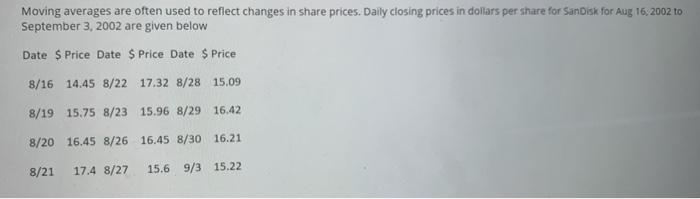

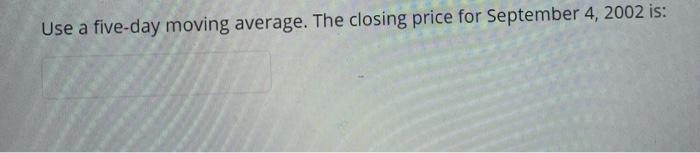

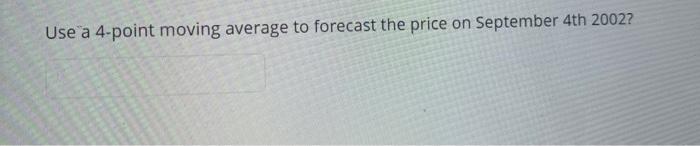

Question: emergency please answer!! all one question!!! use excel! will give thumbs if answered completely! Moving averages are often used to reflect changes in share prices.

emergency please answer!! all one question!!! use excel! will give thumbs if answered completely!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock