Question: ensure entire spreadsheet is visible please. Given the snapshots below and Annual Plant Capacity of 27000000kg/year , Capital Cost Interest Rate of 9% and Variable

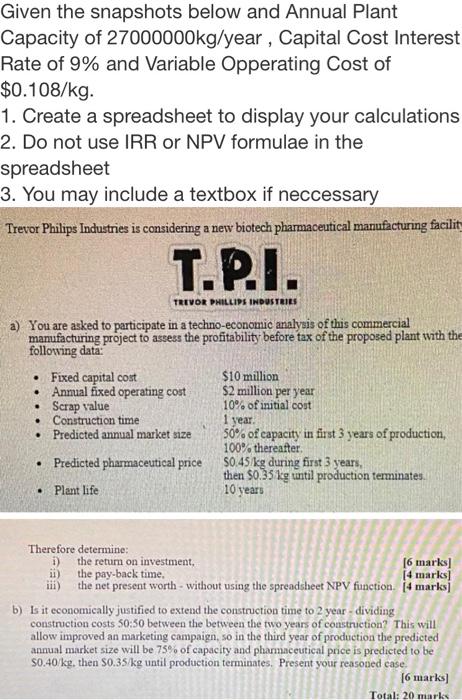

Given the snapshots below and Annual Plant Capacity of 27000000kg/year , Capital Cost Interest Rate of 9% and Variable Opperating Cost of $0.108/kg. 1. Create a spreadsheet to display your calculations 2. Do not use IRR or NPV formulae in the spreadsheet 3. You may include a textbox if neccessary Trevor Philips Industries is considering a new biotech pharmaceutical manufacturing facilit T.P.I. TRIVOR PHILLIPS INDUSTRIES a) You are asked to participate in a techno-economic analysis of this commercial manufacturing project to assess the profitability before tax of the proposed plant with the following data: Fixed capital cost $10 million Annual fixed operating cost $2 million per year Scrap value 10% of initial cost Construction time Predicted annual market size 50% of capacity in first 3 years of production, 100% thereafter Predicted pharmaceutical price $0.45/kg during first 3 years, then 50.35 kg until production terminates. Plant life 10 years . 1 year Therefore determine: 1) the return on investment, [6 marks] ii) the pay back time, (4 marks] ii) the net present worth - without using the spreadsheet NPV function (4 marksi b) Is it economically justified to extend the construction time to 2 year - dividing construction costs 50:50 between the between the two years of construction? This will allow improved an marketing campaign, so in the third year of production the predicted annual market size will be 75% of capacity and pharmaceutical price is predicted to be $0.40/kg, then 80.35 kg until production terminates. Present your reasoned case. [6 marks) Total: 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts