Question: Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December

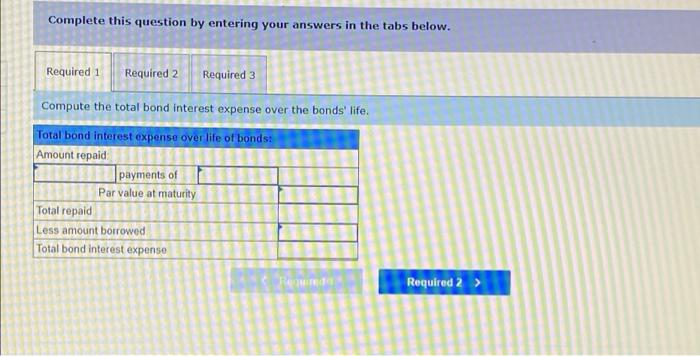

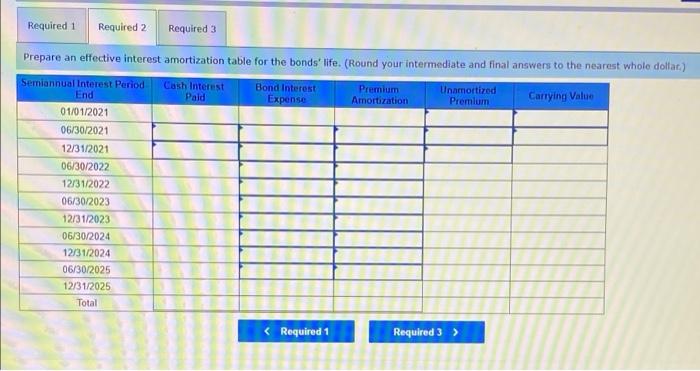

Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871 The annual market rate is 7.5% on the issue date Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense Required 2 > Required 1 Required 2 Required 3 Prepare an effective interest amortization table for the bonds' life. (Round your intermediate and final answers to the nearest whole dollar.) Semiannual Interest Period Cash Interest Pald Bond Interest Expense Premium Amortization Unamortized Premlum End Carrying Value 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Total < Required 1 Required 3 > View transaction list 1 Record the first interest payment on June 30, 2021. 2 Record the second interest payment on December 31, 2021. Credit Note: = journal entry has been entered Record entry Clear entry View general journal Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871 The annual market rate is 7.5% on the issue date Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense Required 2 > Required 1 Required 2 Required 3 Prepare an effective interest amortization table for the bonds' life. (Round your intermediate and final answers to the nearest whole dollar.) Semiannual Interest Period Cash Interest Pald Bond Interest Expense Premium Amortization Unamortized Premlum End Carrying Value 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Total < Required 1 Required 3 > View transaction list 1 Record the first interest payment on June 30, 2021. 2 Record the second interest payment on December 31, 2021. Credit Note: = journal entry has been entered Record entry Clear entry View general journal Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871 The annual market rate is 7.5% on the issue date Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense Required 2 > Required 1 Required 2 Required 3 Prepare an effective interest amortization table for the bonds' life. (Round your intermediate and final answers to the nearest whole dollar.) Semiannual Interest Period Cash Interest Pald Bond Interest Expense Premium Amortization Unamortized Premlum End Carrying Value 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Total < Required 1 Required 3 > View transaction list 1 Record the first interest payment on June 30, 2021. 2 Record the second interest payment on December 31, 2021. Credit Note: = journal entry has been entered Record entry Clear entry View general journal Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871 The annual market rate is 7.5% on the issue date Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense Required 2 > Required 1 Required 2 Required 3 Prepare an effective interest amortization table for the bonds' life. (Round your intermediate and final answers to the nearest whole dollar.) Semiannual Interest Period Cash Interest Pald Bond Interest Expense Premium Amortization Unamortized Premlum End Carrying Value 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Total < Required 1 Required 3 > View transaction list 1 Record the first interest payment on June 30, 2021. 2 Record the second interest payment on December 31, 2021. Credit Note: = journal entry has been entered Record entry Clear entry View general journal Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871 The annual market rate is 7.5% on the issue date Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense Required 2 > Required 1 Required 2 Required 3 Prepare an effective interest amortization table for the bonds' life. (Round your intermediate and final answers to the nearest whole dollar.) Semiannual Interest Period Cash Interest Pald Bond Interest Expense Premium Amortization Unamortized Premlum End Carrying Value 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Total < Required 1 Required 3 > View transaction list 1 Record the first interest payment on June 30, 2021. 2 Record the second interest payment on December 31, 2021. Credit Note: = journal entry has been entered Record entry Clear entry View general journal Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871 The annual market rate is 7.5% on the issue date Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense Required 2 > Required 1 Required 2 Required 3 Prepare an effective interest amortization table for the bonds' life. (Round your intermediate and final answers to the nearest whole dollar.) Semiannual Interest Period Cash Interest Pald Bond Interest Expense Premium Amortization Unamortized Premlum End Carrying Value 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Total < Required 1 Required 3 > View transaction list 1 Record the first interest payment on June 30, 2021. 2 Record the second interest payment on December 31, 2021. Credit Note: = journal entry has been entered Record entry Clear entry View general journal

Step by Step Solution

3.61 Rating (155 Votes )

There are 3 Steps involved in it

Required 1 10 payments of 5 years rate4 82 Par value at maturity 530000 Total re... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

624e8f54df64f_april7.xlsx

300 KBs Excel File