Question: Electronic Sheet- Problem 1-2 1. The time Value Money 2. Smitty's New Home Thanks Problema 1 The Time Value of Money Jackson L. Brown Valuation

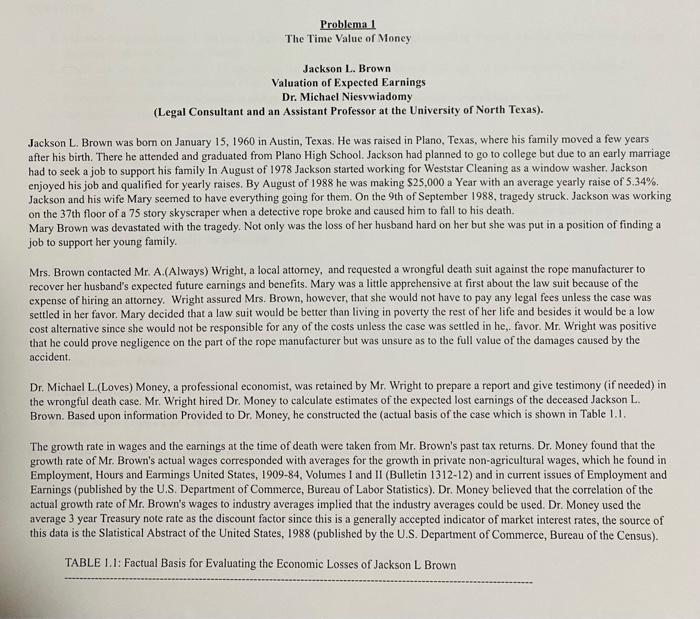

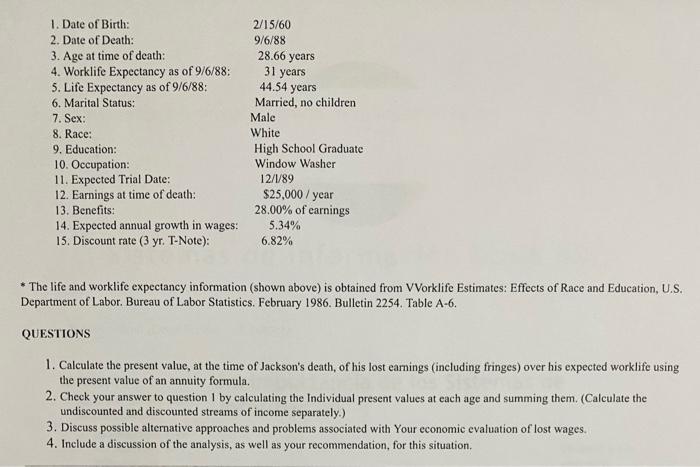

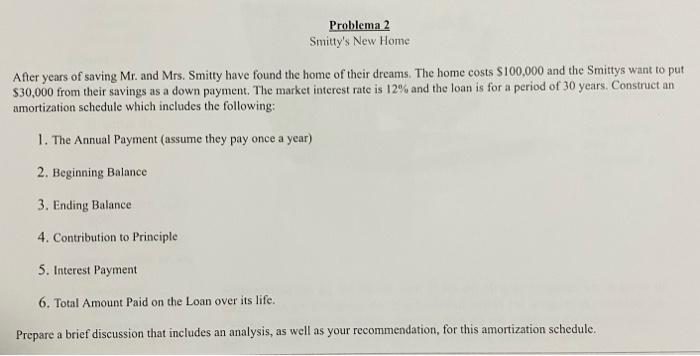

Problema 1 The Time Value of Money Jackson L. Brown Valuation of Expected Earnings Dr. Michael Niesvwiadomy (Legal Consultant and an Assistant Professor at the University of North Texas). Jackson L. Brown was born on January 15, 1960 in Austin, Texas. He was raised in Plano, Texas, where his family moved a few years after his birth. There he attended and graduated from Plano High School. Jackson had planned to go to college but due to an early marriage had to seek a job to support his family in August of 1978 Jackson started working for Weststar Cleaning as a window washer. Jackson enjoyed his job and qualified for yearly raises. By August of 1988 he was making $25,000 a Year with an average yearly raise of 5.34%. Jackson and his wife Mary seemed to have everything going for them. On the 9th of September 1988, tragedy struck. Jackson was working on the 37th floor of a 75 story skyscraper when a detective rope broke and caused him to fall to his death. Mary Brown was devastated with the tragedy. Not only was the loss of her husband hard on her but she was put in a position of finding a job to support her young family. Mrs. Brown contacted Mr. A.(Always) Wright, a local attomey, and requested a wrongful death suit against the rope manufacturer to recover her husband's expected future earnings and benefits. Mary was a little apprehensive at first about the law suit because of the expense of hiring an attorney. Wright assured Mrs. Brown, however, that she would not have to pay any legal fees unless the case was settled in her favor. Mary decided that a law suit would be better than living in poverty the rest of her life and besides it would be a low cost alternative since she would not be responsible for any of the costs unless the case was settled in he, favor. Mr. Wright was positive that he could prove negligence on the part of the rope manufacturer but was unsure as to the full value of the damages caused by the accident Dr. Michael L.(Loves) Money, a professional economist, was retained by Mr. Wright to prepare a report and give testimony (if needed) in the wrongful death case. Mr. Wright hired Dr. Money to calculate estimates of the expected lost earnings of the deceased Jackson L. Brown. Based upon information Provided to Dr. Money, he constructed the actual basis of the case which is shown in Table 1.1. The growth rate in wages and the earnings at the time of death were taken from Mr. Brown's past tax returns. Dr. Money found that the growth rate of Mr. Brown's actual wages corresponded with averages for the growth in private non-agricultural wages, which he found in Employment, Hours and Earmings United States, 1909-84, Volumes I and II (Bulletin 1312-12) and in current issues of Employment and Earnings (published by the U.S. Department of Commerce, Bureau of Labor Statistics). Dr. Money believed that the correlation of the actual growth rate of Mr. Brown's wages to industry averages implied that the industry averages could be used. Dr. Money used the average 3 year Treasury note rate as the discount factor since this is a generally accepted indicator of market interest rates, the source of this data is the Slatistical Abstract of the United States, 1988 (published by the U.S. Department of Commerce, Bureau of the Census). TABLE 11: Factual Basis for Evaluating the Economic Losses of Jackson L Brown 2/15/60 9/6/88 28.66 years 31 years 1. Date of Birth: 2. Date of Death: 3. Age at time of death: 4. Worklife Expectancy as of 9/6/88: 5. Life Expectancy as of 9/6/88: 6. Marital Status: 7. Sex: 8. Race: 9. Education: 10. Occupation: 11. Expected Trial Date: 12. Earnings at time of death: 13. Benefits: 14. Expected annual growth in wages: 15. Discount rate (3 yr. T-Note): 44.54 years Married, no children Male White High School Graduate Window Washer 12/1/89 $25,000/year 28.00% of earnings 5.34% 6.82% * The life and worklife expectancy information (shown above) is obtained from VVorklife Estimates: Effects of Race and Education, U.S. Department of Labor. Bureau of Labor Statistics. February 1986. Bulletin 2254. Table A-6. QUESTIONS 1. Calculate the present value, at the time of Jackson's death, of his lost earnings (including fringes) over his expected worklife using the present value of an annuity formula. 2. Check your answer to question 1 by calculating the Individual present values at each age and summing them. (Calculate the undiscounted and discounted streams of income separately.) 3. Discuss possible alternative approaches and problems associated with Your economic evaluation of lost wages. 4. Include a discussion of the analysis, as well as your recommendation, for this situation, Problema 2 Smitty's New Home After years of saving Mr. and Mrs. Smitty have found the home of their dreams. The home costs $100,000 and the Smittys want to put $30,000 from their savings as a down payment. The market interest rate is 12% and the loan is for a period of 30 years. Construct an amortization schedule which includes the following: 1. The Annual Payment (assume they pay once a year) 2. Beginning Balance 3. Ending Balance 4. Contribution to Principle 5. Interest Payment 6. Total Amount Paid on the Loan over its life. Prepare a brief discussion that includes an analysis, as well as your recommendation, for this amortization schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts