Question: !!!EMERGENCY!!! I would really appreciated answer this question quickly.(Could you write the answers by hand) 1) Consider a portfolio consisting of a long position in

!!!EMERGENCY!!! I would really appreciated answer this question quickly.(Could you write the answers by hand)

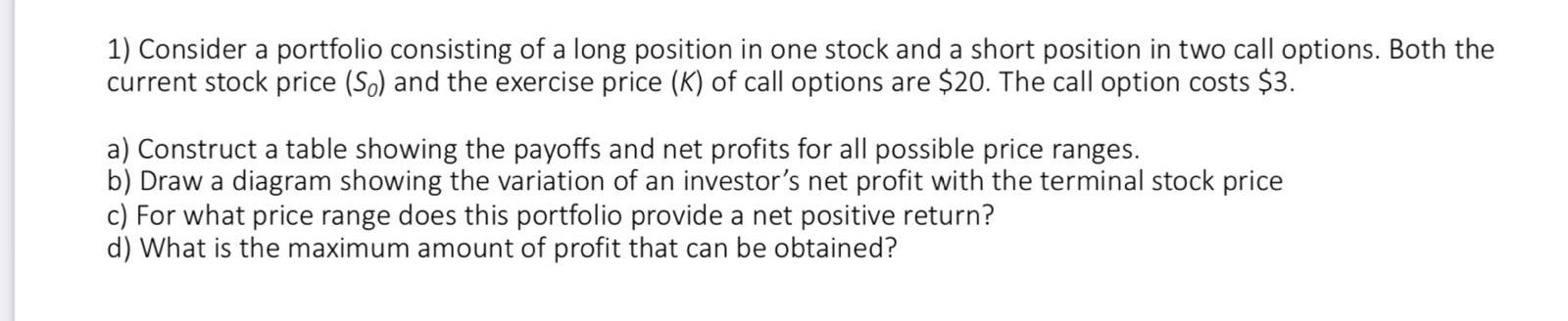

1) Consider a portfolio consisting of a long position in one stock and a short position in two call options. Both the current stock price (So) and the exercise price (K) of call options are $20. The call option costs $3. a) Construct a table showing the payoffs and net profits for all possible price ranges. b) Draw a diagram showing the variation of an investor's net profit with the terminal stock price c) For what price range does this portfolio provide a net positive return? d) What is the maximum amount of profit that can be obtained

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts