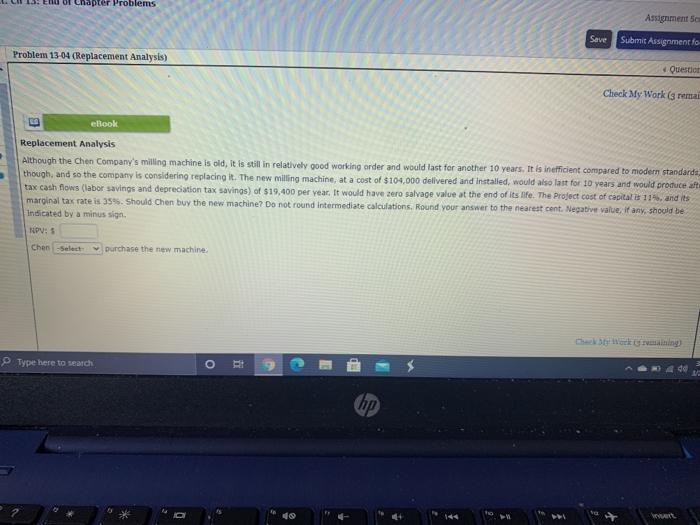

Question: End of Chapter Problems Assignments Save Submit Assignment for Problem 13-04 (Replacement Analysis) Question Check My Work (s remai eBook Replacement Analysis Although the chen

End of Chapter Problems Assignments Save Submit Assignment for Problem 13-04 (Replacement Analysis) Question Check My Work (s remai eBook Replacement Analysis Although the chen Company's milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standardt though, and so the company is considering replacing it. The new milling machine, at a cost of $104,000 delivered and installed, would also last for 10 years and would produce aft tax cash flows (labor savings and depreciation tax savings) of $19,400 per year. It would have sero salvage value at the end of its life. The project cost of capital is 11% and its marginal tax rate is 35. Should Chen buy the new machine? Do not round intermediate calculations, Round your answer to the nearest cont. Negative value, it any should be Indicated by a minus sign NPU: Chen Select Durchase the new machines Type here to search do hop

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts