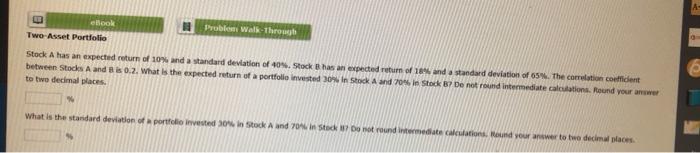

Question: elook Problem Walk-throw Two-Asset Portfolio Stock A has an expected return of 10% and a standard deviation of 409. Stock Bhas an expected return of

elook Problem Walk-throw Two-Asset Portfolio Stock A has an expected return of 10% and a standard deviation of 409. Stock Bhas an expected return of 18 and a standard deviation of 65%. The correlation coefficient between Stokes A and B is 0.2. What is the expected return of a portfolio invested 30 in Stock and 70. In Stock B? De not found intermediate calculations. Round your to two decimal places What is the standard deviation of portfolio invested in Stock And 704 in Stock Dohorodintermediate Calendations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock