Question: English version P 2 - 1 7 R Chapter 1 and 2 Review Problem UltraLift Corp. manufactures chain hoists. The raw materials inventories on hand

English version

PR Chapter and Review Problem

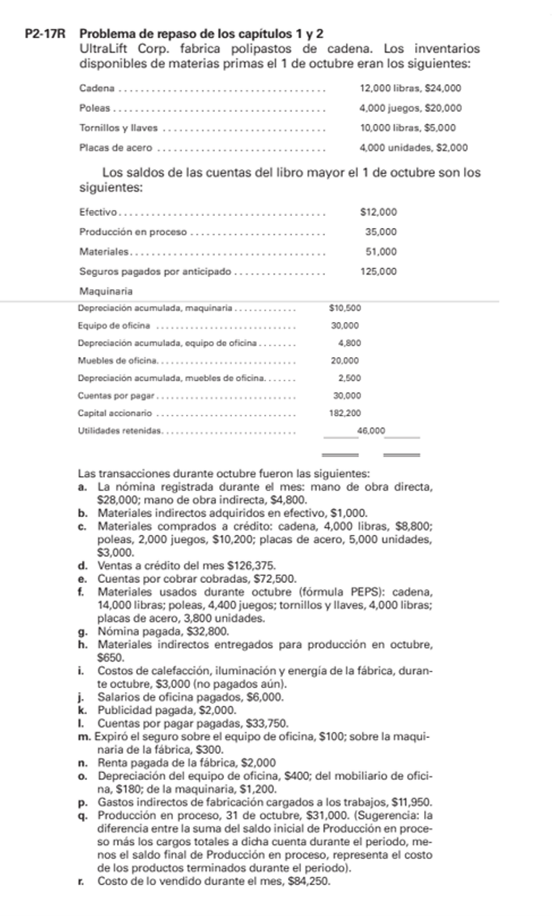

UltraLift Corp. manufactures chain hoists. The raw materials inventories on hand on October were as follows:

Chain: pounds, $

Pulleys: sets, $

Screws and wrenches: pounds, $

Steel plates: units, $

The general ledger account balances on October are as follows:

Cash: $

Work in process: $

Materials: $

Prepaid insurance: $

Machinery

Accumulated depreciation, machinery: $

Office equipment: $

Accumulated depreciation, office equipment: $

Office furniture: $

Accumulated depreciation, office furniture: $

Accounts payable: $

Stockholders equity: $

Retained earnings: $

Transactions during October were as follows:

a Payroll recorded during the month: direct labor, $; indirect labor, $

b Indirect materials purchased for cash, $

c Materials purchased on credit: chain, pounds, $; pulleys, sets, $; Steel plates, units, $

d Credit sales for the month, $

e Materials used during October FIFO formula: chain, pounds; pulleys, sets; bolts and wrenches, pounds; steel plates, units.

f Indirect materials issued for work in process, $

g Heating, lighting, and factory power costs, during October, $not yet paid

h Office salaries paid, $

i Advertising paid, $

j Accounts payable collected, $

k Insurance on office equipment expired, $; portion not charged to factory, $

l Rent paid on factory, $

m Depreciation on office equipment, $; on office furniture, $; on machinery, $

n Manufacturing overhead charged to jobs, $

o Work in process, October $Hint: The difference between the sum of the beginning balance of Work in process plus the total charges to that account during the period, less the ending balance of Work in process, represents the cost of finished goods during the period.

p Cost of goods sold during the month, $

Spanish version

PR Problema de repaso de los captulos y UltraLift Corp. fabrica polipastos de cadena. Los inventarios disponibles de materias primas al de octubre eran los siguientes: Cadena: libras, $ Poleas: juegos, $ Tornillos y llaves: libras, $ Placas de acero: unidades, $ Los saldos de las cuentas del libro mayor el de octubre son los siguientes: Efectivo: $ Produccin en proceso: $ Materiales: $ Seguros pagados por anticipado: $ Maquinaria: $ Depreciacin acumulada, maquinaria: $ Equipo de oficina: $ Depreciacin acumulada, equipo de oficina: $ Muebles de oficina: $ Depreciacin acumulada, muebles de oficina: $ Cuentas por pagar: $ Capital accionario: $ Utilidades retenidas: $ Las transacciones durante octubre fueron las siguientes: a La nmina registrada durante el mes: mano de obra directa, $; mano de obra indirecta, $ b Materiales indirectos adquiridos en efectivo, $ c Materiales comprados a crdito: cadena, libras, $; poleas, juegos, $; placas de acero, unidades, $ d Ventas a crdito del mes $ e Cuentas por cobrar cobradas, $ f Materiales usados durante octubre frmula PEPS: cadena, libras; poleas, juegos; tornillos y llaves, libras; placas de acero, unidades. g Nmina pagada, $ h Materiales indirectos entregados para produccin en octubre, $ i Costos de calefaccin iluminacin y energa de la fbrica durante octubre, $no pagados an j Salarios de oficina pagados, $ k Publicidad pagada, $ l Cuentas por pagar pagadas, $ m Expir el seguro sobre el equipo de oficina, $; sobre la maquinaria, $ n Renta pagada de la fbrica $ o Depreciacin del equipo de oficina, $; del mobiliario de oficina, $; de la maquinaria, $ p Gastos indirectos de fabricacin cargados a los trabajos, $ q Produccin en proceso, de octubre, $Sugerencia: la diferencia entre la suma del saldo inicial de Produccin en proceso y los cargos totales a dicha cuenta durante el periodo, menos los saldo final de Produccin en proceso, representa el costo de los productos terminados durante el periodo. r Costo de lo vendido durante el mes, $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock