Question: Either B or D. The other 2 are incorrect. Dorothy is single, is not claimed as a dependent on anyone else's tax return, and has

Either B or D. The other 2 are incorrect.

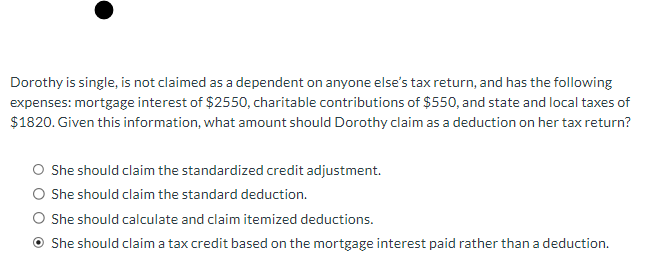

Dorothy is single, is not claimed as a dependent on anyone else's tax return, and has the following expenses: mortgage interest of $2550, charitable contributions of $550, and state and local taxes of $1820. Given this information, what amount should Dorothy claim as a deduction on her tax return? She should claim the standardized credit adjustment. She should claim the standard deduction. She should calculate and claim itemized deductions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts