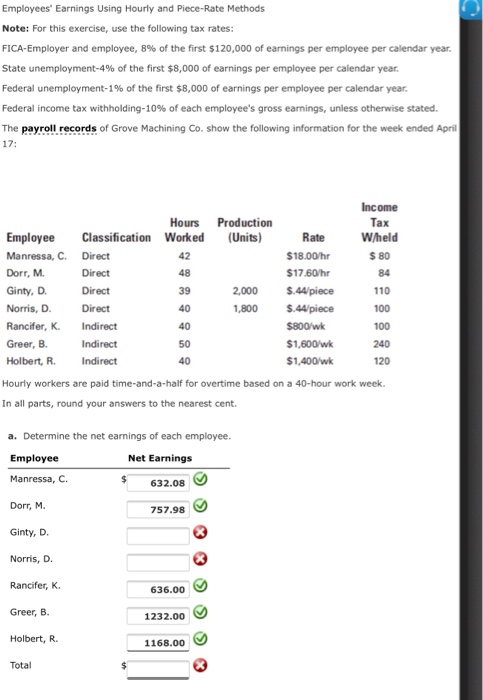

Question: Employees Earnings Using Hourly and Piece-Rate Methods Note: For this exercise, use the following tax rates: FICA-Employer and employee, 896 of the first $120,000 of

Employees Earnings Using Hourly and Piece-Rate Methods Note: For this exercise, use the following tax rates: FICA-Employer and employee, 896 of the first $120,000 of earnings per employee per calendar year. State unemployment-4% of the first $8,000 of earnings per employee per calendar year. Federal unemployment-196 of the first $8,000 of earnings per employee per calendar year. Federal income tax withholding-10% of each employee's gross earnings, unless otherwise stated. The payroll records of Grove Machining Co. show the following information for the week ended April 17: Income Tax Wheld $ 80 Hours Production Employee Classification Worked (Units) Manressa, C. Direct Dorr, M. Ginty, D Norris, D. Direct Rancifer, K. Indirect Greer, B Holbert, R. Indirect Hourly workers are paid time-and-a-half for overtime based on a 40-hour work week In all parts, round your answers to the nearest cent Rate $18.00/hr $17.60hr 2,000 $44/piece 1,800 $.44/piece Direct 48 39 40 40 50 40 110 100 100 240 120 $1,600/wk $1,400/wk Indirect a. Determine the net earnings of each employee. Employee Manressa, C. Dorr, M Ginty, D. Norris, D. Rancifer, K Greer, B. Holbert, R. Net Earnings $632.08 757.98 636.00 1232.0 1168.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts