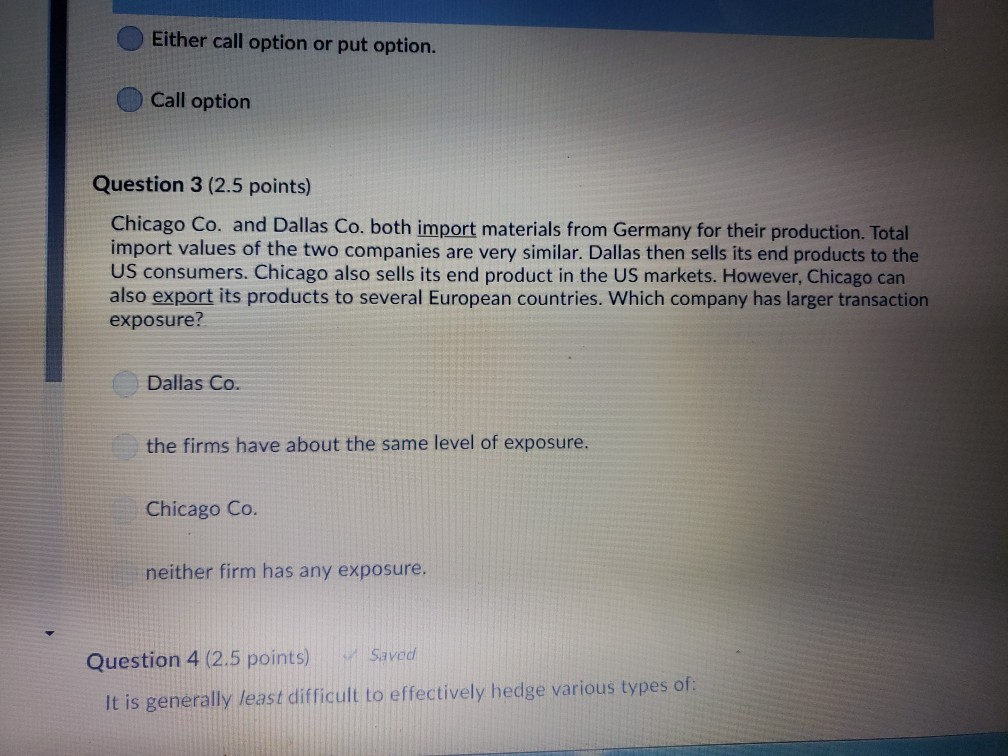

Question: Either call option or put option. Call option Question 3 (2.5 points) Chicago Co. and Dallas Co. both import materials from Germany for their production.

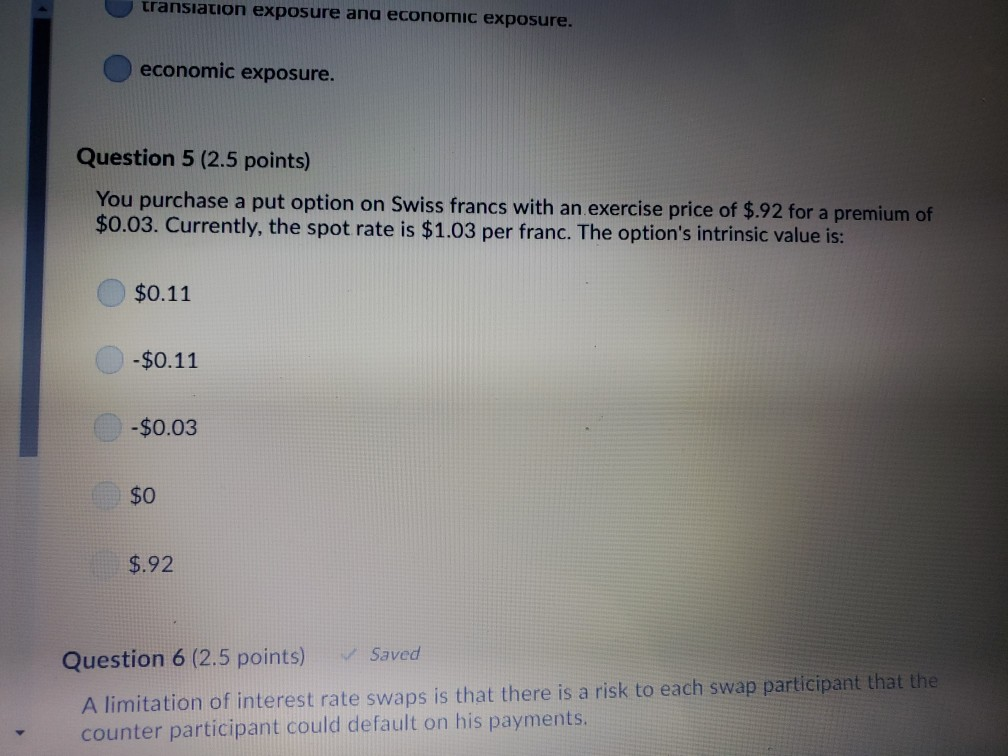

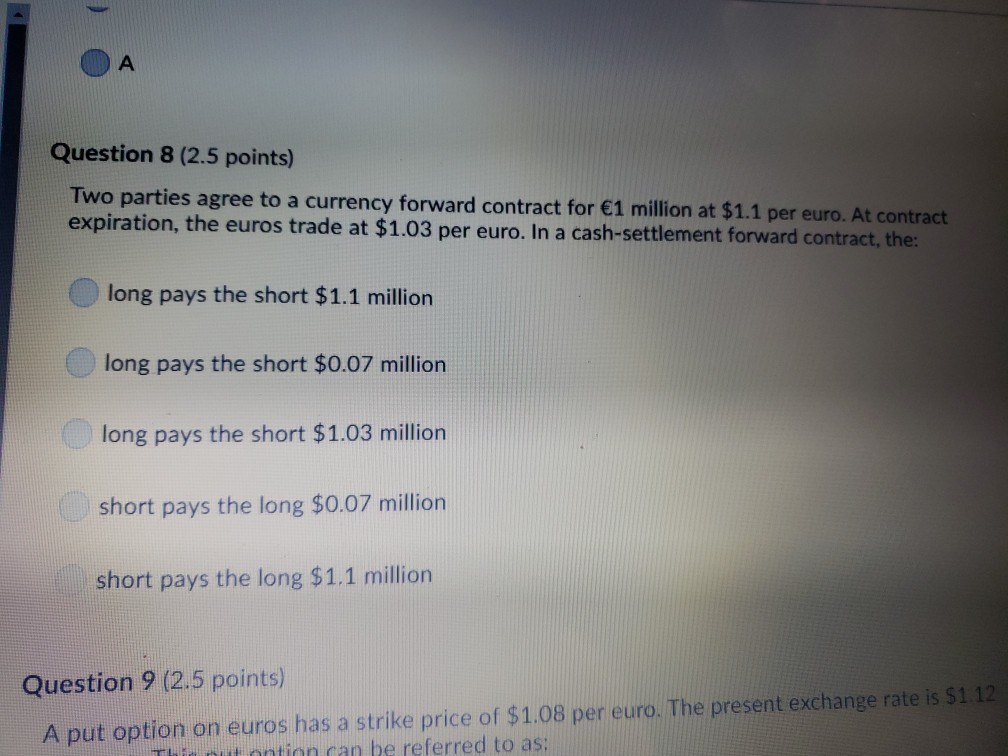

Either call option or put option. Call option Question 3 (2.5 points) Chicago Co. and Dallas Co. both import materials from Germany for their production. Total import values of the two companies are very similar. Dallas then sells its end products to the US consumers. Chicago also sells its end product in the US markets. However, Chicago can also export its products to several European countries. Which company has larger transaction exposure? Dallas Co. the firms have about the same level of exposure. Chicago Co. neither firm has any exposure Saved Question 4 (2.5 points) It is generally least difficult to effectively hedge various types of: transiation exposure ana ecoOmic exposure. economic exposure. Question 5 (2.5 points) You purchase a put option on Swiss francs with an exercise price of $.92 for a premium of $0.03. Currently, the spot rate is $1.03 per franc. The option's intrinsic value is: $0.11 -$0.11 -$0.03 $0 $.92 Question 6 (2.5 points) A limitation of interest rate swaps is that there is a risk to each swap participant that the counter participant could default on his payments. A Question 8 (2.5 points) Two parties agree to a currency forward contract for 1 million at $1.1 per euro. At contract expiration, the euros trade at $1.03 per euro. In a cash-settlement forward contract, the: long pays the short $1.1 million long pays the short $0.07 million long pays the short $1.03 million short pays the long $0.07 million short pays the long $1.1 million Question 9 (2.5 points) A put option on euros has a strike price of $1.08 per euro. The present exchange rate is $1.12 n can be referred to as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts