Question: Employers prefer the defined benefit plan to the defined contribution plan because the former is inherently less risky and its accounting treatment is similar to

“Employers prefer the defined benefit plan to the defined contribution plan because the former is inherently less risky and its accounting treatment is similar to the latter”. Discuss this statement. Your answer should briefly explain the key differences between these two types of post-employment benefit plans from the perspectives of employers.

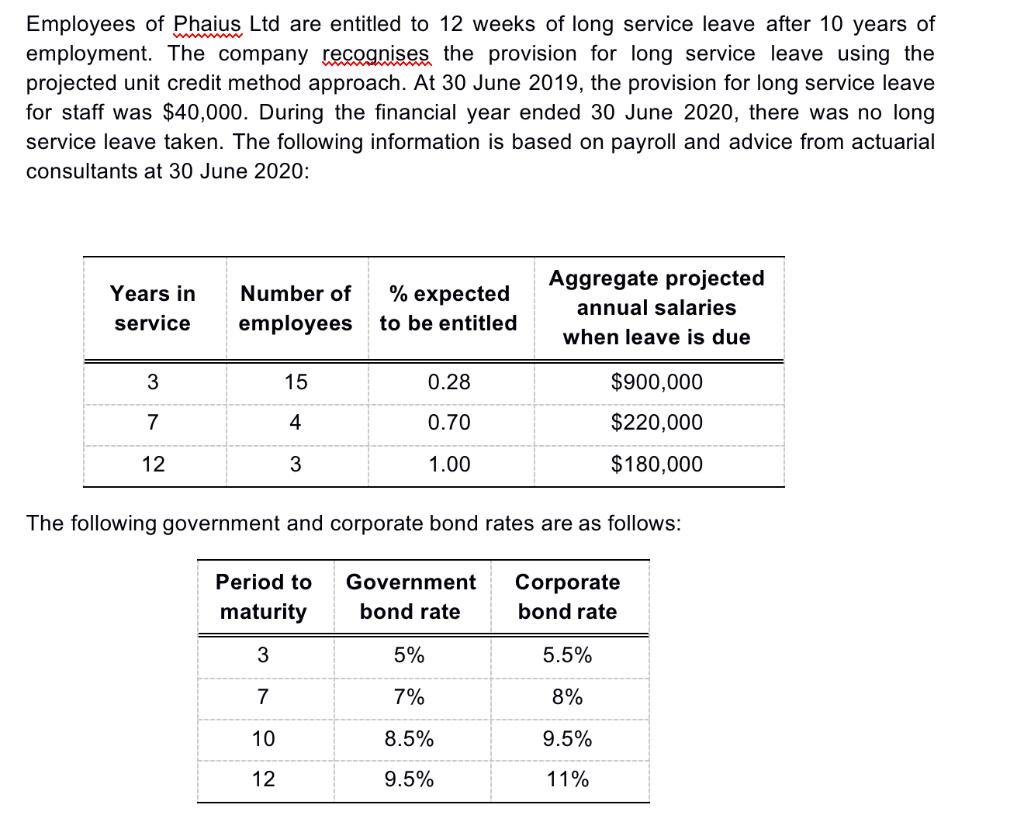

Employees of Phaius Ltd are entitled to 12 weeks of long service leave after 10 years of employment. The company recognises the provision for long service leave using the projected unit credit method approach. At 30 June 2019, the provision for long service leave for staff was $40,000. During the financial year ended 30 June 2020, there was no long service leave taken. The following information is based on payroll and advice from actuarial consultants at 30 June 2020: Aggregate projected Years in Number of % expected annual salaries service employees to be entitled when leave is due 3 15 0.28 $900,000 7 4 0.70 $220,000 12 1.00 $180,000 The following government and corporate bond rates are as follows: Period to Government Corporate maturity bond rate bond rate 5% 5.5% 7 7% 8% 10 8.5% 9.5% 12 9.5% 11%

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Defined contribution plan is a kind of post employment benefit plan where the employees and the empl... View full answer

Get step-by-step solutions from verified subject matter experts