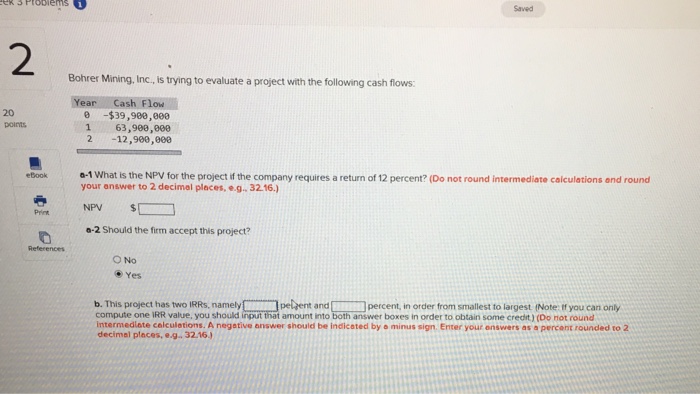

Question: ek Problems Saved 2 Bohrer Mining, Inc., is trying to evaluate a project with the following cash flows: Year Cash Flow 20 points 0 $39,908,800

ek Problems Saved 2 Bohrer Mining, Inc., is trying to evaluate a project with the following cash flows: Year Cash Flow 20 points 0 $39,908,800 63,908,800 2 12,900,808 1 eDook -1 What is the NPV for the project if the company requires a return of 12 percent? (Do not round intermediate caiculations end round your answer to 2 decimel places, .g. 32.16) e-2 Should the firm accept this project? O No Yes b. This project has two IRRs, namely compute one IRR value, you should input that amount into both answer boxes in order to obtain some credit) (Do not round intermedlate calculations. A negative answer should be indicated by o minus sign Enter your onswers as a percent rounded to 2 decimal places,e.g. 32.16 percent, in order from smallest to largest (Note: ff you can only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts