Rec Tum 1A Invent Tumover A Days Salin LA Days Sal Uncol For both companies compute the acid test ratio. Asid-Test Ratio Choose Numerator Short term investments Acid-Test Ratio + Company Cash Barcos Kyan Me Choose Denominator Accounts receivable, not Current liabilities Acid-test ratio 10,500 37 000 Accounts receivable, et Merchandise inventory Prepaid expenses Plant assets, bet $ 19,500 $ 37,000 38,400 54,400 84,540 134,500 5.400 7.750 320,000 309,400 $467,840 $543,050 Sales Coat of goods sold Interest expense Income tax expense Net income Basie warnings per share Cash dividends per share 5810,000 $890,200 590,100 640,500 9,200 14.000 15,569 24.576 195, 131 211,124 4.88 4.67 3.79 3.96 Total assets Liabilities and Equity Current liabilities Long-term notes payable Common stock, 35 par value Retained earnings Total liabilities and equity $ 68,340 $106,300 81,800 101,000 200,000 226,000 117,700 111,750 $467,840 $543,050 Beginning-of-year balance sheet data counts receivable, met Merchandise inventory Total assets Common stock, $5 par value Retained earnings $ 29,800 $ 52,200 65,600 117,400 388,000 402.500 200,000 226,000 74,169 79,618 Required: 1a. For both companies compute the (a) current ratio. (b) acid-test ratio, accounts receivable turnover (inventory turnover, (e) days' sales in inventory, and days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current LA Acid Test Ratio 1A Acct Rec Tum IA Invent Turnover A Days Salin Iny 1A Days Sal Uncol 18 short term For both companies compute the accounts (including notes) receivable turnover. (e) Company Choose Numerator: Accounts Receivable Turnover Choose Denominator: - Accounts Receivable Turnover - Accounts receivable turnover Barco Kyan ( 1 Aeld Test Rate 1A invent Turnover > ment #5 - Chapter 17 Seved Help Save & Assets Cash Accounts receivabla, net Merchandise inventory Prepaid expenses Plant asta, net Total asuta $19.500 $ 37,000 38,400 54,400 84,540 134,500 5.400 7.750 320,000 309,400 $467,840 $543,050 Sales Cost of goods sold Interest expense Income tax expense Net income Basie earnings per share Cash dividends per share $810,000 $890,200 590,100 640,500 9,200 14,000 15.569 24,576 195,131 211,124 4.88 4.67 3.79 Liabilities and Equity Current liabilities Long-term botas payable Common stock, $5 par value Retained earnings Total liabilities and equity $ 68,340 $104,300 81,800 101,000 200.000 226,000 117,700 111,750 $467,840 $543,050 Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets Common stock, $5 par value Retained earnings $ 29,800 $ 52,200 65.600 117.400 388.000 402.500 200,000 226,000 74,16979,618 Print Required: 1a. For both companies compute the current ratio, (b) acid-test ratio, ( accounts receivable turnover. (d) inventory turnover, (e) days' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. LA Current Ratio 1A Acid Test Ratio 1A Acet Rec 1A went Turnover Tum LA Days Sal in in 1A Days Sal Uncol 18 short term For both companies compute the inventory turnover. (d Company Choose Numerator: Inventory Turnover Choose Denominator Inventory Turnover Inventory turnover TI Help Save & Exit Saved 45. Chapter 176 Check my Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses plant assets, net Total assets $ 19,500 $ 37,000 38,400 54,400 86,540 134.500 5.400 7.750 320,000 309, 400 $467,840 $543,050 Sales Coat of goods sold Interest expense Income tax expense Net Income Basie earnings per share Cash dividends per share $810,000 $890,200 590. 100 640.500 9,200 14,000 15.569 24,576 195,131 211,124 4.67 3.79 3.96 Liabilities and Equity Current liabilities Long-term botes payable Connon stock, 35 par value Retained earnings Total liabilities and equity Beginning-of-year balance sheet data $ 60, 340 $104, 300 Accounts receivable, net 81,800 101,000 Merchandise inventory 200.000 226,000 Total assets 117,700 111,750 Common stock, 35 par value $467,840 $543,050 Retained earnings $ 29,800 $ 52,00 65,600 117,400 388,000 402.500 200,000 226,000 74,16979,618 Required: 10. For both companies compute the (current ratio. (acid-test ratio, accounts receivable turnover, (d) inventory turnover (c) days! sales in inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. IA Add Test LA Days Salin LA Current Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal Uncol 18 short term Ratio For both companies compute the days' sales in inventory Days Sales In Inventory Choose Denominator: Company Choose Numerator: Days - Days' Sales in Inventory Barco Kyan Days' sales in inventory o days o days 5 - Chapter 17 Help Save & Exit Check my we Assets Canh Accounts receivable, net Merchandise inventory Prepaid expenses plant asta, not Total assets $19,500 37.000 38,400 54,400 84,540 134,500 5,400 7.750 320,000 309,400 $467,840 9541,050 Sales Coat of goods sold Interest expense Income tax expense Net income Basie earnings per share Cash dividends per share $81.000 890,200 590,100 640.500 9,200 14.000 15,569 20.576 195,131211, 124 4.88 4.67 3.79 3.96 Liabilities and Equity Current abilities Long-ten sotes payable Common stock, $5 par value Retained in Total liabilities and equity Beginning-of-year balance sheet data $68,300 $100, 300 Accounts receivable, net 81.800 101.000 Merchandise inventory 200.000 226,000 Total assets 117.700 111.750 Common stock, 55 par value 5467,840 354), 050 Betained earnings $ 29,800 $ 52,200 65,600 117,400 388,000 402.500 200,000 226,000 74,169 79.518 Required: 1a. For both companies compute the current ratio, () acid-test ratio, accounts receivable turnover, () inventory turnover, (e) days' sales in inventory, and (1) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. LA Current Ratio A Acid Test Ratio LA Ace Rec Tum Anwent Turnover A Days Salin in IA Dos Sal 18 short term For both companies compute the days' sales uncollected Days' Sales Uncollected / Choose Denominator Company Choose Numerator Days Days' Sales Uncollected Days uncollected oldays o days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts