Question: Emerson, Inc. is evaluating whether to replace a machine. The current machine was purchased 3 years ago for $6,000 and falls into the MACRS 3-year

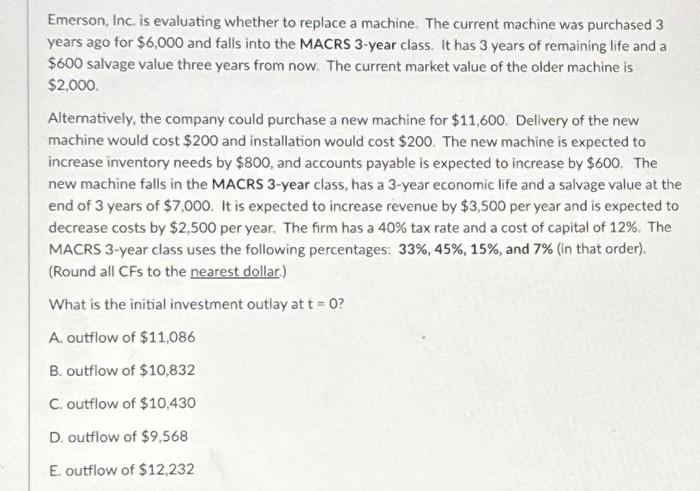

Emerson, Inc. is evaluating whether to replace a machine. The current machine was purchased 3 years ago for $6,000 and falls into the MACRS 3-year class. It has 3 years of remaining life and a $600 salvage value three years from now. The current market value of the older machine is $2,000 Alternatively, the company could purchase a new machine for $11,600. Delivery of the new machine would cost $200 and installation would cost $200. The new machine is expected to increase inventory needs by $800, and accounts payable is expected to increase by $600. The new machine falls in the MACRS 3-year class, has a 3-year economic life and a salvage value at the end of 3 years of $7,000. It is expected to increase revenue by $3,500 per year and is expected to decrease costs by $2,500 per year. The firm has a 40% tax rate and a cost of capital of 12%. The MACRS 3-year class uses the following percentages: 33%,45%,15%, and 7% (in that order). (Round all CFs to the nearest dollar.) What is the initial investment outlay at t=0 ? A. outflow of $11,086 B. outflow of $10,832 C. outflow of $10,430 D. outflow of $9,568

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts