Question: ek 8 Assignment - Foreign Affillates i 1 Compre, Incorporated ( a U . S . - based company ) , establishes a subsidary in

ek Assignment Foreign Affillates

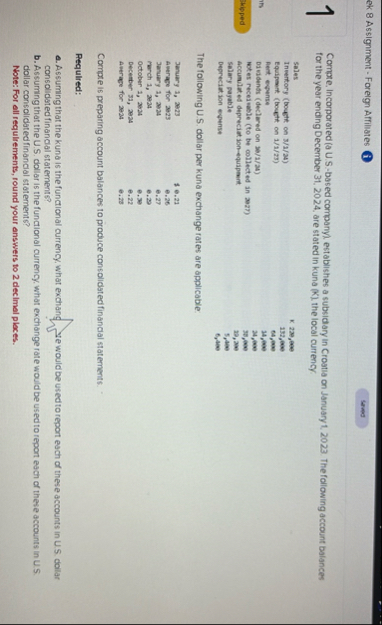

Compre, Incorporated a USbased company establishes a subsidary in Croatia on January The following account balances for the year ending December are stated in kuna K the local currency.

tablesadesKInvertiony bought on Equipuent boyett on Hent evense,Disidents declered on eWester recessuble to be collected in Accumlet ed deprecial ionequapment,Selary payable,Deprecietion eyenst,

The following US dollar per kuna exchange rates are applicable:

tableJanuary Amerage for eJanuery eFerch eOctober eDecenter eAverage for

Compre is preparing account balances to produce consolidated financlal statements.

Required:

Assuming that the kuna is the functional currency, what exchang ye would be usedto report each of these accounts in US dollar consolidated financial statements?

b Assuming that the US dollar is the functional currency, what exchange rate would be used to report each of these accounts in US dollar consolidated financial statements?

Note: For all requirements, round your answers to decimal places.

a Assuming that the kuna is the functional currency, what exchange rate would be used to report each of these accounts in US dollar consolidated financial statements?

b Assuming that the US dollar is the functional currency, what exchange rate would be used to report each of these accounts in US dollar consolidated financial statements?

Note: For all requirements, round your answers to decimal places.

tableAooountExchange flea Sales,a Inventory, Equipment,a Rent expense,a Dividends,$ a Notes receivable,$ a Accumulated depreciationequipment,$ a Salary payable,$ a Depreciation expense,$ b Sales,b Inventory,B Equipment,b Rent expense,b Dividends,b Notes receivable,b Acoumulated depreciationequipment,b Salary payable,b Depreciation expense,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock