Question: engineering economics Exercise 2 Compare between the following two (After Tax cash flow) machines using internal rate of return analysis, present worth analysis, and annual

engineering economics

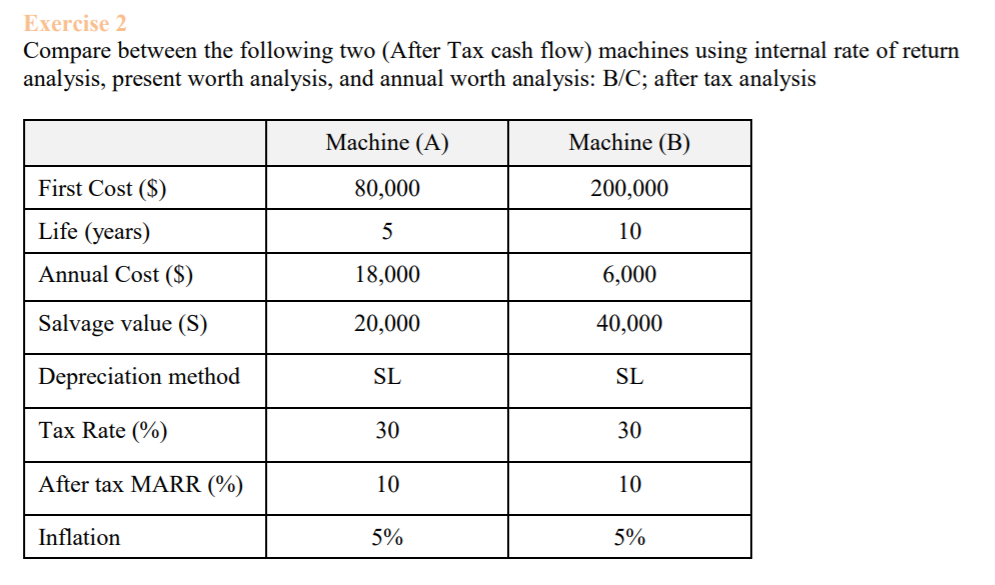

Exercise 2 Compare between the following two (After Tax cash flow) machines using internal rate of return analysis, present worth analysis, and annual worth analysis: B/C; after tax analysis Machine (A) Machine (B) First Cost ($) 80,000 200,000 5 10 Life (years) Annual Cost ($) 18,000 6,000 Salvage value (S) 20,000 40,000 Depreciation method SL SL Tax Rate (%) 30 30 After tax MARR (%) 10 10 Inflation 5% 5% Exercise 2 Compare between the following two (After Tax cash flow) machines using internal rate of return analysis, present worth analysis, and annual worth analysis: B/C; after tax analysis Machine (A) Machine (B) First Cost ($) 80,000 200,000 5 10 Life (years) Annual Cost ($) 18,000 6,000 Salvage value (S) 20,000 40,000 Depreciation method SL SL Tax Rate (%) 30 30 After tax MARR (%) 10 10 Inflation 5% 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts