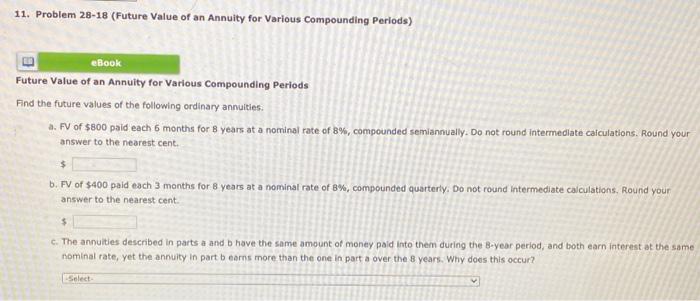

Question: eleven Dropdown answer 11. Problem 28-18 (Future Value of an Annuity for Various Compounding periods) eBook Future Value of an Annuity for Various Compounding periods

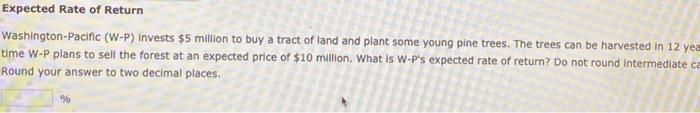

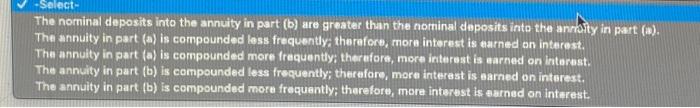

11. Problem 28-18 (Future Value of an Annuity for Various Compounding periods) eBook Future Value of an Annuity for Various Compounding periods Find the future values of the following ordinary annuities. a. FV of $800 paid each 6 months for 8 years at a nominal rate of 8%, compounded semiannually. Do not round intermediate calculations. Round your answer to the nearest cent. $ b. FV of $400 paid each 3 months for 8 years at a nominal rate of 8%, compounded quarterly. Do not round Intermediate calculations, Round your answer to the nearest cent. $ c. The annuities described in parts a and have the same amount of money paid into them during the 8-year period, and both earn interest at the same nominal rate, yet the annuity in part barns more than the one in part a over the years. Why does this occur? -Select- Expected Rate of Return Washington-Pacific (W-P) Invests $5 million to buy a tract of land and plant some young pine trees. The trees can be harvested in 12 yea time W-P plans to sell the forest at an expected price of $10 million. What is W-P's expected rate of return? Do not round intermediate ca Round your answer to two decimal places. % -Select- The nominal deposits into the annuity in part (b) are greater than the nominal deposits into the annuity in part (s). The annuity in part (a) is compounded less frequently, therefore, more interest is earned on interest. The annuity in part (a) is compounded more frequently, therefore, more interest is earned on interest. The annuity in part (b) is compounded less frequently; therefore, more interest is earned on interest. The annuity in part (b) is compounded more frequently; therefore, more interest is earned on interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts