Question: Email 3: For: [ Your name here] From: Martha Rodriguez (CEO) Subject: Swimmers headphones project. Hi, I just wanted to tell you a couple of

![Email 3: For: [Your name here] From: Martha Rodriguez (CEO) Subject:](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffbf9ecf8ef_76666ffbf9e1c6e3.jpg)

Email 3:

For: [Your name here]

From: Martha Rodriguez (CEO)

Subject: Swimmers headphones project.

Hi,

I just wanted to tell you a couple of things regarding the Swimmers headphones project and about some financial policies that you may not know yet:

p. 4

- Be sure to include Cannibalization in your financial model, as it has often been a factor to consider with our existing products. I just finished reading a study con- ducted by one of our marketing trainees, who found that for our basket of audio products, there is 10% Cannibalization on average. In the same vein, the average

price and cost of our basket of audio products is around 85% of the projected pri- ce and cost for the Swimmers headphones.

I want to be clear on this important issue that has got me into trouble a couple of times before. If we assume that we will sell 215,000 headphones in year 1, that will reduce the sale of the firms other audio products by 21,500 (=215,000*10%) units. Therefore, our sale estimate for that year must be reduced by an average of USD 85*85% = 72.25*21,500

= 1,553,375 due to cannibalization. Of course, we also need to reduce the cost by USD 40*85% = 34*21,500 = 731,000 for that year.

I know you may be wondering how reliable these 10% and 85% figures are. Unfortuna- tely, I have not had the time to go through the report thoroughly and we should proba- bly not take these figures at face value, but I think for the moment, we can model them with a normal distribution.

- Given the difficulty of calculating the incremental impact of any given project on the Systech working capital accounts, in this case, we estimate that after the pro- ject begins (Time 1) the cash needed could be the following: 5% of sales, accounts receivable of 10% sales, inventory of 7% sales, and accounts payable of 8% of cost of goods sold. Of course, all these figures are average values, so you can model them using a normal distribution with those figures as expected values and a standard deviation of +/-10% of the given expected value. The initial (Time zero) working capital will be around USD 2,000,000.

- As I once mentioned to you, the average WACC for Syntech is 12%; however, we are trying to differentiate the WACC calculations among different lines of business, given different market risks and financing possibilities.

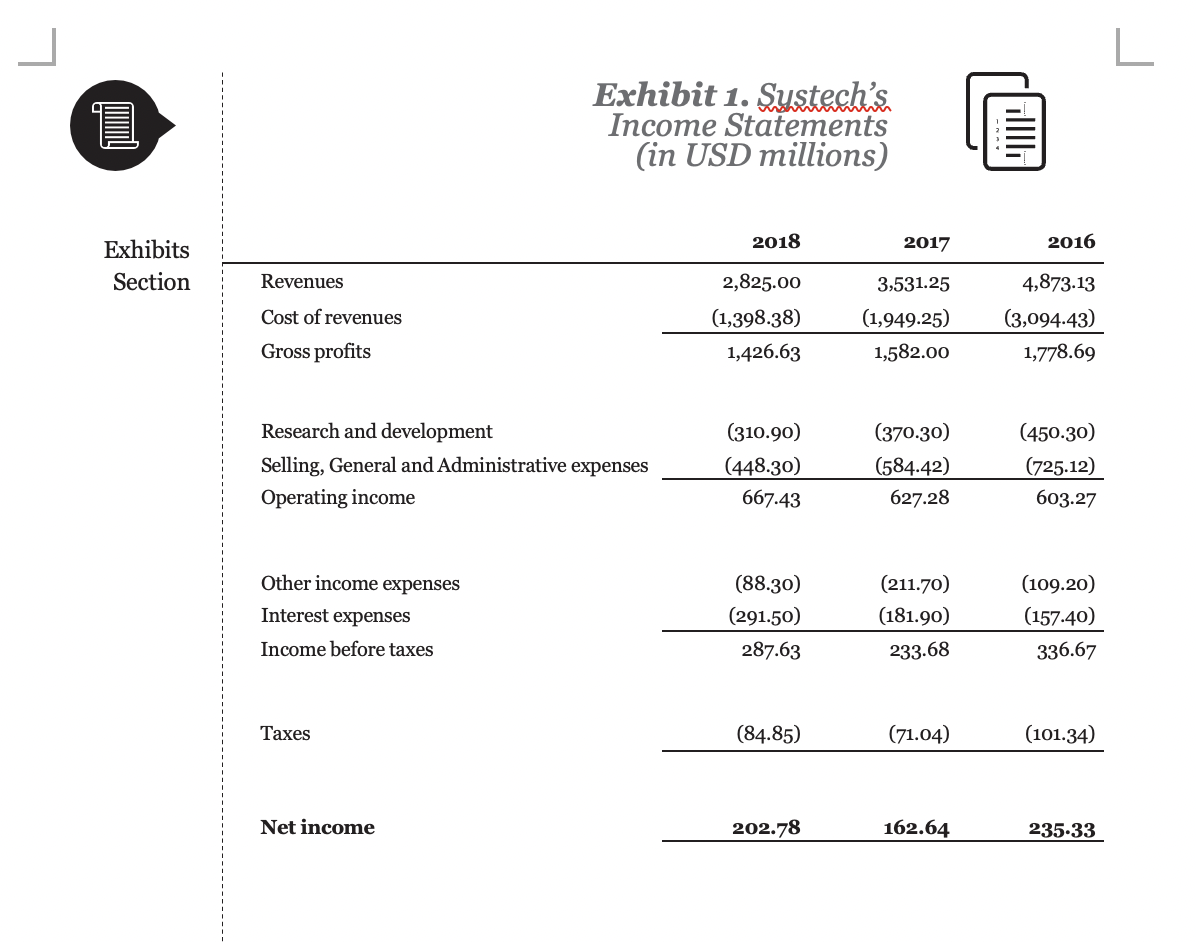

For this project, we can use the average market-based Debt-to-Equity ratio using only long-term financial debt (see Exhibit 1). The cost of debt has been very stable throu- gh the last couple of years so you can use the average implicit cost of debt that could be extracted from Exhibit 1. To estimate the WACC, there are always discussions and di- sagreements among the members of the board concerning the adequate cost of equity. I would recommend that we use the CAPM with a 4% risk free interest rate and a 7% market risk premium. I gathered this data from professor Damodarans web page a few month ago. I also send attached information about four other companies that also make audio products. This may help you to estimate the project Beta (see Exhibit 2), althou- gh it is important to notice (and this observation could be raised by a board member du- ring the discussion), that none of these comparable firms make Swimmers headphones.

p. 5

Finally, it is a common practice in Systechs project analysis to assume a Terminal or Continuation Value equal to a perpetual growth rate of 2% per year after the last Free Cash Flow of each project considered. However, some regional managers believe that

after 5 years all competitors will already be producing a similar product, and that we will be better off ending the project by selling the brand, the equipment, and the wor- king capital for USD 20 million (assuming that the sale of the project will take place at the end of the fifth year and the USD 20 million represent the net Free Cash Flow you will receive - net of taxes).

In case we decide to use the liquidation value of USD 20 million, we will assume that the recovery of the initial working capital will be included in that. In this case, if we decide to go on with the traditional practice of using the terminal value instead, we dont need to consider the recovery of the working capital in the analysis.

Regards,

Martha.

Question. Prepare proforma income statement for Systech

L Exhibit 1. (cont.) Sustesh Balance Sheet (in USD millions) NIH 2018 2017 2016 Current assets: Cash and equivalent Net receivables Inventory Other current assets Total current assets 605.00 538.90 97.30 54-50 1,295.70 733.90 503-30 26.10 4.90 1,268.20 370.60 505.80 29.00 2.40 907.80 Property, plant, and equipment, net Goodwill Intangible assets Other assets Deferred long term assets 291.30 477.80 162.10 695.00 126.80 242.50 280.80 138.30 691.30 121.30 215-30 278.60 137.00 633.40 119.50 Total assets 3,048.70 2,742.40 2,291.60 Current liabilities: Accounts payables Short / current Long Term Debt Other current liabilities Total current liabilities 26.89 8.40 40.25 75-54 24.18 10.80 44.12 79.10 18.90 106.00 39.39 164.29 Long term debt Other long term liabilities Deferred long term liabilities 2,459.60 2.19 21.64 1,983.90 2.26 20.23 1,650.01 2.49 172.50 Total liabilities 2,558.97 2,085.49 1,989.29 Book value of equity and reserves 489.73 656.91 302.31 Total liabilities and equity 3,048.70 2,742.40 2,291.60 91.77 88.58 78.25 Number of shares outstading (thousand) End of the year stock price ($ per share) 49.68 41.33 38.95 O L 1 Exhibit 1. Sustech's. Income Statements (in USD millions) UP 2018 2017 2016 Exhibits Section Revenues Cost of revenues 2,825.00 (1,398.38) 1,426.63 3,531.25 (1,949.25) 1,582.00 4,873.13 (3,094.43) 1,778.69 Gross profits Research and development Selling, General and Administrative expenses Operating income (310.90) (448.30) 667.43 (370.30) (584.42) 627.28 (450.30) (725.12) 603.27 Other income expenses Interest expenses Income before taxes (88.30) (291.50) 287.63 (211.70) (181.90) (109.20) (157.40) 336.67 233.68 Taxes (84.85) (71.04) (101.34) Net income 202.78 162.64 235-33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts