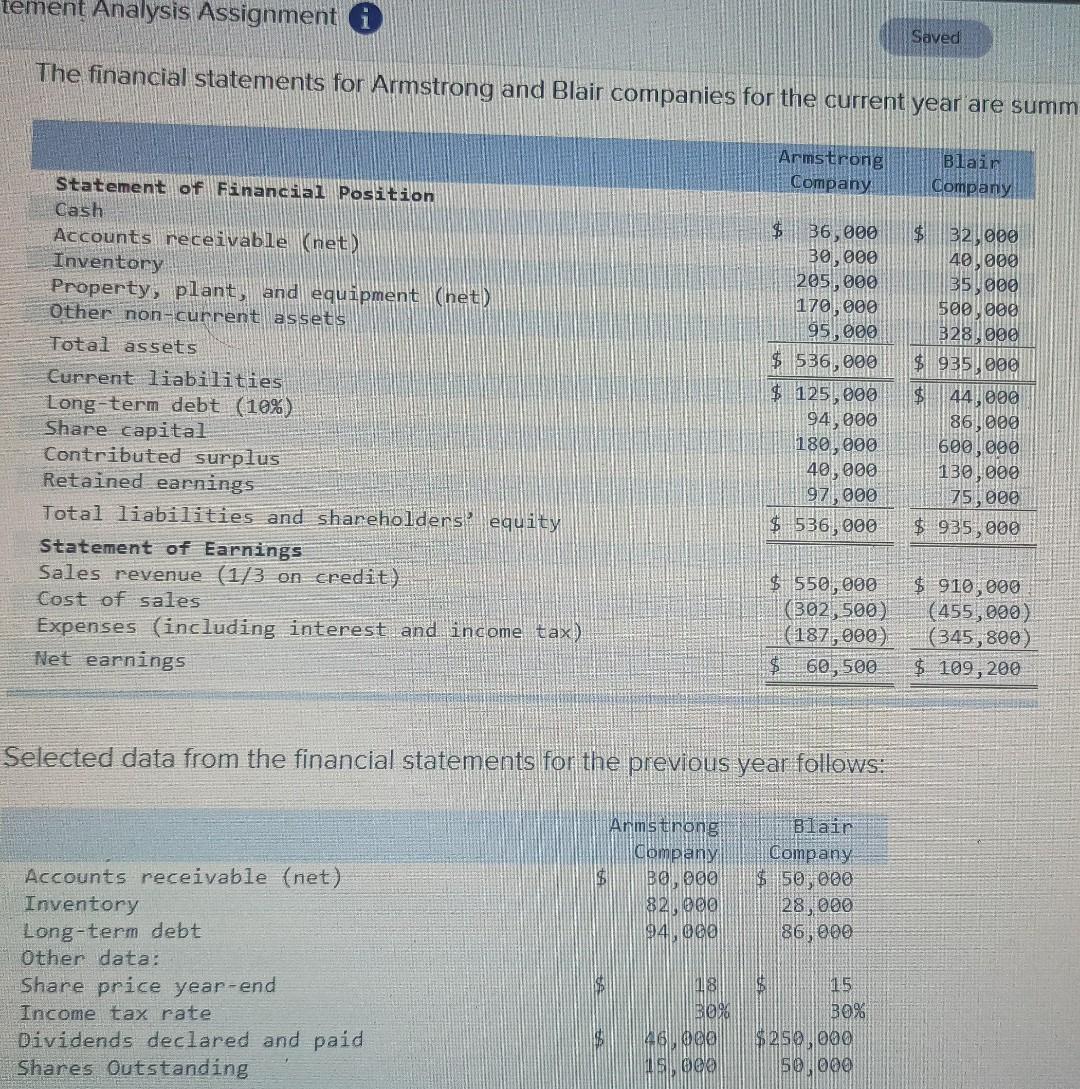

Question: ement Analysis Assignment i Saved The financial statements for Armstrong and Blair companies for the current year are summ Armstrong Company Blair Company Statement of

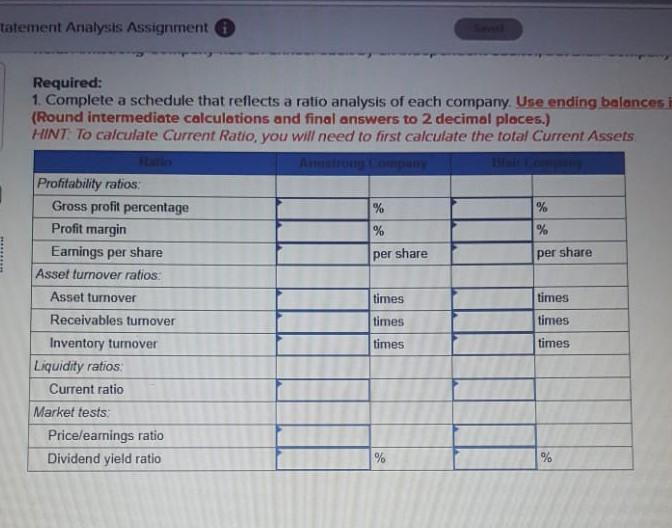

ement Analysis Assignment i Saved The financial statements for Armstrong and Blair companies for the current year are summ Armstrong Company Blair Company Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (het) Other non-current assets Total assets Current liabilities Long-term debt (10%) Share capital Contributed surplus Retained earnings Total liabilities and shareholders equity Statement of Earnings Sales revenue (1/3 on credit) Cost of sales Expenses (including interest and income tax) Net earnings $ 36,000 30,000 205,000 170,000 95,000 $ 536,000 $ 125,000 94,000 180,000 40,000 971 000 $ 536, 000 $ 3200g 40,000 35 000 500,000 B28000 $ 935000 $ 44,000 86, 000 600,000 130 000 75,000 $ 935,000 $ 550,000 (302,500 (187,000) $ 60, 500 $ 910,000 (455,000) (345,800) $ 109,200 Selected data from the financial statements for the previous year follows: Armstrong Company $ BOL 900 82,000 94.ee Blair Company $ 50 000 28, 000 86,000 Accounts receivable (net) Inventory Long-term debt Other data: Share price year-end Income tax rate Dividends declared and paid Shares Outstanding 18 $ 15 BO B0% 26 e$ 250,000 cal 50 000 tatement Analysis Assignment Required: 1. Complete a schedule that reflects a ratio analysis of each company. Use ending balances (Round intermediate calculations and final answers to 2 decimal places.) HINT: To calculate Current Ratio, you will need to first calculate the total Current Assets % % % % per share per share Profitability ratios Gross profit percentage Profit margin Earnings per share Asset turnover ratios. Asset turnover Receivables turnover Inventory tumover Liquidity ratios Current ratio Market tests Price/earnings ratio Dividend yield ratio times times times times times times % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts