Question: End of Exercise 122 (L02) Writing Write a paragraph explaining why. In the calculation of a company EVA, noninterest-bearing current liabilities are subtracted from italsts

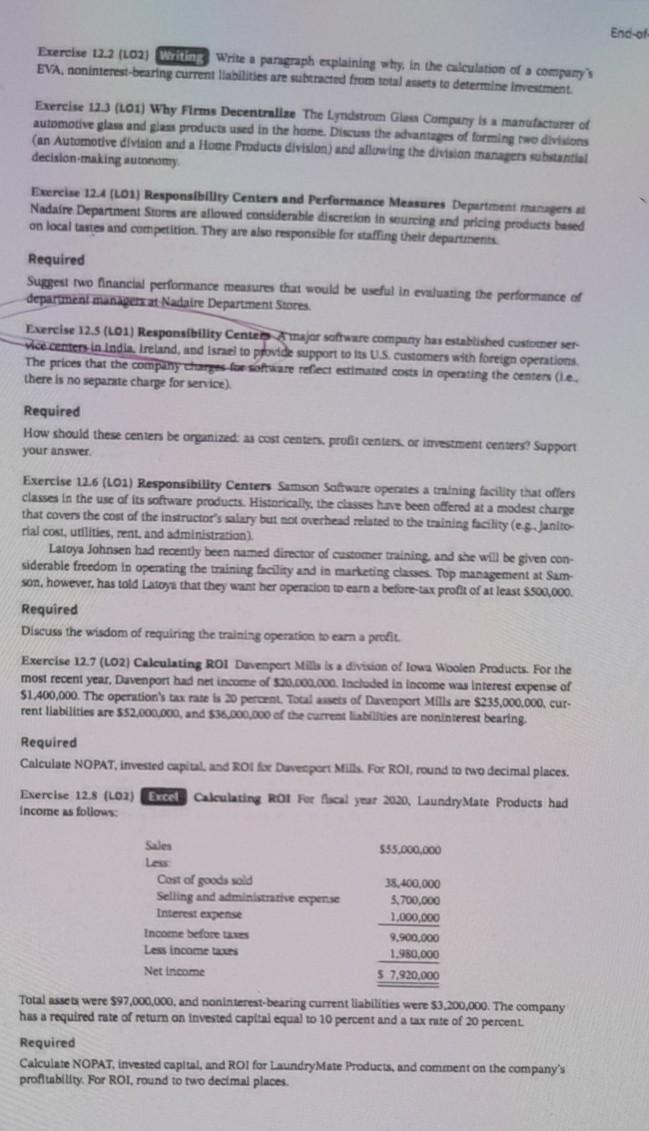

End of Exercise 122 (L02) Writing Write a paragraph explaining why. In the calculation of a company EVA, noninterest-bearing current liabilities are subtracted from italsts to determine investment. Exercise 113 (101) Why Firms Decentralize The Lyndstrom Glass Company is a manufacturer of automotive glass and plan products used in the home. Discuss the advantages of forming two divisions (an Automotive division and a Home Products division) and allowing the division manage substantial decision-making autonomy Exercise 12A (LOI) Responsibility Centers and Performance Measures Department managers at Nadaire Department Stores are allowed considerable discretion in seurcing and pricing products based on local tastes and competition. They are also responsible for staffing their departments Required Suggest two financial performance meatures that would be useful in elusting the performance of department manager at Nadaire Department Stores Exercise 12.5 (L01) Responsibility Center A major software company has established customer ser vice centers in India, Ireland, and Israel to provide support to tas U.S. customers with foreign operations The prices that the company changes for software efect estimated costs in operating the centers (le. there is no separate charge for senice) Required How should these centers be organized as cost centers, profit centers or investment centers? Support your answer Exercise 12.6 (L01) Responsibility Centers Samson Saftware operates a training facility that offers classes in the use of its software products. Historically, the classes have been offered at a modest charge that covers the cost of the instructor's salary but not overhead related to the training facility (es. Janito rial cost, utilities, rent and administration Latoya Johnsen had recently been named director of customer training, and she will be given con- siderable freedom in operating the training facility and in marketing classes. Top management at Sum- son, however, has told Latoya that they want her operation to earn a before tax profit of at least $500,000. Required Discuss the wisdom of requiring the training operation to earn a profit Exercise 12.7 (LO2) Calculating ROI Davenport Mills is a division of lowa Woolen Products. For the most recent year, Davenport had net income of $20.000.000. Included in Income was interest expense of S1.400,000. The operation's tax rate is 20 percent. Totalt af Davenport Mills $235.000.000, cur rent liabilities are 552.000.000, and $36.000.000 of the current liabilities are noninterest bearing Required Calculate NOPAT, invested capital and ROI for Davecport Mills For ROI, round to two decimal places. Exercise 12.5 (L03) Income as follows: Excel leulating ROI for fiscal year 2020, Laundry Mate Products had 555.000.000 Sales Los Cost of goods sold Selling and administrative expense Interest expense Income before Less income Net Income 38.400.000 5.700.000 1.000.000 9.900.000 1.950,000 $ 7,920,000 Total assets were $97,000,000, and noninterest-bearing current liabilities were 53.200,000. The company has a required rate of return on invested capital equal to 10 percent and a tax rate of 20 percent Required Calculate NOPAT, invested capital, and ROI for Laundry Mate Products, and comment on the company's profitability. For ROI, round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock