Question: Engineering Economics, thank you! Problem 7-26 (book/static) Question Help An assembly operation at a software company currently requires $100,000 per year in labor costs. A

Engineering Economics, thank you!

Engineering Economics, thank you!

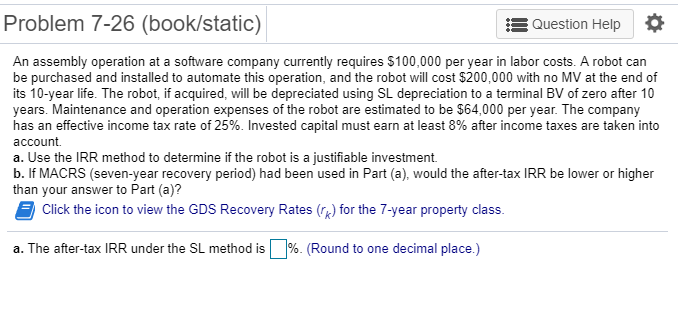

Problem 7-26 (book/static) Question Help An assembly operation at a software company currently requires $100,000 per year in labor costs. A robot can be purchased and installed to automate this operation, and the robot will cost $200,000 with no MV at the end of its 10-year life. The robot, if acquired, will be depreciated using SL depreciation to a terminal BV of zero after 10 years. Maintenance and operation expenses of the robot are estimated to be $64,000 per year. The company has an effective income tax rate of 25%. Invested capital must earn at least 8% after income taxes are taken into account. a. Use the IRR method to determine if the robot is a justifiable investment. b. If MACRS (seven-year recovery period) had been used in Part (a), would the after-tax IRR be lower or higher than your answer to Part (a)? Click the icon to view the GDS Recovery Rates) for the 7-year property class. a. The after-tax IRR under the SL method is | %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts