Question: Engineering economics just answer whatever you can 2) The table summarizes the financial conditions for Intel Corporation (INTC), a manufacturer of various computer- processing chips

Engineering economics

just answer whatever you can

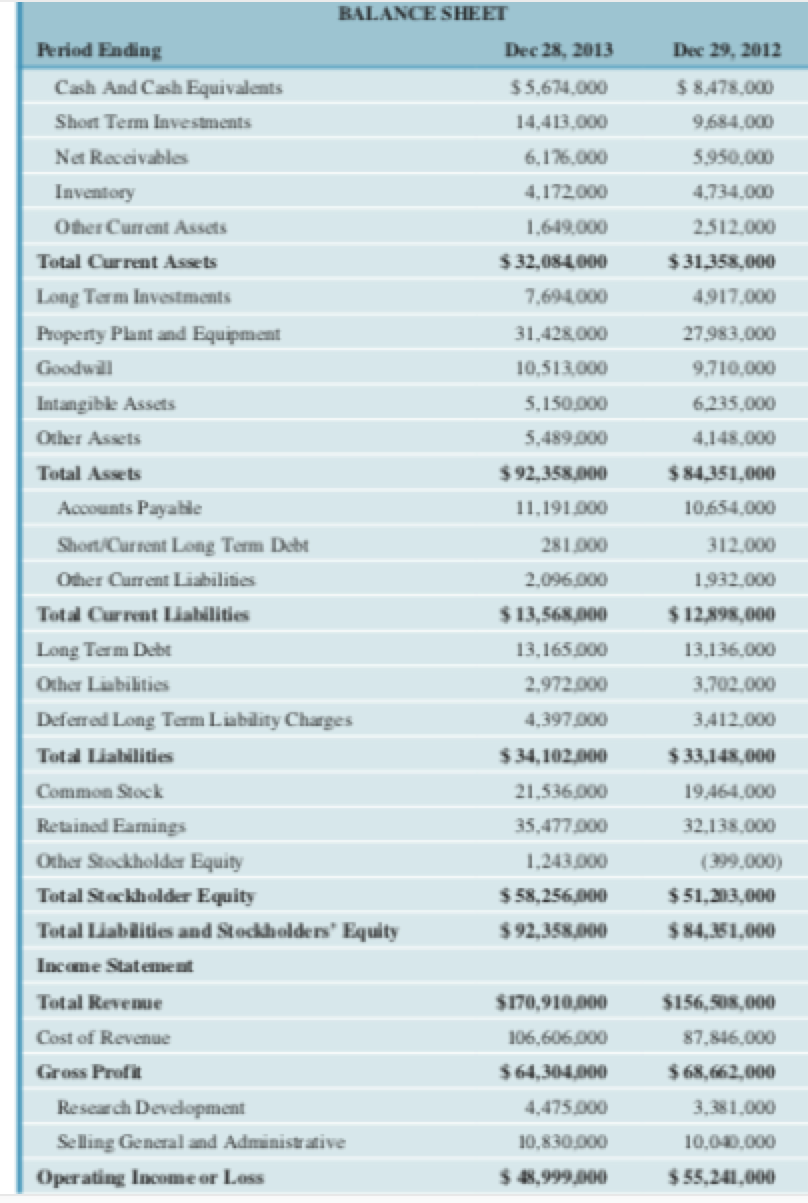

2) The table summarizes the financial conditions for Intel Corporation (INTC), a manufacturer of various computer- processing chips for fiscal year 2013. Compute the various financial ratios and interpret the firm's financial health during fiscal year 2013. The closing stock price was $25.50 on December 31, 2013. Debt ratio Current ratio Quick (acid-test) ratio Inventory-turnover ratio Days-sales-outstanding Total-assets-turnover ratio BALANCE SHEET Period Ending Dec 28, 2013 Cash And Cash Equivalents $ 5,674,000 Short Term Investments 14,413,000 Not Receivables 6,176.000 Inventory 4,172,000 Other Current Assets 1.619.000 Total Current Assets $32,08-2000 Long Term Investments 7,694,000 Property Plant and Equipment 31,428,000 Goodwill 10,513,000 Intangible Assets 5,150.000 Other Assets 5,489.000 Total Assets $92,358,000 Accounts Payabile 11.191.000 Short Current Long Term Dutt 281.000 Other Current Liabilities 2,096,000 Total Current Liabilities $ 13,568,000 Long Term Debt 13,165.000 Other Liabilities 2,972.000 Deferred Long Term Liability Charges 4,397.000 Total Liabilities $ 34,102.000 Common Stock 21,536.000 Retained Eamings 35,477.000 Other Stockholdier Equity 1.243.000 Total Stackholder Equity $58, 256,000 Total Ilabilities and Stockholders' Equity $92,358,000 Income Statement Total Revenue $170,910,000 Cost of Revenue 106,606,000 Gross Profit $64,364,000 Research Development 4,475.000 Selling General and Administrative 10.830.000 Operating Income or Less $ 48,999,000 Dec 29, 2012 $ 8,478,000 9,684,000 5.950.000 4,734,000 2,512,000 $31,358,000 4,917,000 27.983.000 9,710,000 6,235,000 4,148.000 $84,351,000 10,654,000 312.000 1932.000 $12,898,000 13,136.000 3,702,000 3,412.000 $33,148,000 19,464,000 32.138.000 $51,213,000 $84251.000 $156,500,000 87.816.000 $68,662,000 3,381,000 10.000.000 $55,241,00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts