Question: Energy Less, Inc. uses the allowance method for bad debts and adjusts the allowance for uncollectible accounts to a desired amount based on an aging

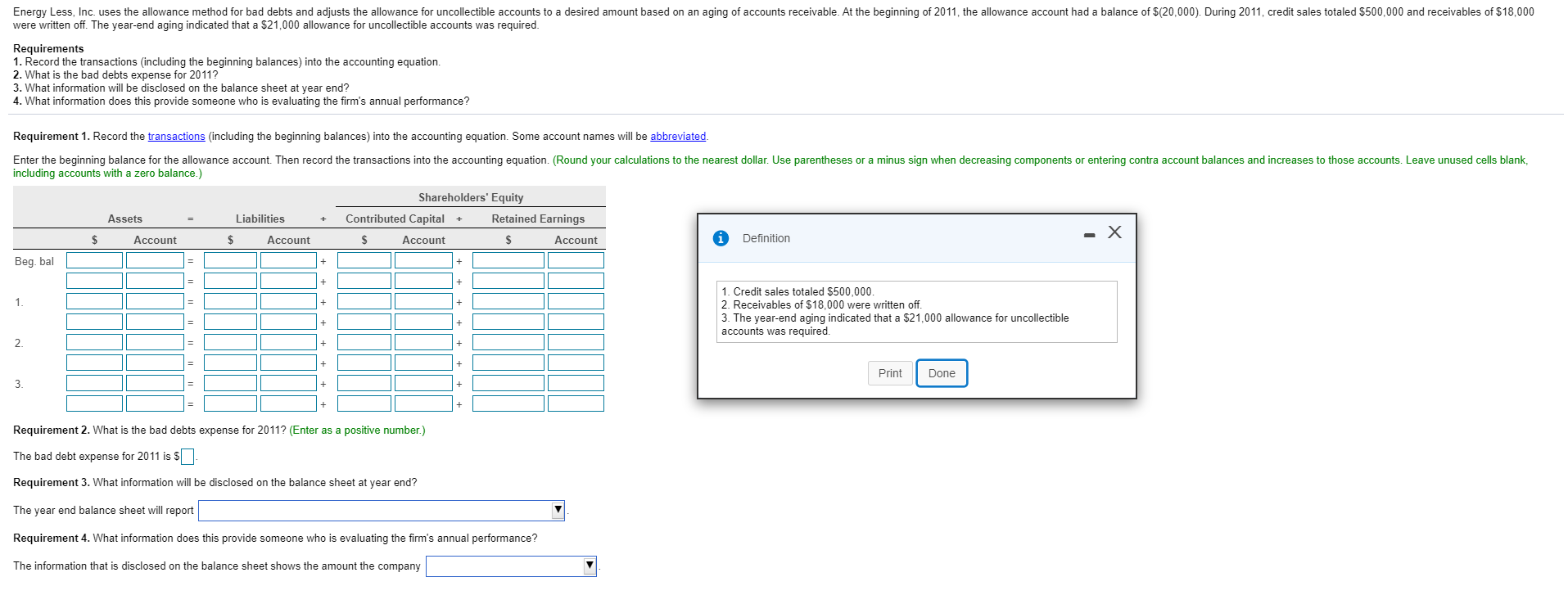

Energy Less, Inc. uses the allowance method for bad debts and adjusts the allowance for uncollectible accounts to a desired amount based on an aging of accounts receivable. At the beginning of 2011, the allowance account had a balance of $(20,000). During 2011, credit sales totaled $500,000 and receivables of $18,000 were written off. The year-end aging indicated that a $21,000 allowance for uncollectible accounts was required. Requirements 1. Record the transactions including the beginning balances) into the accounting equation. 2. What is the bad debts expense for 2011? 3. What information will be disclosed on the balance sheet at year end? 4. What information does this provide someone who is evaluating the firm's annual performance? Requirement 1. Record the transactions (including the beginning balances) into the accounting equation. Some account names will be abbreviated. Enter the beginning balance for the allowance account. Then record the transactions into the accounting equation. (Round your calculations to the nearest dollar. Use parentheses or a minus sign when decreasing components or entering contra account balances and increases to those accounts. Leave unused cells blank, including accounts with a zero balance.) + Assets Account Liabilities Account Shareholders' Equity Contributed Capital + Retained Earnings Account $ Account $ Definition Beg. bal + 1. Credit sales totaled $500,000. 2. Receivables of $18,000 were written off. 3. The year-end aging indicated that a $21,000 allowance for uncollectible accounts was required. + + + Print Done + + Requirement 2. What is the bad debts expense for 2011? (Enter as a positive number.) The bad debt expense for 2011 is $0 Requirement 3. What information will be disclosed on the balance sheet at year end? The year end balance sheet will report Requirement 4. What information does this provide someone who is evaluating the firm's annual performance? The information that is disclosed on the balance sheet shows the amount the company Energy Less, Inc. uses the allowance method for bad debts and adjusts the allowance for uncollectible accounts to a desired amount based on an aging of accounts receivable. At the beginning of 2011, the allowance account had a balance of $(20,000). During 2011, credit sales totaled $500,000 and receivables of $18,000 were written off. The year-end aging indicated that a $21,000 allowance for uncollectible accounts was required. Requirements 1. Record the transactions including the beginning balances) into the accounting equation. 2. What is the bad debts expense for 2011? 3. What information will be disclosed on the balance sheet at year end? 4. What information does this provide someone who is evaluating the firm's annual performance? Requirement 1. Record the transactions (including the beginning balances) into the accounting equation. Some account names will be abbreviated. Enter the beginning balance for the allowance account. Then record the transactions into the accounting equation. (Round your calculations to the nearest dollar. Use parentheses or a minus sign when decreasing components or entering contra account balances and increases to those accounts. Leave unused cells blank, including accounts with a zero balance.) + Assets Account Liabilities Account Shareholders' Equity Contributed Capital + Retained Earnings Account $ Account $ Definition Beg. bal + 1. Credit sales totaled $500,000. 2. Receivables of $18,000 were written off. 3. The year-end aging indicated that a $21,000 allowance for uncollectible accounts was required. + + + Print Done + + Requirement 2. What is the bad debts expense for 2011? (Enter as a positive number.) The bad debt expense for 2011 is $0 Requirement 3. What information will be disclosed on the balance sheet at year end? The year end balance sheet will report Requirement 4. What information does this provide someone who is evaluating the firm's annual performance? The information that is disclosed on the balance sheet shows the amount the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts