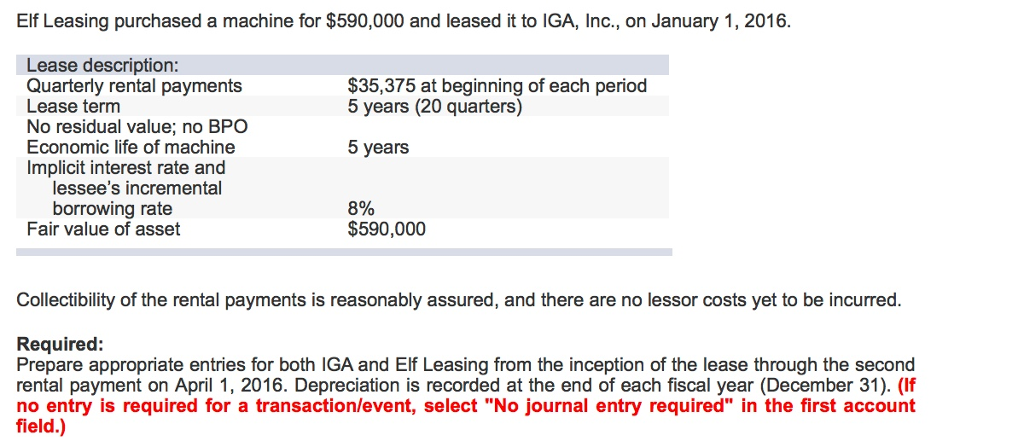

Question: ELF leasing purchsaed a machine for 590,000 and leased it to IGA on Jan. 1-- Record the following journal entries. (Image attached) 1. Record the

ELF leasing purchsaed a machine for 590,000 and leased it to IGA on Jan. 1-- Record the following journal entries. (Image attached)

1. Record the entry to lease machinery from ELF on Jan 1, 2016

2. Record the cash paid for lease payment

3. Record the cash paid for the lease payment with interest

4. Record ELF leased receivable at Jan 1, 2016

5. Record the cash receipt for the lease payments

6. Record the cash receipt for the lease payments with interest

Elf Leasing purchased a machine for $590,000 and leased it to IGA, Inc., on January 1, 2016. Lease description Quarterly rental payments Lease term No residual value; no BPO Economic life of machine Implicit interest rate and $35,375 at beginning of each period 5 years (20 quarters) 5 years lessee's incremental borrowing rate 8% $590,000 Fair value of asset Collectibility of the rental payments is reasonably assured, and there are no lessor costs yet to be incurred. Required: Prepare appropriate entries for both IGA and Elf Leasing from the inception of the lease through the second rental payment on April 1, 2016. Depreciation is recorded at the end of each fiscal year (December 31) If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts