Question: Eleazar uses the aging method to record bad debt at the end of each fiscal year on December 31. This year, he made sales

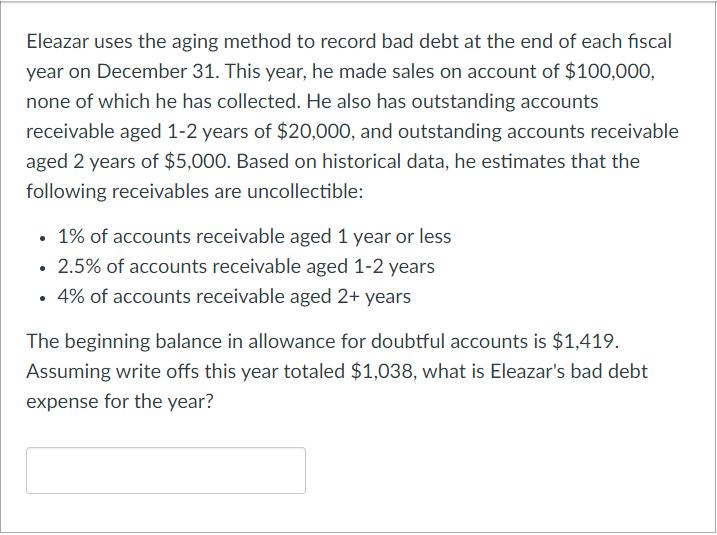

Eleazar uses the aging method to record bad debt at the end of each fiscal year on December 31. This year, he made sales on account of $100,000, none of which he has collected. He also has outstanding accounts receivable aged 1-2 years of $20,000, and outstanding accounts receivable aged 2 years of $5,000. Based on historical data, he estimates that the following receivables are uncollectible: 1% of accounts receivable aged 1 year or less 2.5% of accounts receivable aged 1-2 years 4% of accounts receivable aged 2+ years The beginning balance in allowance for doubtful accounts is $1,419. Assuming write offs this year totaled $1,038, what is Eleazar's bad debt expense for the year?

Step by Step Solution

There are 3 Steps involved in it

To calculate Eleazars bad debt expense for the year using the aging method we need ... View full answer

Get step-by-step solutions from verified subject matter experts