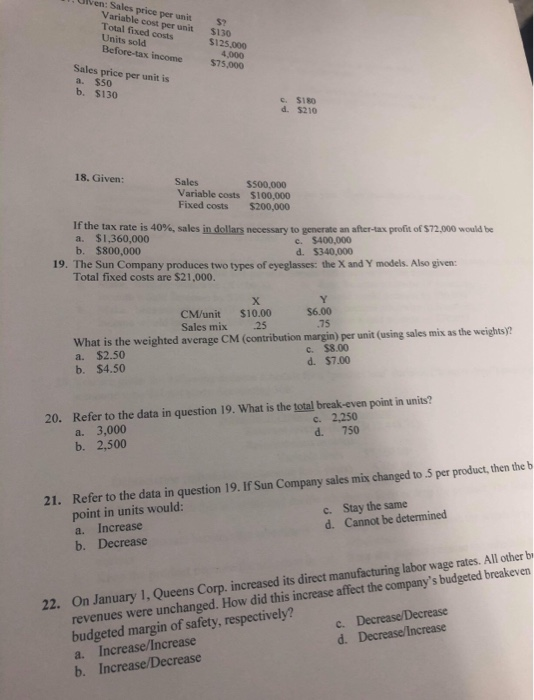

Question: en: Sales price per unit Variable cost per unit. Total fixed costs Units sold Before-tax income $130 $125,000 4,000 $75,000 Sales price per unit is

en: Sales price per unit Variable cost per unit. Total fixed costs Units sold Before-tax income $130 $125,000 4,000 $75,000 Sales price per unit is a. $50 b. $130 c. $180 d. $210 18. Given: Sales Variable costs Fixed costs $500,000 $100,000 $200,000 If the tax rate is 40% , sales in dollars necessary to generate an after-tax profit of $72,000 would be a. $1,360,000 b. $800,000 19. The Sun Company produces two types of eyeglasses: the X and Y models. Also given: Total fixed costs are $21,000. c. $400,000 d. $340,000 Y X $10.00 25 $6.00 75 CM/unit Sales mix What is the weighted average CM (contribution margin) per unit (using sales mix as the weights)? a. $2.50 b. $4.50 c. $8.00 d. $7.00 Refer to the data in question 19. What is the total break-even point in units? a. 3,000 b. 2,500 20. c. 2,250 d. 750 21. Refer to the data in question 19. If Sun Company sales mix changed to .5 per product, then the b point in units would: a. Increase b. Decrease c. Stay the same d. Cannot be determined 22. revenues were unchanged. How did this increase affect the company's budgeted breakeven budgeted margin of safety, respectively? a. Increase/Increase b. Increase/Decrease On January 1, Queens Corp. increased its direct manufacturing labor wage rates. All other b c. Decrease/Decrease d. Decrease/Increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts