Question: Eliminating Entries After First and Second Years During 2017, Peerless Company's wholly owned subsidiary Safeco Inc. reported net income of $1, 6000,000 and declared and

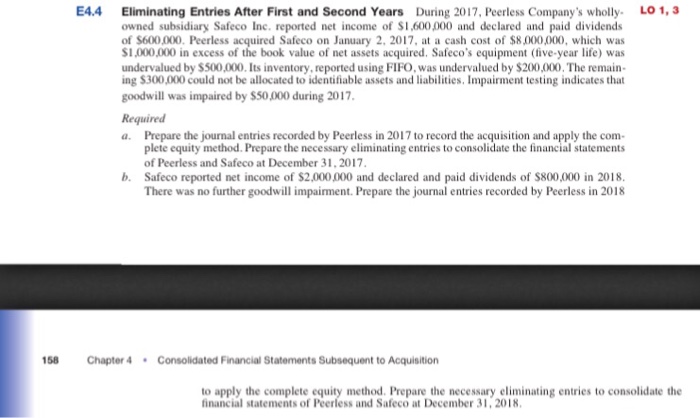

Eliminating Entries After First and Second Years During 2017, Peerless Company's wholly owned subsidiary Safeco Inc. reported net income of $1, 6000,000 and declared and paid dividends of $6000,000. Peerless acquired Safeco on January 2, 2017, at a cash cost of $8,000,000, which was $1,000,000 in excess of the book value of net assets acquired. Safeco's equipment (live-year life) was undervalued by $500,000. Its inventory, reported using FIFO, was undervalued by $200,000. The remaining $3000,000 could not be allocated to identifiable assets and liabilities. Impairment testing indicates that goodwill was impaired by $50,000 during 2017. Prepare the journal entries recorded by Peerless in 2017 to record the acquisition and apply the complete equity method. Prepare the necessary eliminating entries to consolidate the financial statements of Peerless and Safeco al December 31. 2017. Safeco reported net income of $800,000 in 2018. There was no further goodwill impairment. Prepare the journal entries recorded By Peerless in 2018 to apply the complete equity method. Prepare the necessary eliminating entries to consolidate the financial statements of Peerless and Safeco at December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts