Question: em 16-15 Protit potential associated with margin [LO 16-2] A $1.000 par value bond was issued 20 years ago at a 12 percent coupon rate.

![em 16-15 Protit potential associated with margin [LO 16-2] A $1.000](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6f8fdd3704_62966f6f8fd73e2a.jpg)

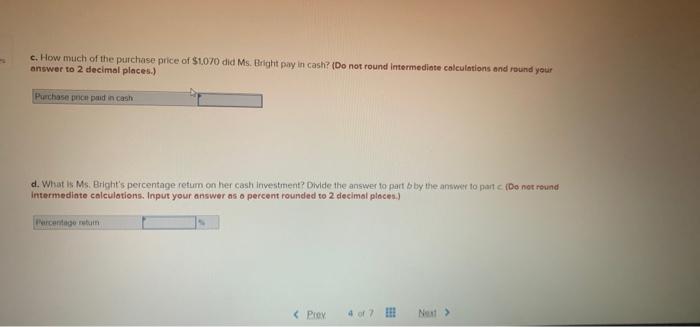

em 16-15 Protit potential associated with margin [LO 16-2] A $1.000 par value bond was issued 20 years ago at a 12 percent coupon rate. It currently has 15 years remaining to maturity. Interest rates on similar obligations are now 8 percent. Assume Ms. Bright bought the bond three years ago when it had a price of $1070 Furthet assume Ms. Bright paid 40 percent of the purchase price in cash and borrowed the rest known as buying on margin). She used the interest payments from the bond to cover the interest costs on the loan. What is the current price of the bond? Use Table 16:2. Input your answer to 2 decimal places.) Price of the bond b. What is her dollar profit based on the bond's current price? (Do not round Intermediate calculations and round your answer to 2 decimal places.) Dollar profil c. How much of the purchase price of $1070 did Ms. Bright pay in cash? (Do not round Intermediate calculations and round your answer to 2 decimal places.) Purchase pricepud in cash d. What is Ms. Bright's percentage retum on her cash investment? Divide the answer to part by the answer to part (Do not round Intermediate calculations. Input your answer os o percent rounded to 2 decimal places.) centage return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts