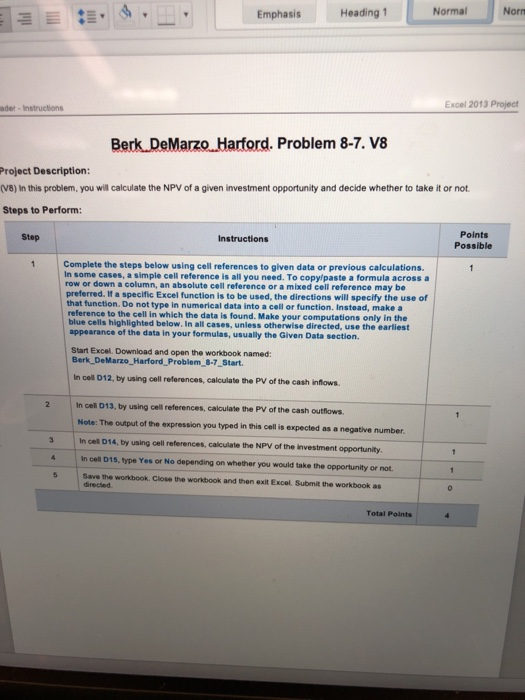

Question: Emphasis Heading 1 Normal Norm Excel 2013 Project ader Instructions Berk.DeMarzo.Harford. Problem 8-7. V8 Project Description (V8) In this problem, you will calculate the NPV

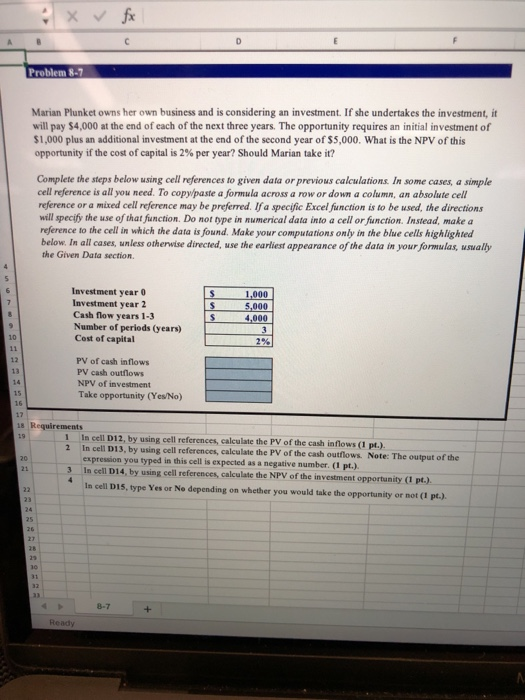

Emphasis Heading 1 Normal Norm Excel 2013 Project ader Instructions Berk.DeMarzo.Harford. Problem 8-7. V8 Project Description (V8) In this problem, you will calculate the NPV of a given investment opportunity and decide whether to take it or not Steps to Perform: Points Possible Step Instructions Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Start Excel. Download and open the workbook named Berk DeMarzo Harford Problem 8-7_Start In cell D12, by using cell references, calculate the PV of the cash inflows. 2 in cell D13, by using cel references, calculate the PV of the cash outfows Note: The output of the expression you typed in this cell is expected as a negative number. 3 In cel 014, by using cell references, calculate the NPV of the investment opportunity 4 In cell D15, type Yes or No depending on whether you would take the opportunity or not. 5 Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed Total Points Problem 8-7 Marian Plunket owns her own business and is considering an investment. If she undertakes the investment, it will pay $4,000 at the end of each of the next three years. The opportunity requires an initial investment of $1,000 plus an additional investment at the end of the second year of $5,000. What is the NPV of this opportunity if the cost of capital is 2% per year? Should Marian take it? Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. Ifa specific Excel function is to be used, the directions will specify the use of that function. Do not ype in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section Investment year0 Investment year 2 Cash flow years 1-3 Number of periods (years) Cost of capital 1,000 4,000 2% 12 PV of cash inflows PV cash outflows NPV of investment Take opportunity (Yes/No) s Requirements In cell D12, by using cell references, calculate the PV of the cash inflows (1 pt.) In cell D13, by using cell references, calculate the PV of the cash outflows. Note: The output of the expression you typed in this cell is expected as a negative number. (O In cell D14, by using cell references, calculate the NPV of the investment opportunity (1 pt.) i 2 21 In cell DI5, type Yes or No depending on whether you would take the opportunity or not (1 pt.) 8-7 Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts