Question: Engineering economy, please solve quickly 15 From the information given in Question 14, and by using rate of return (ROR) analysis, the sign for Alt.

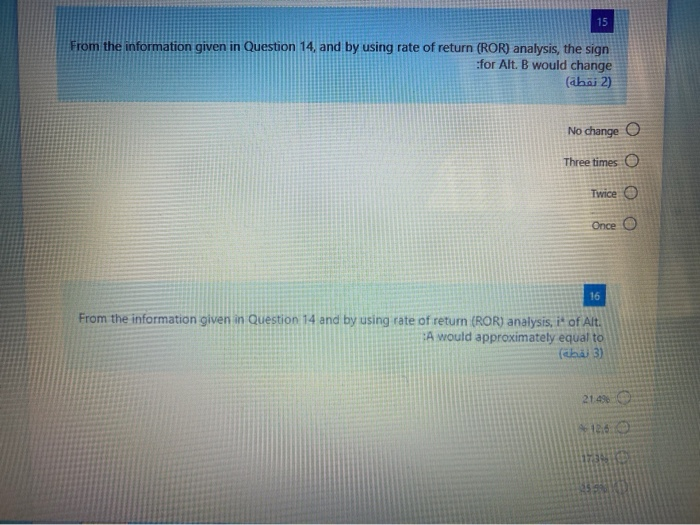

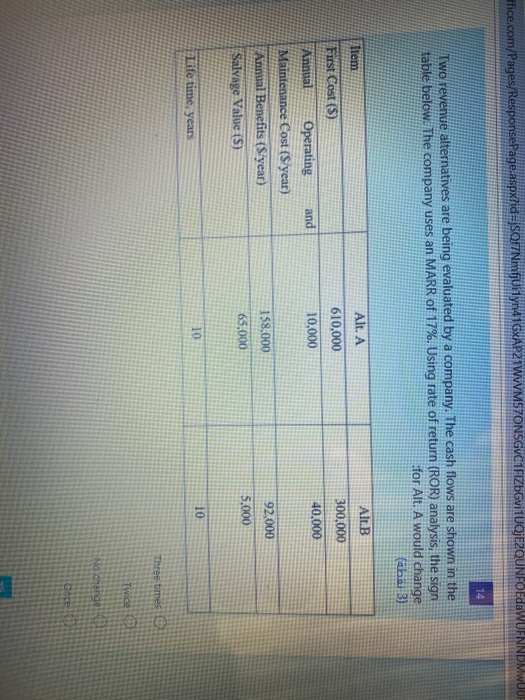

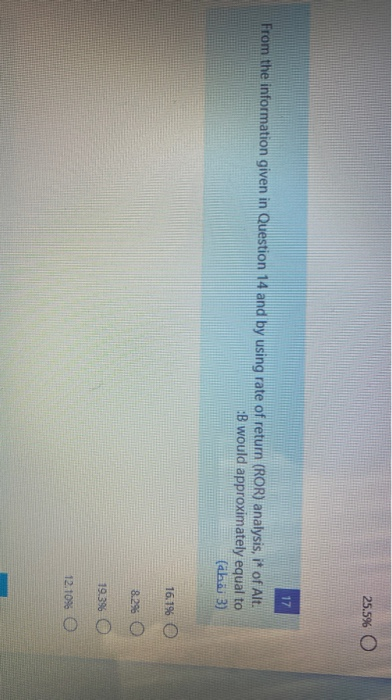

15 From the information given in Question 14, and by using rate of return (ROR) analysis, the sign for Alt. B would change (abai 2) No change o Three times o Twice o Once O 16 From the information given in Question 14 and by using rate of return (ROR) analysis, it of Alt. A would approximately equal to label 3) 2149 ffice.com/Pages/ResponsePage.aspx?id=jSQF7NmfjUilyn41GXAP21WWM570N5GVCAFIZOGVI1UQJEZQUNFOEDWUFNNDMWUOF 14 Two revenue alternatives are being evaluated by a company. The cash flows are shown in the table below. The company uses an MARR of 17%. Using rate of return (ROR) analysis, the sign for Alt. A would change (aha 3) AltB Alt. A 610,000 300,000 and 10,000 40,000 Item First Cost (5) Annual Operating Maintenance Cost (S/year) Annual Benefits (Skyear) Salvage Value (S) 158.000 92.000 65,000 5.000 10 10 Life time, years Three times Twice No change Dace 25.5% O 17 From the information given in Question 14 and by using rate of return (ROR) analysis, i* of Alt. :B would approximately equal to (aha 3) 16.1% 8.2% 0 19.396 12.1098 15 From the information given in Question 14, and by using rate of return (ROR) analysis, the sign for Alt. B would change (abai 2) No change o Three times o Twice o Once O 16 From the information given in Question 14 and by using rate of return (ROR) analysis, it of Alt. A would approximately equal to label 3) 2149 ffice.com/Pages/ResponsePage.aspx?id=jSQF7NmfjUilyn41GXAP21WWM570N5GVCAFIZOGVI1UQJEZQUNFOEDWUFNNDMWUOF 14 Two revenue alternatives are being evaluated by a company. The cash flows are shown in the table below. The company uses an MARR of 17%. Using rate of return (ROR) analysis, the sign for Alt. A would change (aha 3) AltB Alt. A 610,000 300,000 and 10,000 40,000 Item First Cost (5) Annual Operating Maintenance Cost (S/year) Annual Benefits (Skyear) Salvage Value (S) 158.000 92.000 65,000 5.000 10 10 Life time, years Three times Twice No change Dace 25.5% O 17 From the information given in Question 14 and by using rate of return (ROR) analysis, i* of Alt. :B would approximately equal to (aha 3) 16.1% 8.2% 0 19.396 12.1098

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts