Question: Eno c h Ch e m i sts Gh a n a L td is a c ompa n y b a s e d

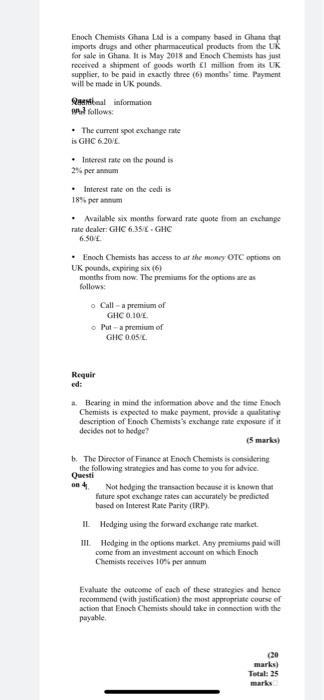

Enoch Chemists Ghana Ltd is a company based in Ghana that imports drugs and other pharmaceutical products fromthe UK for sale in Ghana. It is May 2018 and Enoch Chemists has just received a shipment of goods worth 1 millionfrom its UK supplier, to be paid in exactly three (6) months time. Payment will be made in UK pounds.

Additional information is as follows:

The current spot exchange rate is GH 6.20/.

Interest rate on the pound is 2% per annum

Interest rate on the cedi is 18% per annum

Available six months forward rate quote from an exchange rate dealer: GH 6.35/ - GH

6.50/.

Enoch Chemists has access to at the money OTC options on UK pounds, expiring six (6)

months from now. The premiums for the options are as follows:

o Call a premium of GH 0.10/.

o Put a premium of GH 0.05/.

Required:

a. Bearing in mind the information above and the time Enoch Chemists is expected to make payment, provide a qualitative description of Enoch Chemistss exchange rate exposure if it decides not to hedge?

(5 marks)

b. The Director of Finance at Enoch Chemists is considering the following strategies and has come to you foradvice.

I. Not hedging the transaction because it is known that future spot exchange rates can accurately bepredicted based on Interest Rate Parity (IRP).

II. Hedging using the forward exchange rate market.

III. Hedging in the options market. Any premiums paid will come from an investment account on which Enoch Chemists receives 10% per annum

Evaluate the outcome of each of these strategies and hence recommend (with justification) the most appropriatecourse of action that Enoch Chemists should take in connection with the payable.

Quakitenal information ph23 kollowes: * The current spot exchange nate is GIIC 6.201e. - Interent rate ce the pound is 24i per anevam - Interest ratc on the cedi is 18, per antumit - Availabie six months forward rate quote from an cveluange rate dealier: GHC 6.35.L = GHC 6.50i * Enoch Chemists has access to ar the moner OMC options on EK posinds, ckpering six (6) monthe from now. The premiums for the optioms are as Gollows: Call - a premium of GaHC 0,10 E Put - a premium of Gille 0,05)L. Ptequir ed: a. Bearing in mind the infeemation above and the time Fnoch Chemists is expectiod to make payment, previde a qualitative description of Enocl Chemists's exchange rate exposare if it deciden not to ladedge? (5 marias) b. The Directee of Finance at Enocat Chomists as cunsillering the following stratcgies and has come io you for advice. Questi 0i 4). Not hodeging the transaction becasest it is known that firture spot exchange rates can accurately be peodicted based on Interest Rate Parity (IR.P). IL. Hedging using the forward exchange rate market. 1I1. Hedging in the opties market. Atyy potmiurns paid aill come from an investmcent account on which Enoch Chemists recetves 10 fis per antram Evalaate the sutcoene of cach of these stracegies and hence Quakitenal information ph23 kollowes: * The current spot exchange nate is GIIC 6.201e. - Interent rate ce the pound is 24i per anevam - Interest ratc on the cedi is 18, per antumit - Availabie six months forward rate quote from an cveluange rate dealier: GHC 6.35.L = GHC 6.50i * Enoch Chemists has access to ar the moner OMC options on EK posinds, ckpering six (6) monthe from now. The premiums for the optioms are as Gollows: Call - a premium of GaHC 0,10 E Put - a premium of Gille 0,05)L. Ptequir ed: a. Bearing in mind the infeemation above and the time Fnoch Chemists is expectiod to make payment, previde a qualitative description of Enocl Chemists's exchange rate exposare if it deciden not to ladedge? (5 marias) b. The Directee of Finance at Enocat Chomists as cunsillering the following stratcgies and has come io you for advice. Questi 0i 4). Not hodeging the transaction becasest it is known that firture spot exchange rates can accurately be peodicted based on Interest Rate Parity (IR.P). IL. Hedging using the forward exchange rate market. 1I1. Hedging in the opties market. Atyy potmiurns paid aill come from an investmcent account on which Enoch Chemists recetves 10 fis per antram Evalaate the sutcoene of cach of these stracegies and hence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts