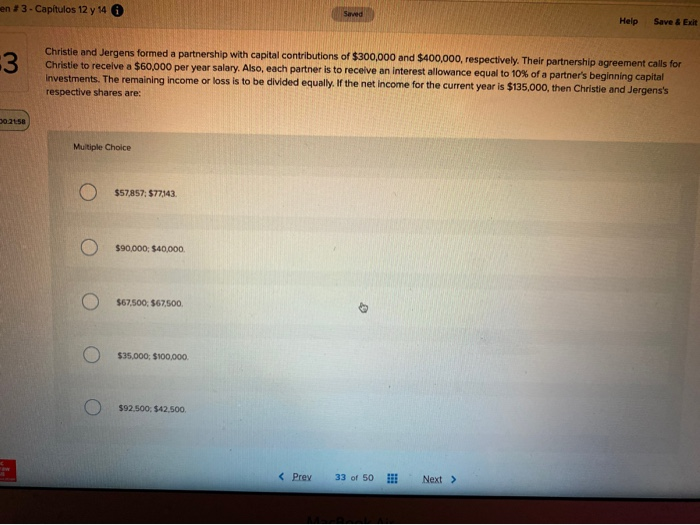

Question: en #3 - Captulos 12 y 14 6 Help Save & Exit Christie and Jergens formed a partnership with capital contributions of $300,000 and $400,000,

en #3 - Captulos 12 y 14 6 Help Save & Exit Christie and Jergens formed a partnership with capital contributions of $300,000 and $400,000, respectively. Their partnership agreement calls for Christle to receive a $60,000 per year salary. Also, each partner is to receive an interest allowance equal to 10% of a partner's beginning capital Investments. The remaining income or loss is to be divided equally. If the net income for the current year is $135,000, then Christie and Jergens's respective shares are: 02158 Multiple Choice 0 $57,857: $77,143. O $90,000 $40,000 0 $67,500,567,500 0 O $35.000 $100,000 0 0 $92.500, $42.500, 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts