Question: EMERGENCY! PLEASE LEND A HAND TO ANSWER THE ABOVE QUESTION Q5. Shareholders and regulators have different view in term of capital adequacy. Given below is

EMERGENCY! PLEASE LEND A HAND TO ANSWER THE ABOVE QUESTION

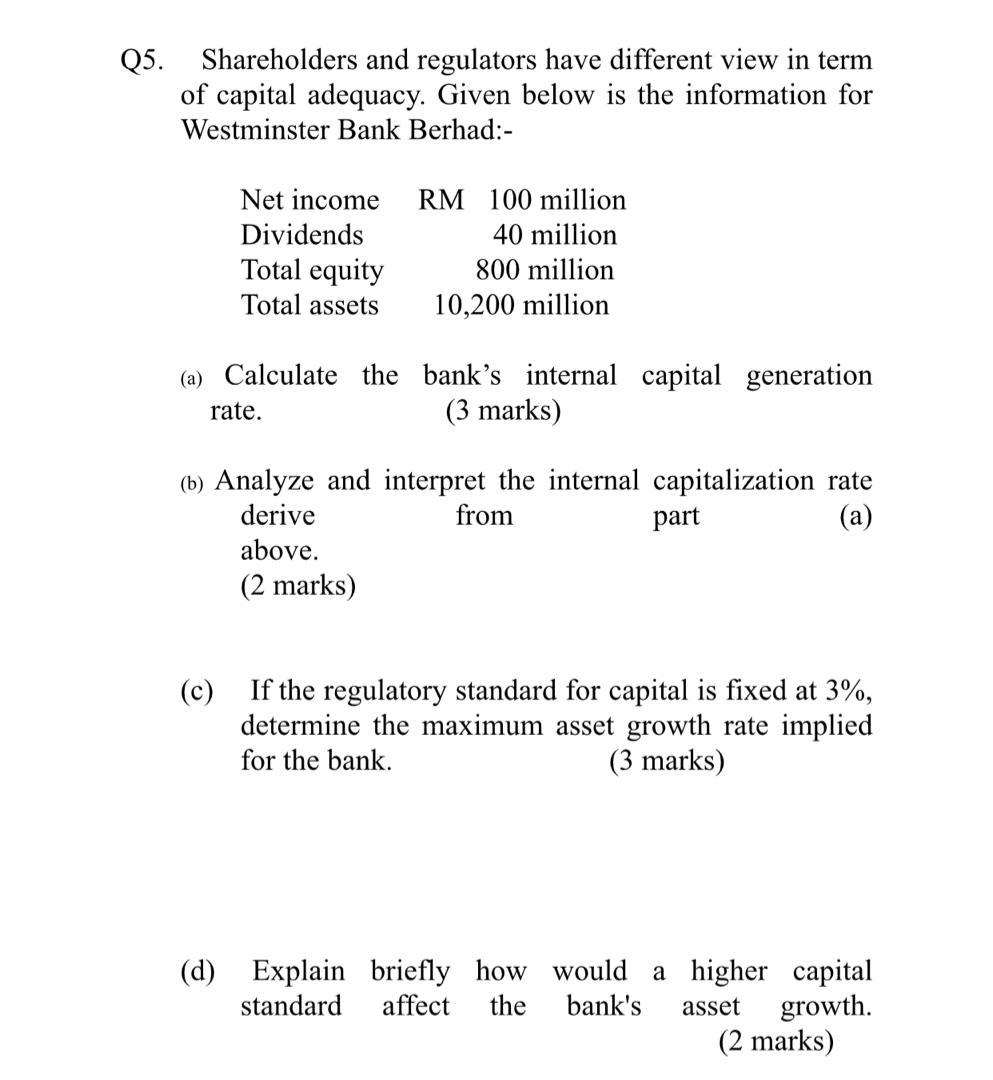

Q5. Shareholders and regulators have different view in term of capital adequacy. Given below is the information for Westminster Bank Berhad:- Net income Dividends Total equity Total assets RM 100 million 40 million 800 million 10,200 million (a) Calculate the bank's internal capital generation (3 marks) rate. (b) Analyze and interpret the internal capitalization rate derive from part (a) above. (2 marks) (c) If the regulatory standard for capital is fixed at 3%, determine the maximum asset growth rate implied for the bank. (3 marks) (d) Explain briefly how would a higher capital standard affect the bank's asset growth. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts