Question: Endo Mountain Bikes Inc. is purchasing a new machine for constructing hydraulic shocks. The machine costs $2,500,000 and falls in a 7-year property class. (7-year

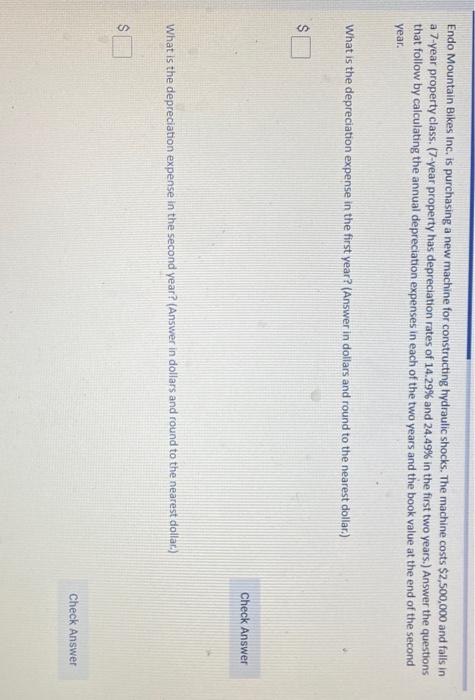

Endo Mountain Bikes Inc. is purchasing a new machine for constructing hydraulic shocks. The machine costs $2,500,000 and falls in a 7-year property class. (7-year property has depreciation rates of 14.29% and 24.49% in the first two years.) Answer the questions that follow by calculating the annual depreciation expenses in each of the two years and the book value at the end of the second year. What is the depreciation expense in the first year? (Answer in dollars and round to the nearest dollar) Check Answer What is the depreciation expense in the second year? (Answer in dollars and round to the nearest dollar.) $ Check

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock