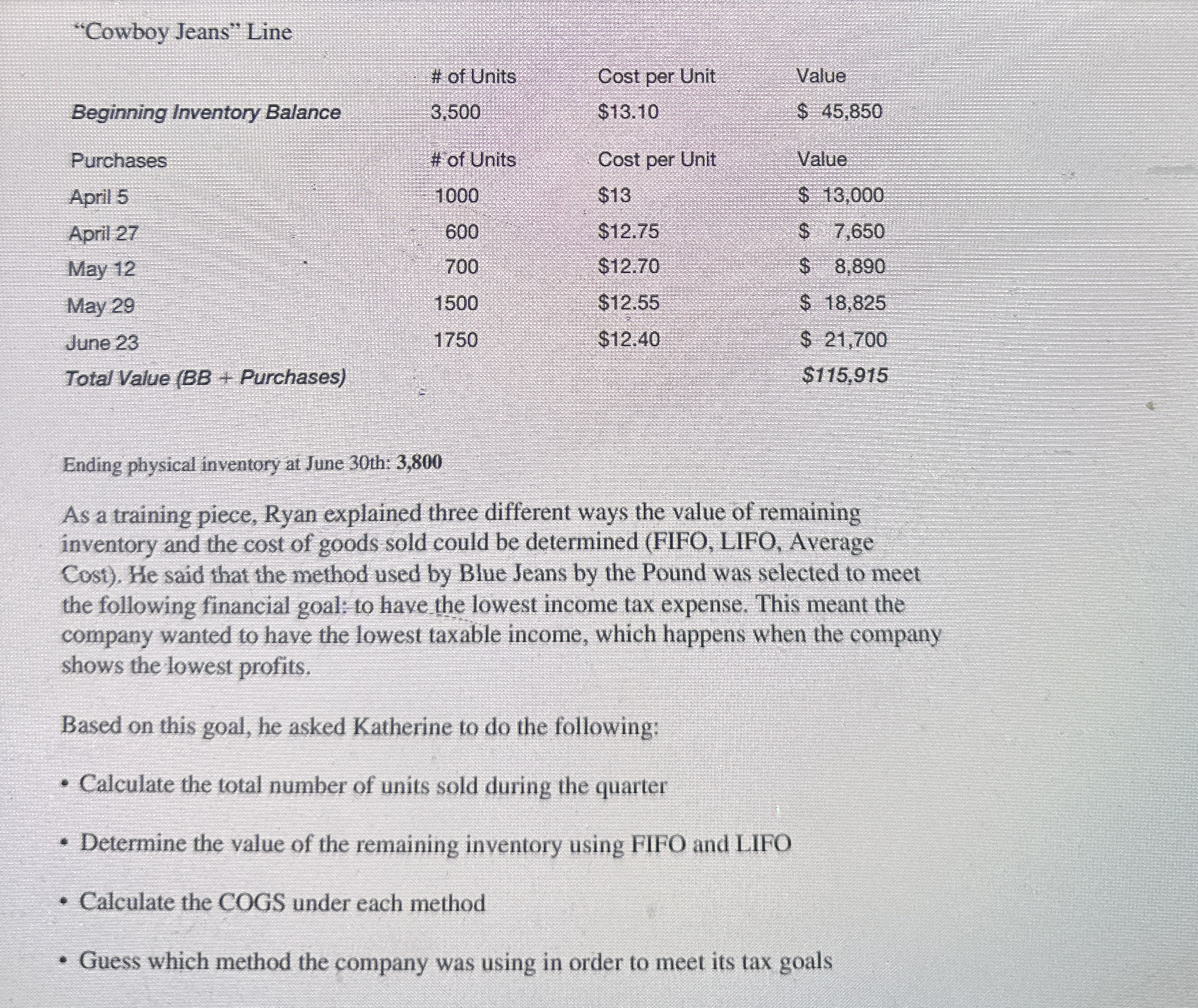

Question: Ending physical inventory at June 3 0 th: 3 , 8 0 0 As a training piece, Ryan explained three different ways the value of

Ending physical inventory at June th:

As a training piece, Ryan explained three different ways the value of remaining

inventory and the cost of goods sold could be determined FIFO LIFO, Average

Cost He said that the method used by Blue Jeans by the Pound was selected to meet

the following financial goal: to have the lowest income tax expense. This meant the

company wanted to have the lowest taxable income, which happens when the company

shows the lowest profits.

Based on this goal, he asked Katherine to do the following:

Calculate the total number of units sold during the quarter

Determine the value of the remaining inventory using FIFO and LIFO

Calculate the COGS under each method

Guess which method the company was using in order to meet its tax goals

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock