Question: End of Chapter Case Study: Catalyst Acquires Targacept in Reverse Merger Case Study Objectives: To Illustrate Motivations for going public The mechanics of reverse mergers

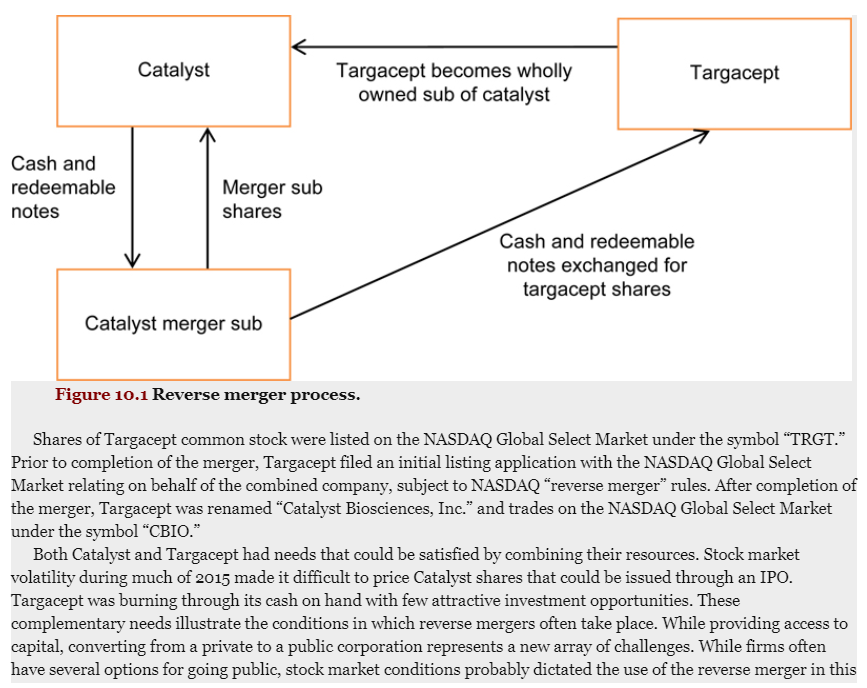

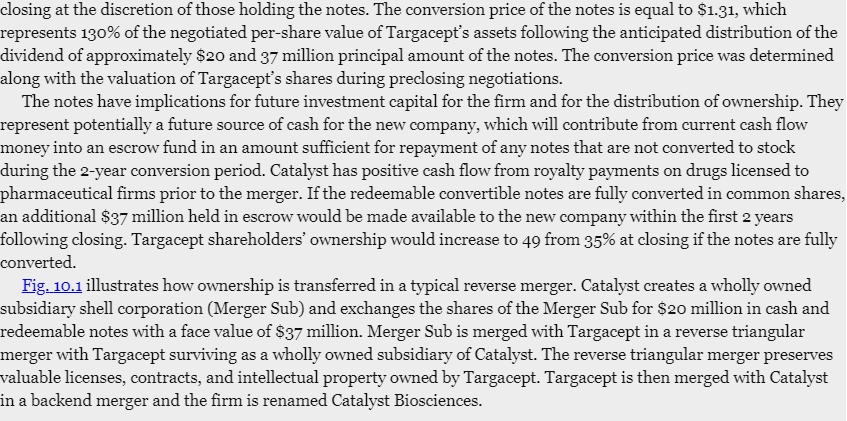

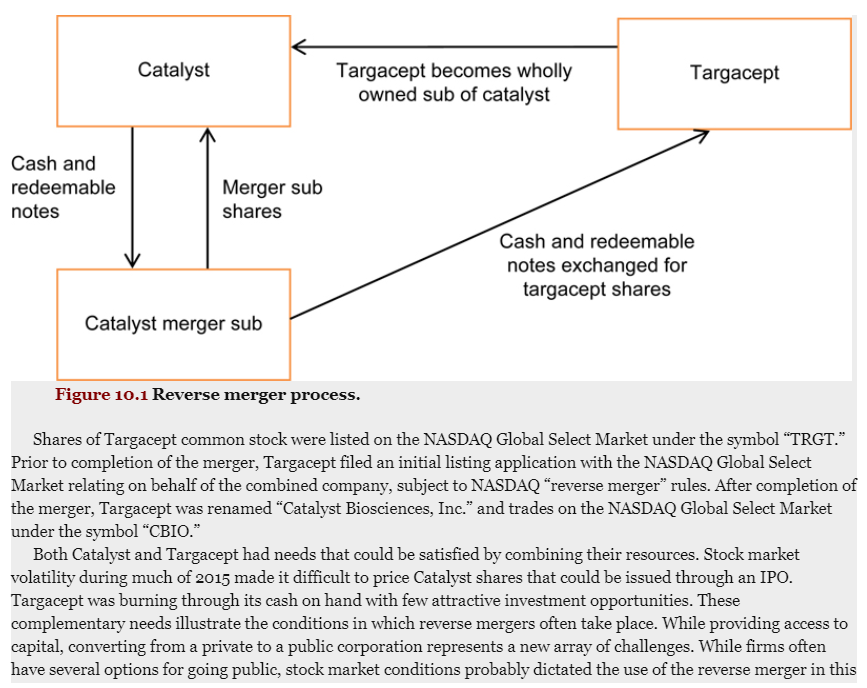

End of Chapter Case Study: Catalyst Acquires Targacept in Reverse Merger Case Study Objectives: To Illustrate Motivations for "going public" The mechanics of reverse mergers Why reverse mergers may be preferred to IPOs for firms wanting to go public" Biotech companies often partner with major pharmaceutical firms to fund the development of new drugs. Biotech firms can attract talent and unlike big pharmaceutical firms have relatively little bureaucracy that often impedes research and development activities at bigger firms. Without funding from the big drug companies, small biotech firms must find alternative sources of funds often by listing on a major stock exchange. This is commonly done by taking a private biotech company public through an IPO or by merging with an existing public company through a reverse merger. In the years following the 2008-09 recession, biotech firms have been able to successfully go public through IPOs due to the robust rise in stock prices and the desire for investors to achieve greater returns in the wake of record low interest rates. However, when the stock market stalled in 2015, investors were less receptive to IPOs. Biotech firms, wanting to go public, have had to seek alternative means of doing so. Reverse mergers represented one such alternative. Biotech firm Catalyst Biosciences (Catalyst) had early success in partnering with Pharmaceutical giant, Wyeth, having reached an agreement to license its drug designed to control bleeding in late 2009. But the results of the partnership in the ensuing years were modest. Catalyst had drugs in development in the so-called pipeline) and other drugs that were at various stages of clinical testing. But the firm needed money and was unable to get financing from big pharmaceutical firms. By 2015, Catalyst went public in a reverse merger with publicly traded Targacept, the beleaguered biotech that had suffered a number of clinical trial failures in recent years. Targacept had little to attract investment from big drug companies and in late 2014 its partnership with AstreZeneca fell apart diminishing its royalty revenue stream. Targacept was left to search for a new role for itself in the biotech industry. Targacept still had substantial cash on hand but few attractive investment opportunities. Its prospects were to continue to burn cash by going it alone, seek a partner, or merge with a firm having significant growth opportunities. The firm projected that at the current rate of usage it would exhaust its cash on hand in 18 24 months and few parties seemed interested in investing in the foundering company. A merger seemed like the best hope. Targacept tried to conserve cash by cutting back on its operations. But this would simply extend the day of reckoning. By the time it was able to find a merger partner, it had laid off most of its employees. By early 2015, Targacept had just 18 full-time employees down from a peak of 144 in 2012. In contrast to Targacept, Catalyst had a series of promising new drugs but was running short of cash. The long- lead time required to bring drugs to market means that many biotech firms experience an inability to finance aggressive R&D projects. To finance future research and development, it too had to partner with a large pharmaceutical firm, or to go public through an IPO or a reverse merger. Cutbacks at large drug companies made the likelihood of finding an investment partner slim and the lackluster stock market made an IPO impractical. Therefore, the firm decided it needed to merge with a cash-flush public firm that offered the opportunity to attract new R&D talent with the offer of stock options and the ability to raise cash through future equity issues. Early in 2015, biotech firm Tobira Therapeutics tested the waters by going public through a reverse merger after its IPO fizzled. This successful reverse merger seemed to pave the way for Catalyst to pursue this means of going public during the choppy 2015 stock market. The merger between Catalyst and Targacept was announced in May 2015 and represented the creation of a new company named Catalyst Biosciences. The new firm contained Catalyst's protease therapeutics pipeline and financial resources came mostly from Targacept. It represented a well-funded firm hoping to develop new treatment options for patients with bleeding disorders. While conventional IPOs can take months to complete, reverse mergers can take only a few weeks. Moreover, as the reverse merger is solely a mechanism to convert a private company into a public entity, the process is less dependent on financial market conditions because the company often is not proposing to raise capital at the time it goes public. At closing, the combined firms had a pipeline of protease therapeutics, four other promising drug candidates, and cash and cash equivalents of $40 million. Of the cash on hand, $35 million came from Targacept and the remaining $5 million came from Catalyst. Existing Targacept shareholders received a special dividend prior to closing of about $20 million distributed from Targacept's cash on hand and redeemable convertible notes (convertible into Catalyst Biosciences common shares) totaling $37 million. The notes are guaranteed by the new firm Catalyst Biosciences. The Catalyst stockholders will initially own approximately 65% of the combined company, with Targacept shareholders owning the remainder. The notes will be convertible into the combined company's common stock at any time within 2 years following closing at the discretion of those holding the notes. The conversion price of the notes is equal to $1.31, which represents 130% of the negotiated per-share value of Targacept's assets following the anticipated distribution of the dividend of approximately $20 and 37 million principal amount of the notes. The conversion price was determined along with the valuation of Targacept's shares during preclosing negotiations. The notes have implications for future investment capital for the firm and for the distribution of ownership. They represent potentially a future source of cash for the new company, which will contribute from current cash flow money into an escrow fund in an amount sufficient for repayment of any notes that are not converted to stock during the 2-year conversion period. Catalyst has positive cash flow from royalty payments on drugs licensed to pharmaceutical firms prior to the merger. If the redeemable convertible notes are fully converted in common shares, an additional $37 million held in escrow would be made available to the new company within the first 2 years following closing. Targacept shareholders' ownership would increase to 49 from 35% at closing if the notes are fully converted. Fig. 10.1 illustrates how ownership is transferred in a typical reverse merger. Catalyst creates a wholly owned subsidiary shell corporation (Merger Sub) and exchanges the shares of the Merger Sub for $20 million in cash and redeemable notes with a face value of $37 million. Merger Sub is merged with Targacept in a reverse triangular merger with Targacept surviving as a wholly owned subsidiary of Catalyst. The reverse triangular merger preserves valuable licenses, contracts, and intellectual property owned by Targacept. Targacept is then merged with Catalyst in a backend merger and the firm is renamed Catalyst Biosciences. Catalyst Targacept becomes wholly owned sub of catalyst Targacept Cash and redeemable notes Merger sub shares Cash and redeemable notes exchanged for targacept shares Catalyst merger sub Figure 10.1 Reverse merger process. Shares of Targacept common stock were listed on the NASDAQ Global Select Market under the symbol "TRGT." Prior to completion of the merger, Targacept filed an initial listing application with the NASDAQ Global Select Market relating on behalf of the combined company, subject to NASDAQ "reverse merger rules. After completion of the merger, Targacept was renamed "Catalyst Biosciences, Inc." and trades on the NASDAQ Global Select Market under the symbol "CBIO." Both Catalyst and Targacept had needs that could be satisfied by combining their resources. Stock market volatility during much of 2015 made it difficult to price Catalyst shares that could be issued through an IPO. Targacept was burning through its cash on hand with few attractive investment opportunities. These complementary needs illustrate the conditions in which reverse mergers often take place. While providing access to capital, converting from a private to a public corporation represents a new array of challenges. While firms often have several options for going public, stock market conditions probably dictated the use of the reverse merger in this instance. Discussion Questions 1. What is the purchase price of Targacept and how is it financed? How does this financing structure potentially help the combined firm Catalyst Biosciences fund future spending? How would Catalyst's original shareholders be impacted by a conversion of the notes? 2. What are common reasons for a private firm to go public? What are the advantages and disadvantages or doing so? Be specific. 3. What are corporate shells, and how can they create value? Be specific. 4. Discuss the pros and cons of a reverse merger versus an IPO. 5. What is the purpose of private firm in listing of a major stock exchange such as NASDAQ? End of Chapter Case Study: Catalyst Acquires Targacept in Reverse Merger Case Study Objectives: To Illustrate Motivations for "going public" The mechanics of reverse mergers Why reverse mergers may be preferred to IPOs for firms wanting to go public" Biotech companies often partner with major pharmaceutical firms to fund the development of new drugs. Biotech firms can attract talent and unlike big pharmaceutical firms have relatively little bureaucracy that often impedes research and development activities at bigger firms. Without funding from the big drug companies, small biotech firms must find alternative sources of funds often by listing on a major stock exchange. This is commonly done by taking a private biotech company public through an IPO or by merging with an existing public company through a reverse merger. In the years following the 2008-09 recession, biotech firms have been able to successfully go public through IPOs due to the robust rise in stock prices and the desire for investors to achieve greater returns in the wake of record low interest rates. However, when the stock market stalled in 2015, investors were less receptive to IPOs. Biotech firms, wanting to go public, have had to seek alternative means of doing so. Reverse mergers represented one such alternative. Biotech firm Catalyst Biosciences (Catalyst) had early success in partnering with Pharmaceutical giant, Wyeth, having reached an agreement to license its drug designed to control bleeding in late 2009. But the results of the partnership in the ensuing years were modest. Catalyst had drugs in development in the so-called pipeline) and other drugs that were at various stages of clinical testing. But the firm needed money and was unable to get financing from big pharmaceutical firms. By 2015, Catalyst went public in a reverse merger with publicly traded Targacept, the beleaguered biotech that had suffered a number of clinical trial failures in recent years. Targacept had little to attract investment from big drug companies and in late 2014 its partnership with AstreZeneca fell apart diminishing its royalty revenue stream. Targacept was left to search for a new role for itself in the biotech industry. Targacept still had substantial cash on hand but few attractive investment opportunities. Its prospects were to continue to burn cash by going it alone, seek a partner, or merge with a firm having significant growth opportunities. The firm projected that at the current rate of usage it would exhaust its cash on hand in 18 24 months and few parties seemed interested in investing in the foundering company. A merger seemed like the best hope. Targacept tried to conserve cash by cutting back on its operations. But this would simply extend the day of reckoning. By the time it was able to find a merger partner, it had laid off most of its employees. By early 2015, Targacept had just 18 full-time employees down from a peak of 144 in 2012. In contrast to Targacept, Catalyst had a series of promising new drugs but was running short of cash. The long- lead time required to bring drugs to market means that many biotech firms experience an inability to finance aggressive R&D projects. To finance future research and development, it too had to partner with a large pharmaceutical firm, or to go public through an IPO or a reverse merger. Cutbacks at large drug companies made the likelihood of finding an investment partner slim and the lackluster stock market made an IPO impractical. Therefore, the firm decided it needed to merge with a cash-flush public firm that offered the opportunity to attract new R&D talent with the offer of stock options and the ability to raise cash through future equity issues. Early in 2015, biotech firm Tobira Therapeutics tested the waters by going public through a reverse merger after its IPO fizzled. This successful reverse merger seemed to pave the way for Catalyst to pursue this means of going public during the choppy 2015 stock market. The merger between Catalyst and Targacept was announced in May 2015 and represented the creation of a new company named Catalyst Biosciences. The new firm contained Catalyst's protease therapeutics pipeline and financial resources came mostly from Targacept. It represented a well-funded firm hoping to develop new treatment options for patients with bleeding disorders. While conventional IPOs can take months to complete, reverse mergers can take only a few weeks. Moreover, as the reverse merger is solely a mechanism to convert a private company into a public entity, the process is less dependent on financial market conditions because the company often is not proposing to raise capital at the time it goes public. At closing, the combined firms had a pipeline of protease therapeutics, four other promising drug candidates, and cash and cash equivalents of $40 million. Of the cash on hand, $35 million came from Targacept and the remaining $5 million came from Catalyst. Existing Targacept shareholders received a special dividend prior to closing of about $20 million distributed from Targacept's cash on hand and redeemable convertible notes (convertible into Catalyst Biosciences common shares) totaling $37 million. The notes are guaranteed by the new firm Catalyst Biosciences. The Catalyst stockholders will initially own approximately 65% of the combined company, with Targacept shareholders owning the remainder. The notes will be convertible into the combined company's common stock at any time within 2 years following closing at the discretion of those holding the notes. The conversion price of the notes is equal to $1.31, which represents 130% of the negotiated per-share value of Targacept's assets following the anticipated distribution of the dividend of approximately $20 and 37 million principal amount of the notes. The conversion price was determined along with the valuation of Targacept's shares during preclosing negotiations. The notes have implications for future investment capital for the firm and for the distribution of ownership. They represent potentially a future source of cash for the new company, which will contribute from current cash flow money into an escrow fund in an amount sufficient for repayment of any notes that are not converted to stock during the 2-year conversion period. Catalyst has positive cash flow from royalty payments on drugs licensed to pharmaceutical firms prior to the merger. If the redeemable convertible notes are fully converted in common shares, an additional $37 million held in escrow would be made available to the new company within the first 2 years following closing. Targacept shareholders' ownership would increase to 49 from 35% at closing if the notes are fully converted. Fig. 10.1 illustrates how ownership is transferred in a typical reverse merger. Catalyst creates a wholly owned subsidiary shell corporation (Merger Sub) and exchanges the shares of the Merger Sub for $20 million in cash and redeemable notes with a face value of $37 million. Merger Sub is merged with Targacept in a reverse triangular merger with Targacept surviving as a wholly owned subsidiary of Catalyst. The reverse triangular merger preserves valuable licenses, contracts, and intellectual property owned by Targacept. Targacept is then merged with Catalyst in a backend merger and the firm is renamed Catalyst Biosciences. Catalyst Targacept becomes wholly owned sub of catalyst Targacept Cash and redeemable notes Merger sub shares Cash and redeemable notes exchanged for targacept shares Catalyst merger sub Figure 10.1 Reverse merger process. Shares of Targacept common stock were listed on the NASDAQ Global Select Market under the symbol "TRGT." Prior to completion of the merger, Targacept filed an initial listing application with the NASDAQ Global Select Market relating on behalf of the combined company, subject to NASDAQ "reverse merger rules. After completion of the merger, Targacept was renamed "Catalyst Biosciences, Inc." and trades on the NASDAQ Global Select Market under the symbol "CBIO." Both Catalyst and Targacept had needs that could be satisfied by combining their resources. Stock market volatility during much of 2015 made it difficult to price Catalyst shares that could be issued through an IPO. Targacept was burning through its cash on hand with few attractive investment opportunities. These complementary needs illustrate the conditions in which reverse mergers often take place. While providing access to capital, converting from a private to a public corporation represents a new array of challenges. While firms often have several options for going public, stock market conditions probably dictated the use of the reverse merger in this instance. Discussion Questions 1. What is the purchase price of Targacept and how is it financed? How does this financing structure potentially help the combined firm Catalyst Biosciences fund future spending? How would Catalyst's original shareholders be impacted by a conversion of the notes? 2. What are common reasons for a private firm to go public? What are the advantages and disadvantages or doing so? Be specific. 3. What are corporate shells, and how can they create value? Be specific. 4. Discuss the pros and cons of a reverse merger versus an IPO. 5. What is the purpose of private firm in listing of a major stock exchange such as NASDA